OppFi Investor Presentation Deck

29

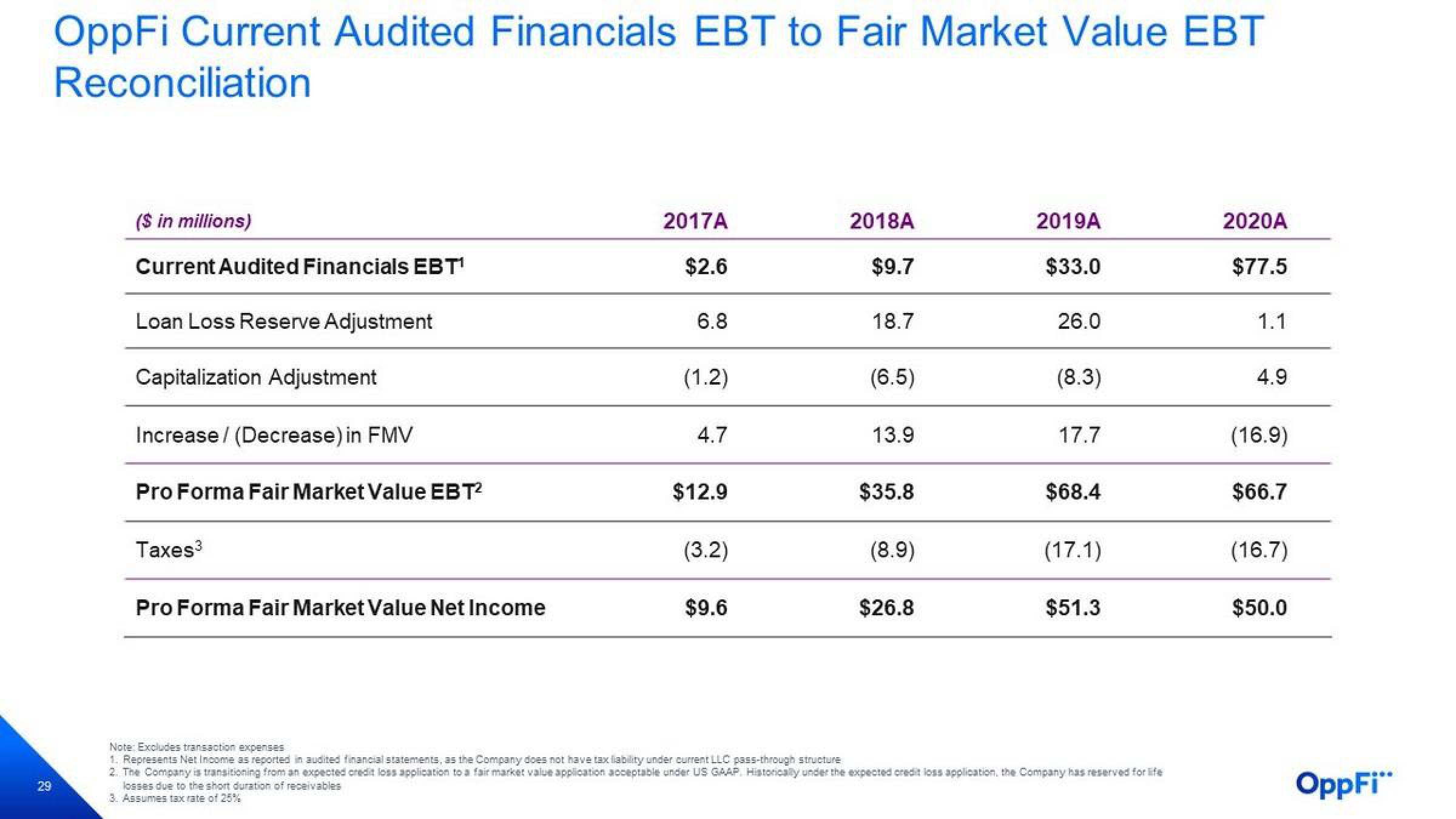

OppFi Current Audited Financials EBT to Fair Market Value EBT

Reconciliation

($ in millions)

Current Audited Financials EBT¹

Loan Loss Reserve Adjustment

Capitalization Adjustment

Increase / (Decrease) in FMV

Pro Forma Fair Market Value EBT²

Taxes³

Pro Forma Fair Market Value Net Income

2017A

$2.6

6.8

(1.2)

4.7

$12.9

(3.2)

$9.6

2018A

$9.7

18.7

(6.5)

13.9

$35.8

(8.9)

$26.8

2019A

$33.0

26.0

(8.3)

17.7

$68.4

(17.1)

$51.3

Note: Excludes transaction expenses

1. Represents Net Income as reported in audited financial statements, as the Company does not have tax liability under current LLC pass-through structure

2. The Company is transitioning from an expected credit loss application to a fair market value application acceptable under US GAAP. Historically under the expected credit loss application, the Company has reserved for life

losses due to the short duration of receivables

3. Assumes tax rate of 25%

2020A

$77.5

1.1

4.9

(16.9)

$66.7

(16.7)

$50.0

OppFi"View entire presentation