Kering Investor Presentation Deck

Luxury

Non-Luxury

PPR acquires

42% in Gucci

Acquisitions of

YSL &

Boucheron

Sport &

Lifestyle

36%

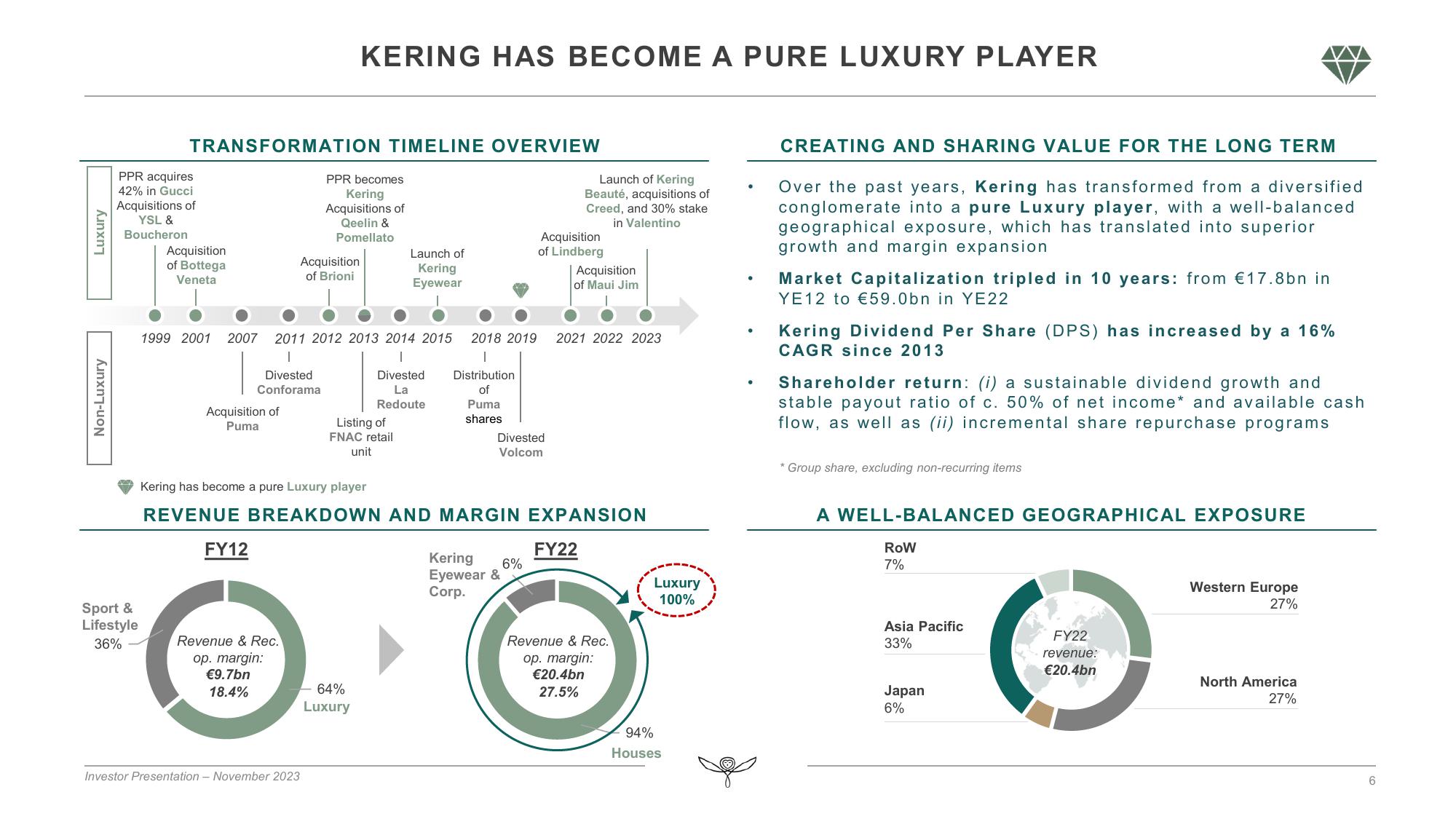

TRANSFORMATION TIMELINE OVERVIEW

Acquisition

of Bottega

Veneta

1999 2001

2007

Acquisition of

Puma

FY12

Revenue & Rec.

op. margin:

€9.7bn

18.4%

2011 2012 2013 2014 2015 2018 2019

1

Divested

Conforama

1

Divested

La

Redoute

T

Distribution

of

Puma

shares

KERING HAS BECOME A PURE LUXURY PLAYER

PPR becomes

Kering

Acquisitions of

Qeelin &

Pomellato

Acquisition

of Brioni

Investor Presentation - November 2023

Listing of

FNAC retail

unit

Launch of

Kering

Eyewear

64%

Luxury

Kering has become a pure Luxury player

REVENUE BREAKDOWN AND MARGIN EXPANSION

Divested

Volcom

Acquisition

of Lindberg

Kering

6%

Eyewear &

Corp.

Launch of Kering

Beauté, acquisitions of

Creed, and 30% stake

in Valentino

Acquisition

of Maui Jim

2021 2022 2023

FY22

Revenue & Rec.

op. margin:

€20.4bn

27.5%

Luxury

100%

94%

Houses

CREATING AND SHARING VALUE FOR THE LONG TERM

Over the past years, Kering has transformed from a diversified

conglomerate into a pure Luxury player, with a well-balanced

geographical exposure, which has translated into superior

growth and margin expansion

Market Capitalization tripled in 10 years: from €17.8bn in

YE12 to €59.0bn in YE22

Kering Dividend Per Share (DPS) has increased by a 16%

CAGR since 2013

Shareholder return: (i) a sustainable dividend growth and

stable payout ratio of c. 50% of net income* and available cash

flow, as well as (ii) incremental share repurchase programs

* Group share, excluding non-recurring items

A WELL-BALANCED GEOGRAPHICAL EXPOSURE

ROW

7%

Asia Pacific

33%

Japan

6%

FY22

revenue:

€20.4bn

Western Europe

27%

North America

27%

6View entire presentation