Taboola Investor Presentation Deck

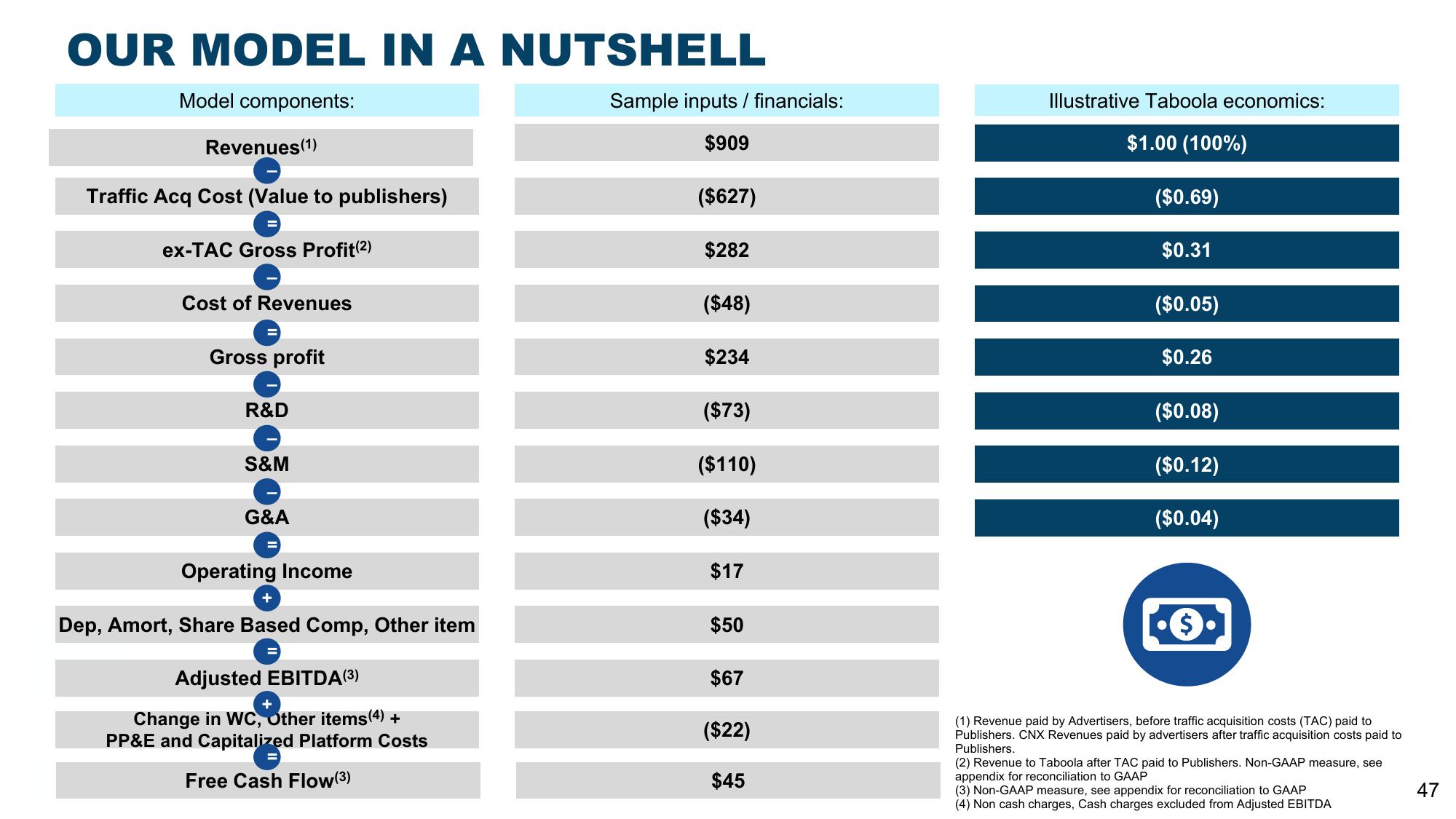

OUR MODEL IN A NUTSHELL

Model components:

Revenues (1)

Traffic Acq Cost (Value to publishers)

ex-TAC Gross Profit (2)

Cost of Revenues

Gross profit

R&D

S&M

G&A

Operating Income

+

Dep, Amort, Share Based Comp, Other item

Adjusted EBITDA(³)

+

Change in WC, Other items (4) +

PP&E and Capitalized Platform Costs

Free Cash Flow (3)

Sample inputs / financials:

$909

($627)

$282

($48)

$234

($73)

($110)

($34)

$17

$50

$67

($22)

$45

Illustrative Taboola economics:

$1.00 (100%)

($0.69)

$0.31

($0.05)

$0.26

($0.08)

($0.12)

($0.04)

(1) Revenue paid by Advertisers, before traffic acquisition costs (TAC) paid to

Publishers. CNX Revenues paid by advertisers after traffic acquisition costs paid to

Publishers.

(2) Revenue to Taboola after TAC paid to Publishers. Non-GAAP measure, see

appendix for reconciliation to GAAP

(3) Non-GAAP measure, see appendix for reconciliation to GAAP

(4) Non cash charges, Cash charges excluded from Adjusted EBITDA

47View entire presentation