Ready Capital Investor Presentation Deck

Financial Flexibility

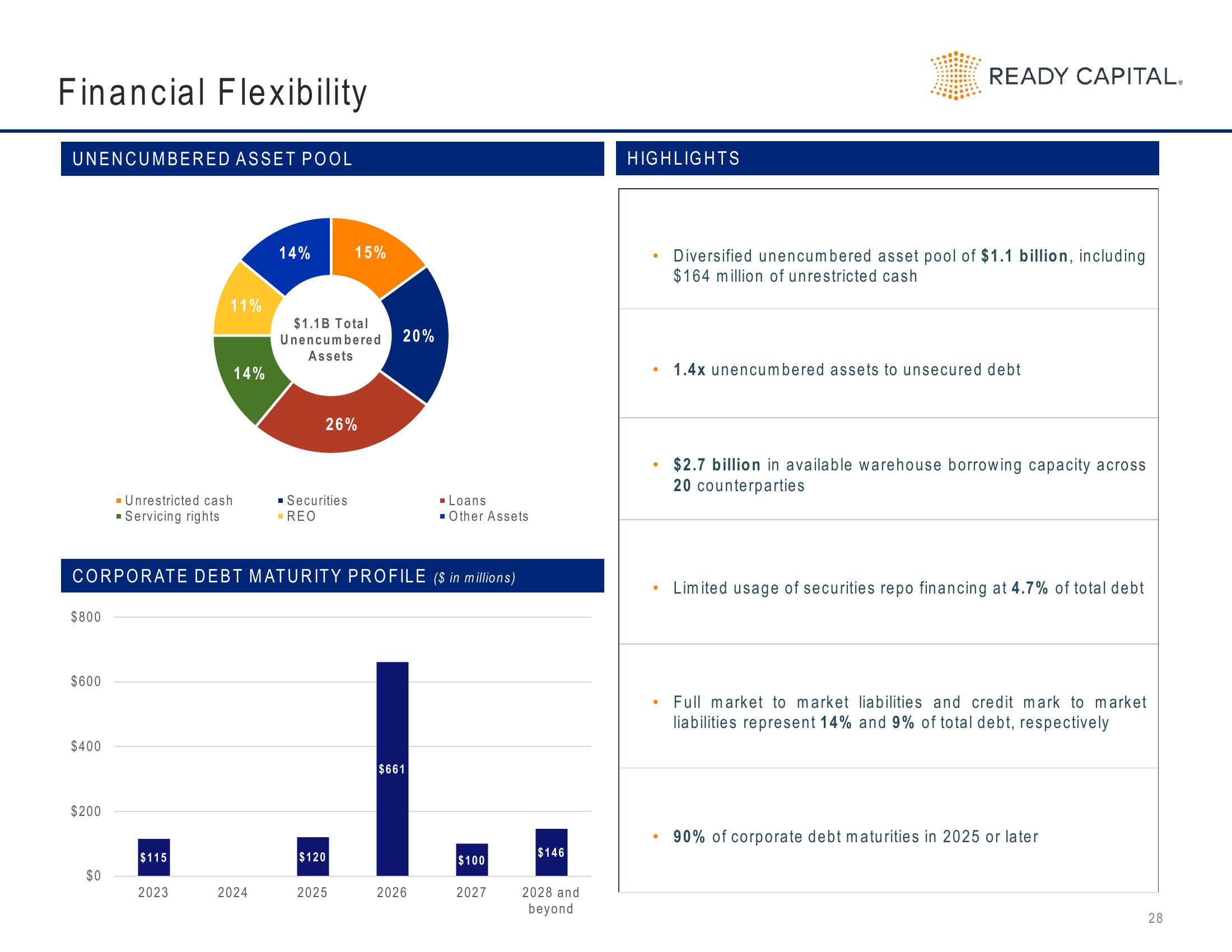

UNENCUMBERED ASSET POOL

$800

$600

$400

$200

$0

■ Unrestricted cash

▪ Servicing rights

11%

$115

2023

14%

CORPORATE DEBT MATURITY PROFILE ($ in millions)

14%

2024

$1.1B Total

Unencumbered

Assets

26%

■ Securities

- REO

15%

$120

20%

2025

$661

.I..

$100

2027

▪ Loans

■ Other Assets

2026

$146

2028 and

beyond

HIGHLIGHTS

READY CAPITAL.

Diversified unencumbered asset pool of $1.1 billion, including

$164 million of unrestricted cash

1.4x unencumbered assets to unsecured debt

$2.7 billion in available warehouse borrowing capacity across

20 counterparties

Limited usage of securities repo financing at 4.7% of total debt

Full market to market liabilities and credit mark to market

liabilities represent 14% and 9% of total debt, respectively

90% of corporate debt maturities in 2025 or later

28View entire presentation