Pershing Square Activist Presentation Deck

Appendix

Sales by Company Operated Restaurants

Rent from Franchise and Affiliate Rest.

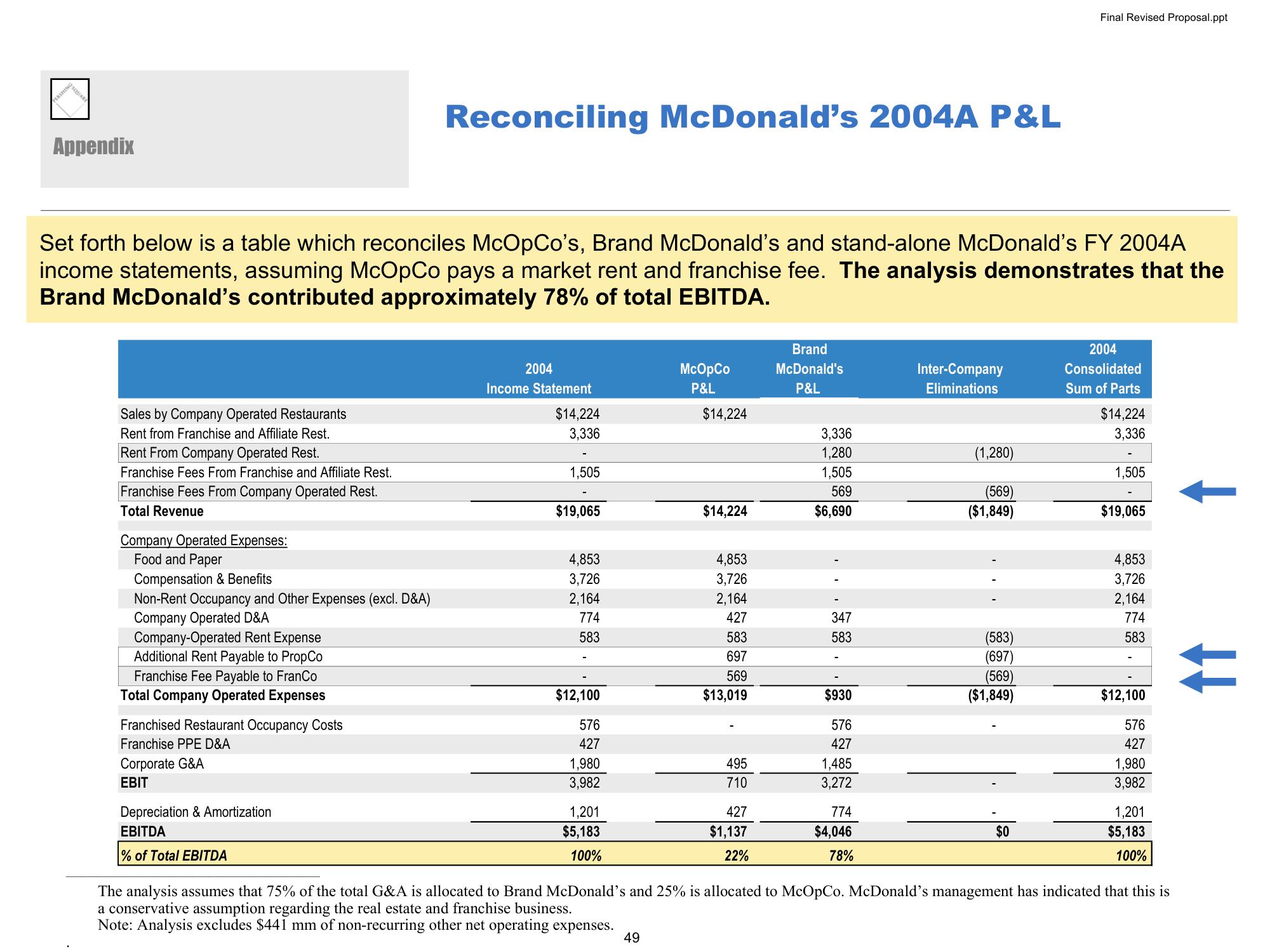

Set forth below is a table which reconciles McOpCo's, Brand McDonald's and stand-alone McDonald's FY 2004A

income statements, assuming McOpCo pays a market rent and franchise fee. The analysis demonstrates that the

Brand McDonald's contributed approximately 78% of total EBITDA.

Rent From Company Operated Rest.

Franchise Fees From Franchise and Affiliate Rest.

Franchise Fees From Company Operated Rest.

Total Revenue

Company Operated Expenses:

Food and Paper

Compensation & Benefits

Non-Rent Occupancy and Other Expenses (excl. D&A)

Company Operated D&A

Company-Operated Rent Expense

Additional Rent Payable to PropCo

Franchise Fee Payable to FranCo

Total Company Operated Expenses

Franchised Restaurant Occupancy Costs

Franchise PPE D&A

Corporate G&A

EBIT

Reconciling McDonald's 2004A P&L

Depreciation & Amortization

EBITDA

% of Total EBITDA

2004

Income Statement

$14,224

3,336

1,505

$19,065

4,853

3,726

2,164

774

583

$12,100

576

427

1,980

3,982

1,201

$5,183

100%

McOpCo

P&L

$14,224

$14,224

4,853

3,726

2,164

427

583

697

569

$13,019

495

710

427

$1,137

22%

Brand

McDonald's

P&L

3,336

1,280

1,505

569

$6,690

347

583

$930

576

427

1,485

3,272

774

$4,046

78%

Inter-Company

Eliminations

(1,280)

(569)

($1,849)

(583)

(697)

(569)

($1,849)

Final Revised Proposal.ppt

$0

2004

Consolidated

Sum of Parts

$14,224

3,336

1,505

$19,065

4,853

3,726

2,164

774

583

$12,100

576

427

1,980

3,982

1,201

$5,183

100%

The analysis assumes that 75% of the total G&A is allocated to Brand McDonald's and 25% is allocated to McOpCo. McDonald's management has indicated that this is

a conservative assumption regarding the real estate and franchise business.

Note: Analysis excludes $441 mm of non-recurring other net operating expenses. 49

↑↑View entire presentation