OppFi Results Presentation Deck

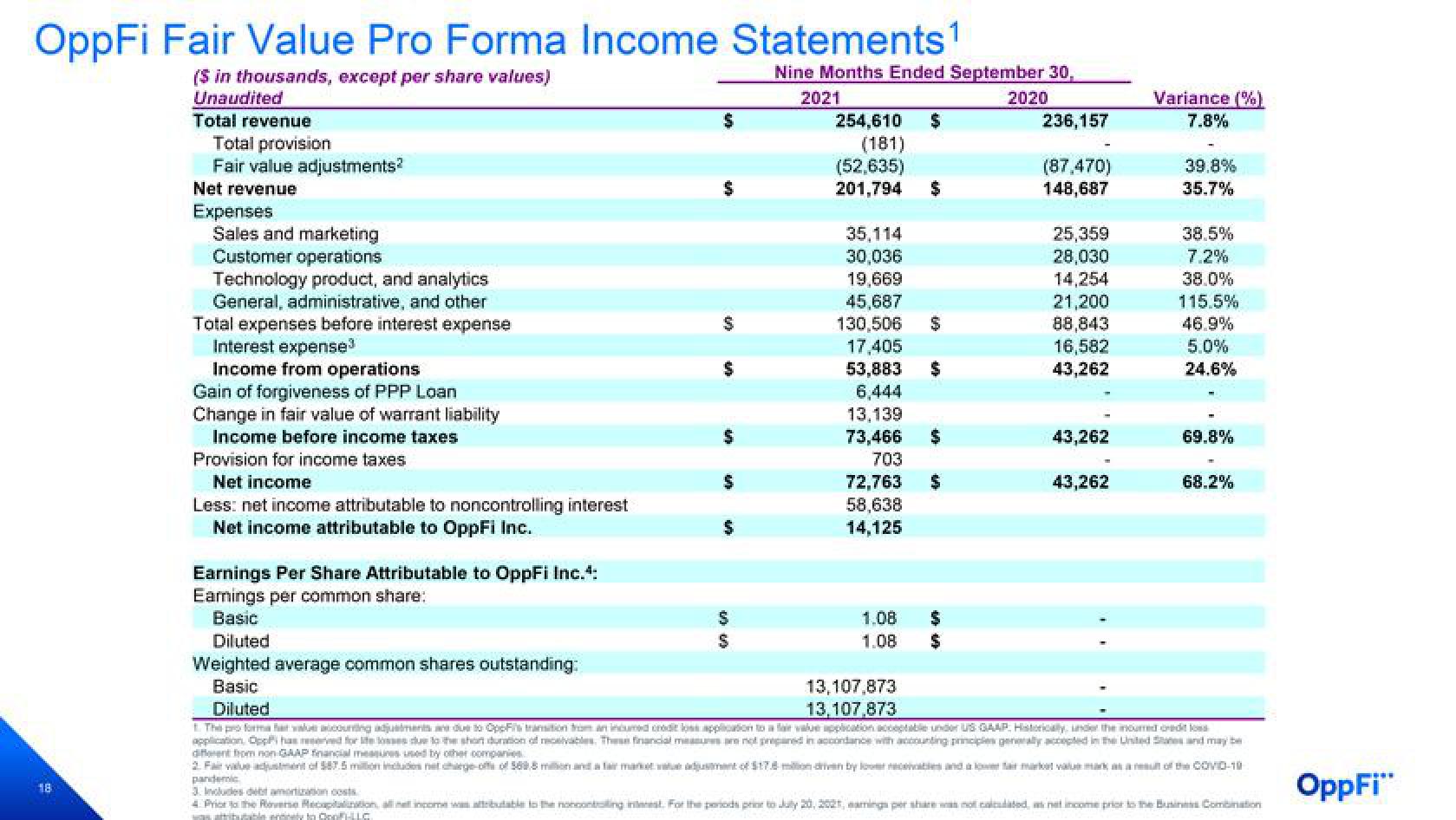

OppFi Fair Value Pro Forma Income Statements¹

($ in thousands, except per share values)

Unaudited

18

Total revenue

Total provision

Fair value adjustments?

Net revenue

Expenses

Sales and marketing

Customer operations

Technology product, and analytics

General, administrative, and other

Total expenses before interest expense

Interest expense³

Income from operations

Gain of forgiveness of PPP Loan

Change in fair value of warrant liability

Income before income taxes

Provision for income taxes

Net income

Less: net income attributable to noncontrolling interest

Net income attributable to OppFi Inc.

$

$

$

$

$

$

0000

Nine Months Ended September 30,

2021

254,610 $

(181)

(52,635)

201,794

35,114

30,036

19,669

45,687

130,506

17,405

53,883

6,444

13,139

73,466

703

72,763

58,638

14,125

$

1.08

1.08

$

$

$

2020

$

$

236,157

(87,470)

148,687

25,359

28,030

14,254

21,200

88,843

16,582

43,262

43,262

43,262

Variance (%)

7.8%

39.8%

35.7%

Earnings Per Share Attributable to OppFi Inc.4:

Earnings per common share:

Basic

Diluted

Weighted average common shares outstanding:

Basic

13,107,873

13,107,873

Diluted

1. The proforma far valuti aŭcounting adjustments and due to Oppfis transition from an incumed credit lost application to a fair value application acceptable under US GAAP. Historically under the incurred credito

application Opp has reserved for lite losses due to the short duration of receivables. These financial measures are not prepared in accordance with accounting principles generally accepted in the United States and may be

different from non GAAP financial measures used by other companies

2. Fair valutment of $87.5 million includes not charge-offs of 569,5 mion and a fair matet value adjustment of $17.8 mon driven by lower receivables and a lower fair market value mark as a result of the COVO-10

3. Includes debt amortization costs

4 Prithverse Recupitalination, alle income was attributable to the nocontrolling interest. For the periods prior to July 20, 202, emings per share was not calculated as net income prior to the Business Combination

wawibutable entry to Onof-LLC

38.5%

7.2%

38.0%

115.5%

46.9%

5.0%

24.6%

69.8%

68.2%

OppFi"View entire presentation