Credit Suisse Investment Banking Pitch Book

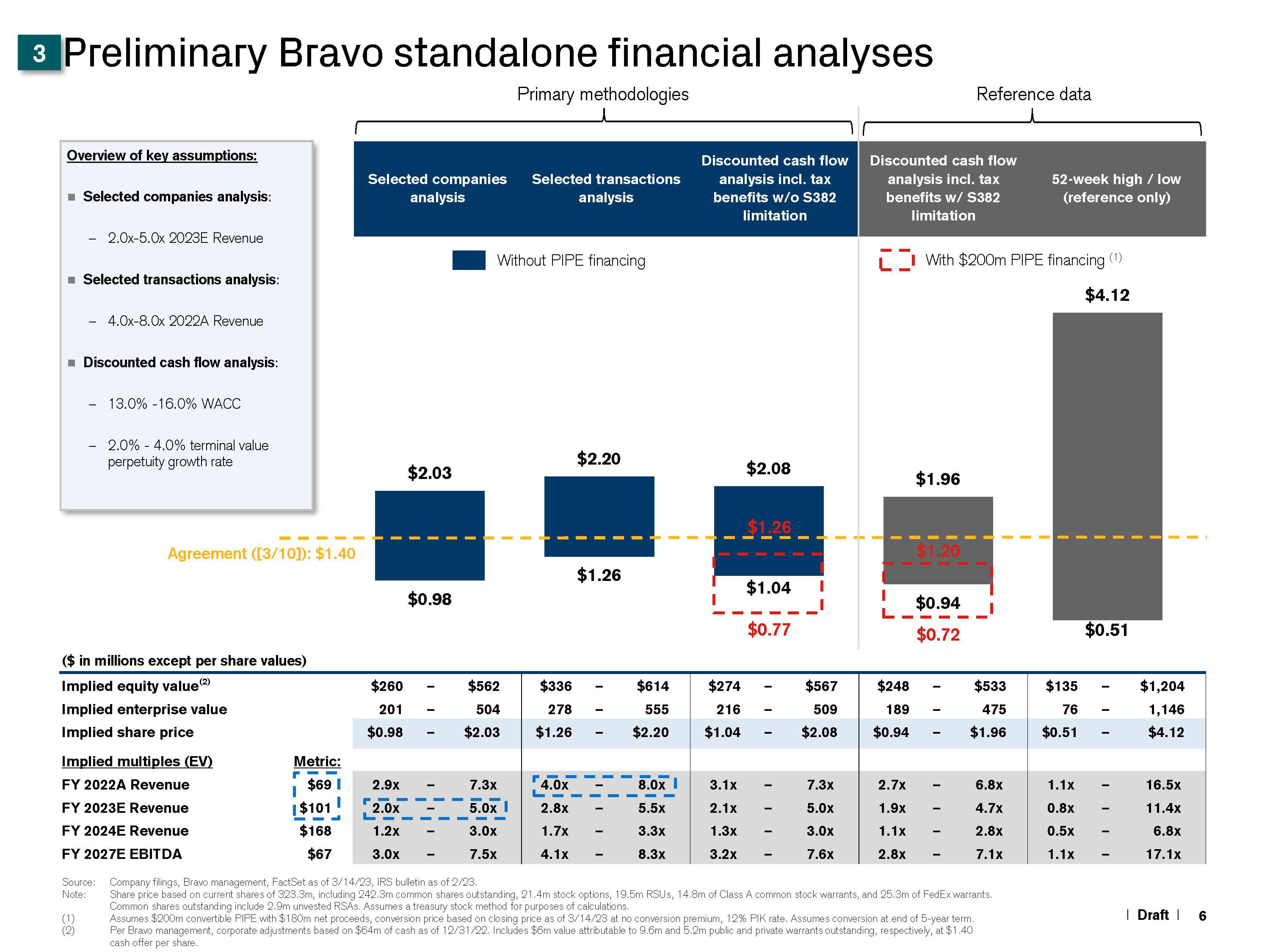

3 Preliminary Bravo standalone financial analyses

Overview of key assumptions:

■ Selected companies analysis:

-

2.0x-5.0x 2023E Revenue

■ Selected transactions analysis:

4.0x-8.0x 2022A Revenue

■ Discounted cash flow analysis:

(1)

(2)

13.0% -16.0% WACC

2.0% - 4.0% terminal value

perpetuity growth rate

Agreement ([3/10]): $1.40

($ in millions except per share values)

Implied equity value (²)

Implied enterprise value

Implied share price

Implied multiples (EV)

FY 2022A Revenue

FY 2023E Revenue

FY 2024E Revenue

FY 2027E EBITDA

Metric:

--

$69 I

I

| $101

$168

$67

Selected companies Selected transactions

analysis

analysis

$260

201

$0.98

2.9x

2.0x

1.2x

3.0x

L

$2.03

$0.98

Primary methodologies

Without PIPE financing

$562

504

$2.03

7.3x

5.0x I

3.0x

7.5x

$336

278

$1.26

r

4.0x

--

2.8x

1.7x

4.1x

$2.20

$1.26

$614 $274

555

216

$2.20 $1.04

8.0x

5.5x

3.3x

8.3x

Discounted cash flow

analysis incl. tax

benefits w/o S382

limitation

-

3.1x

2.1x

1.3x

3.2x

$2.08

$1.26

$1.04

$0.77

7.3x

5.0x

3.0x

7.6x

Discounted cash flow

analysis incl. tax

benefits w/ S382

limitation

I

L

$567

$248

509

189

$2.08 $0.94

2.7x

1.9x

1.1x

2.8x

$1.96

With $200m PIPE financing (¹)

$4.12

$1.20

$0.94

$0.72

Reference data

-

I

$533

475

$1.96

6.8x

4.7x

2.8x

7.1x

Source: Company filings, Bravo management, FactSet as of 3/14/23, IRS bulletin as of 2/23.

Note: Share price based on current shares of 323.3m, including 242.3m common shares outstanding, 21.4m stock options, 19.5m RSUS, 14.8m of Class A common stock warrants, and 25.3m of FedEx warrants.

Common shares outstanding include 2.9m unvested RSAs. Assumes a treasury stock method for purposes of calculations.

Assumes $200m convertible PIPE with $180m net proceeds, conversion price based on closing price as of 3/14/23 at no conversion premium, 12% PIK rate. Assumes conversion at end of 5-year term.

Per Bravo management, corporate adjustments based on $64m of cash as of 12/31/22. Includes $6m value attributable to 9.6m and 5.2m public and private warrants outstanding, respectively, at $1.40

cash offer per share.

52-week high / low

(reference only)

$135

76

$0.51

1.1x

0.8x

0.5x

1.1x

$0.51

-

$1,204

1,146

$4.12

16.5x

11.4x

6.8x

17.1x

| Draft | 6View entire presentation