Meyer Burger Investor Presentation

Consolidated income statement

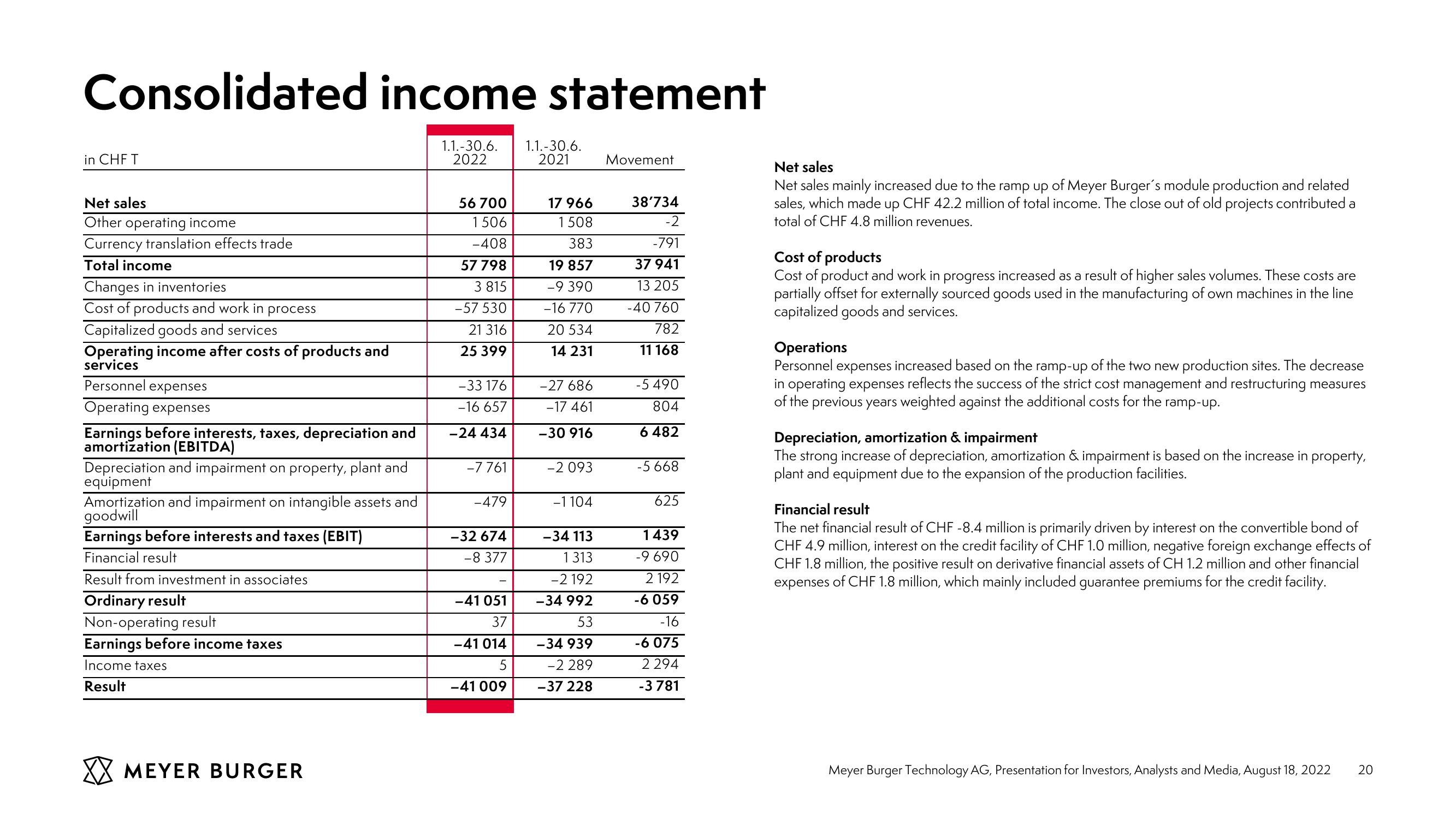

in CHF T

1.1.-30.6. 1.1.-30.6.

2022

2021

Movement

Net sales

Net sales mainly increased due to the ramp up of Meyer Burger's module production and related

sales, which made up CHF 42.2 million of total income. The close out of old projects contributed a

total of CHF 4.8 million revenues.

Cost of product and work in progress increased as a result of higher sales volumes. These costs are

partially offset for externally sourced goods used in the manufacturing of own machines in the line

capitalized goods and services.

Operations

Personnel expenses increased based on the ramp-up of the two new production sites. The decrease

in operating expenses reflects the success of the strict cost management and restructuring measures

of the previous years weighted against the additional costs for the ramp-up.

Depreciation, amortization & impairment

The strong increase of depreciation, amortization & impairment is based on the increase in property,

plant and equipment due to the expansion of the production facilities.

Financial result

The net financial result of CHF -8.4 million is primarily driven by interest on the convertible bond of

CHF 4.9 million, interest on the credit facility of CHF 1.0 million, negative foreign exchange effects of

CHF 1.8 million, the positive result on derivative financial assets of CH 1.2 million and other financial

expenses s of CHF 1.8 million, which mainly included guarantee premiums for the credit facility.

Net sales

56 700

Other operating income

1506

Currency translation effects trade

-408

Total income

57 798

17 966

1508

383

19 857

38'734

-2

Changes in inventories

3 815

-9 390

Cost of products and work in process

-57 530

-16 770

-791

37 941

13 205

-40 760

Cost of products

Capitalized goods and services

21 316

20 534

Operating income after costs of products and

25 399

14 231

782

11 168

services

Personnel expenses

-33 176

Operating expenses

-16 657

Earnings before interests, taxes, depreciation and

-24 434

-27 686

-17 461

-30 916

-5 490

804

6 482

amortization (EBITDA)

Depreciation and impairment on property, plant and

equipment

-7 761

-2093

-5668

Amortization and impairment on intangible assets and

goodwill

-479

-1104

625

Earnings before interests and taxes (EBIT)

-32 674

-34 113

Financial result

-8 377

Result from investment in associates

Ordinary result

Non-operating result

-41 051

37

1313

-2 192

-34 992

53

1439

-9690

2 192

-6.059

-16

Earnings before income taxes

-41 014

Income taxes

5

-34 939

-2 289

-6 075

2 294

Result

-41 009

-37 228

-3 781

MEYER BURGER

Meyer Burger Technology AG, Presentation for Investors, Analysts and Media, August 18, 2022

20View entire presentation