dLocal Investor Day Presentation Deck

2

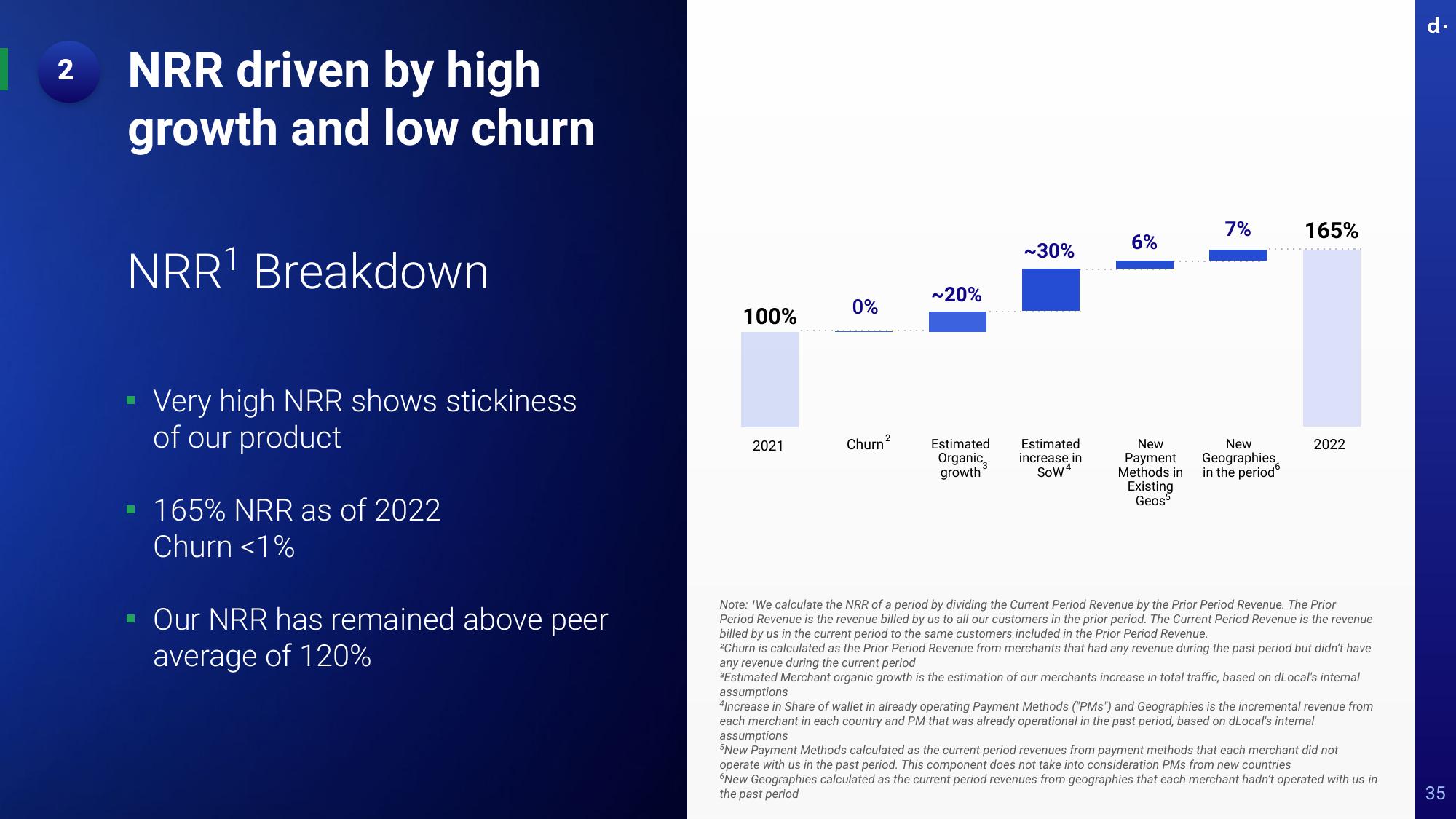

NRR driven by high

growth and low churn

NRR¹ Breakdown

Very high NRR shows stickiness

of our product

▪ 165% NRR as of 2022

Churn <1%

Our NRR has remained above peer

average of 120%

100%

2021

0%

Churn

2

~20%

Estimated

Organic

growth

~30%

Estimated

increase in

SOW4

6%

New

Payment

Methods in

Existing

Geos

7%

New

Geographies

in the period

165%

2022

Note: 'We calculate the NRR of a period. dividing the Current Period Revenue by the Prior Period Revenue. The Prior

Period Revenue is the revenue billed by us to all our customers in the prior period. The Current Period Revenue is the revenue

billed by us in the current period to the same customers included in the Prior Period Revenue.

2Churn is calculated as the Prior Period Revenue from merchants that had any revenue during the past period but didn't have

any revenue during the current period

³Estimated Merchant organic growth is the estimation of our merchants increase in total traffic, based on dLocal's internal

assumptions

4Increase in Share of wallet in already operating Payment Methods ("PMs") and Geographies is the incremental revenue from

each merchant in each country and PM that was already operational in the past period, based on dLocal's internal

assumptions

5New Payment Methods calculated as the current period revenues from payment methods that each merchant did not

operate with us in the past period. This component does not take into consideration PMs from new countries

"New Geographies calculated as the current period revenues from geographies that each merchant hadn't operated with us in

the past period

d.

35View entire presentation