J.P.Morgan 4Q23 Earnings Results

JPMORGAN CHASE & CO.

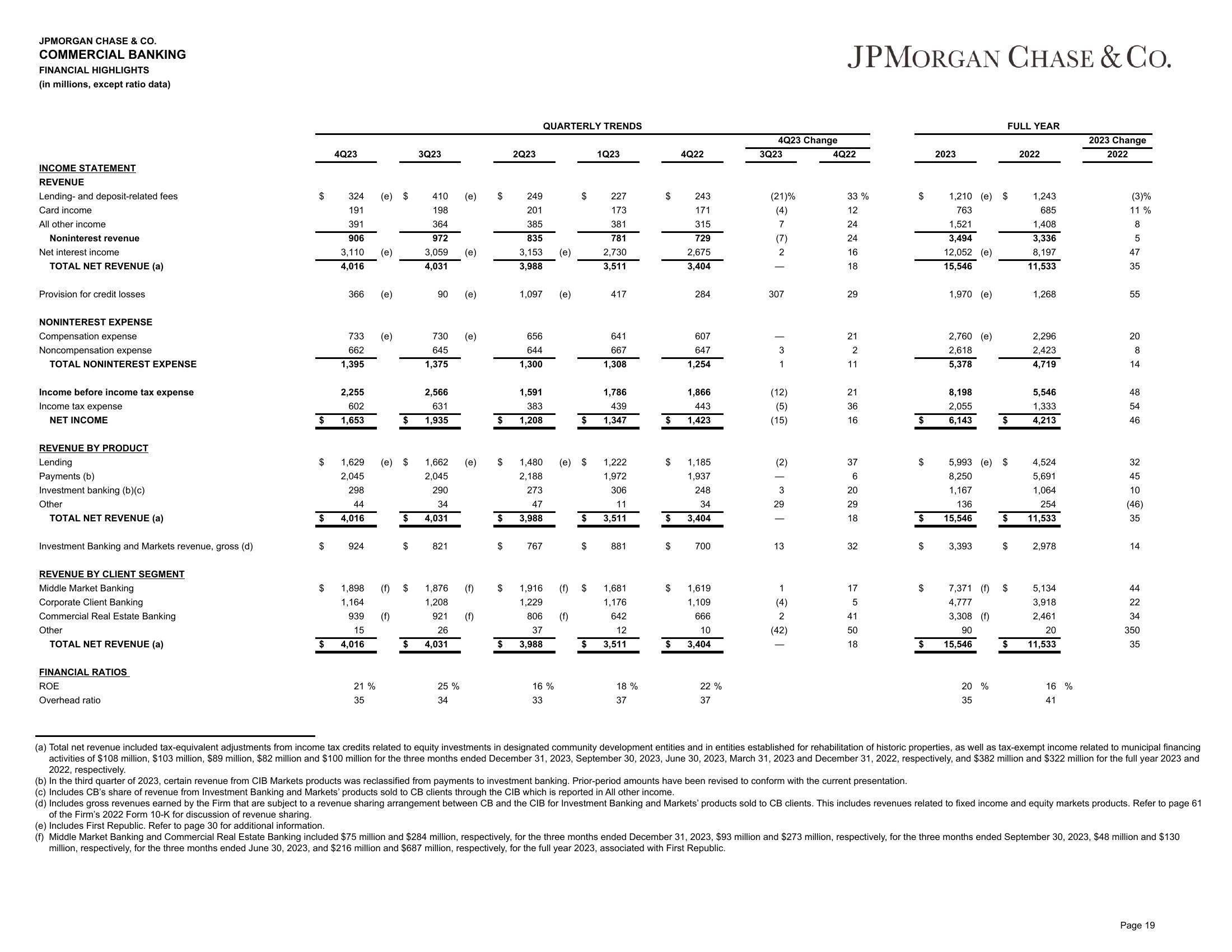

COMMERCIAL BANKING

FINANCIAL HIGHLIGHTS

(in millions, except ratio data)

INCOME STATEMENT

REVENUE

Lending- and deposit-related fees

Card income

All other income

Noninterest revenue

Net interest income

TOTAL NET REVENUE (a)

Provision for credit losses

NONINTEREST EXPENSE

Compensation expense

Noncompensation expense

TOTAL NONINTEREST EXPENSE

Income before income tax expense

Income tax expense

NET INCOME

REVENUE BY PRODUCT

Lending

Payments (b)

Investment banking (b)(c)

Other

TOTAL NET REVENUE (a)

Investment Banking and Markets revenue, gross (d)

REVENUE BY CLIENT SEGMENT

Middle Market Banking

Corporate Client Banking

Commercial Real Estate Banking

Other

TOTAL NET REVENUE (a)

FINANCIAL RATIOS

ROE

Overhead ratio

$

$

$

$

$

$

4Q23

324 (e) $

191

391

906

3,110 (e)

4,016

366

733

662

1,395

2,255

602

1,653

924

1,898

1,164

939

15

4,016

(e)

1,629 (e) $

2,045

298

44

4,016

21 %

35

(e)

$

(f)

$

$

(f) $

3Q23

410

198

364

972

3,059

4,031

90 (e)

2,566

631

1,935

730 (e)

645

1,375

1,662

2,045

290

34

4,031

821

(e) $

1,876

1,208

921

26

4,031

(e)

25 %

34

(e)

$

(f)

$

$

$

(f) $

2Q23

QUARTERLY TRENDS

249

201

385

835

3,153

3,988

1,097

656

644

1,300

1,591

383

1,208

273

47

3,988

767

1,480 (e) $

2,188

1,916

1,229

806

37

$ 3,988

(e)

16%

33

(e)

$

(f)

$

(f) $

1Q23

227

173

381

781

2,730

3,511

417

641

667

1,308

1,222

1,972

306

11

$ 3,511

1,786

439

1,347

881

1,681

1,176

642

12

$ 3,511

18%

37

$

$

$

$

4Q22

$

243

171

315

729

2,675

3,404

284

607

647

1,254

1,185

1,937

248

34

$ 3,404

1,866

443

1,423

700

1,619

1,109

666

10

3,404

22%

37

4Q23 Change

3Q23

(21)%

(4)

7

(7)

2

307

-w1

(12)

(5)

(15)

(2)

3

29

13

1

(4)

2

(42)

JPMORGAN CHASE & Co.

4Q22

33 %

12

24

24

16

18

29

21

2

11

21

36

16

37

6

20

29

18

32

17

5

41

50

18

$

$

$

$

$

$

2023

1,210 (e) $

763

1,521

3,494

12,052 (e)

15,546

1,970 (e)

2,760 (e)

2,618

5,378

8,198

2,055

6,143

3,393

FULL YEAR

5,993 (e) $

8,250

1,167

136

15,546

7,371 (f)

4,777

3,308 (f)

90

15,546

20 %

35

$

$

$

$

$

2022

1,243

685

1,408

3,336

8,197

11,533

1,268

2,296

2,423

4,719

5,546

1,333

4,213

4,524

5,691

1,064

254

11,533

2,978

5,134

3,918

2,461

20

11,533

16 %

41

2023 Change

2022

(3)%

11 %

8

5

47

35

55

20

8

14

48

54

46

32

45

10

(46)

35

14

44

22

34

350

35

(a) Total net revenue included tax-equivalent adjustments from income tax credits related to equity investments in designated community development entities and in entities established for rehabilitation of historic properties, as well as tax-exempt income related to municipal financing

activities of $108 million, $103 million, $89 million, $82 million and $100 million for the three months ended December 31, 2023, September 30, 2023, June 30, 2023, March 31, 2023 and December 31, 2022, respectively, and $382 million and $322 million for the full year 2023 and

2022, respectively.

(b) In the third quarter of 2023, certain revenue from CIB Markets products was reclassified from payments to investment banking. Prior-period amounts have been revised to conform with the current presentation.

(c) Includes CB's share of revenue from Investment Banking and Markets' products sold to CB clients through the CIB which is reported in All other income.

(d) Includes gross revenues earned by the Firm that are subject to a revenue sharing arrangement between CB and the CIB for Investment Banking and Markets' products sold to CB clients. This includes revenues related to fixed income and equity markets products. Refer to page 61

of the Firm's 2022 Form 10-K for discussion of revenue sharing.

(e) Includes First Republic. Refer to page 30 for additional information.

(f) Middle Market Banking and Commercial Real Estate Banking included $75 million and $284 million, respectively, for the three months ended December 31, 2023, $93 million and $273 million, respectively, for the three months ended September 30, 2023, $48 million and $130

million, respectively, for the three months ended June 30, 2023, and $216 million and $687 million, respectively, for the full year 2023, associated with First Republic.

Page 19View entire presentation