Sale of a 19.9% Ownership Interest in NIPSCO

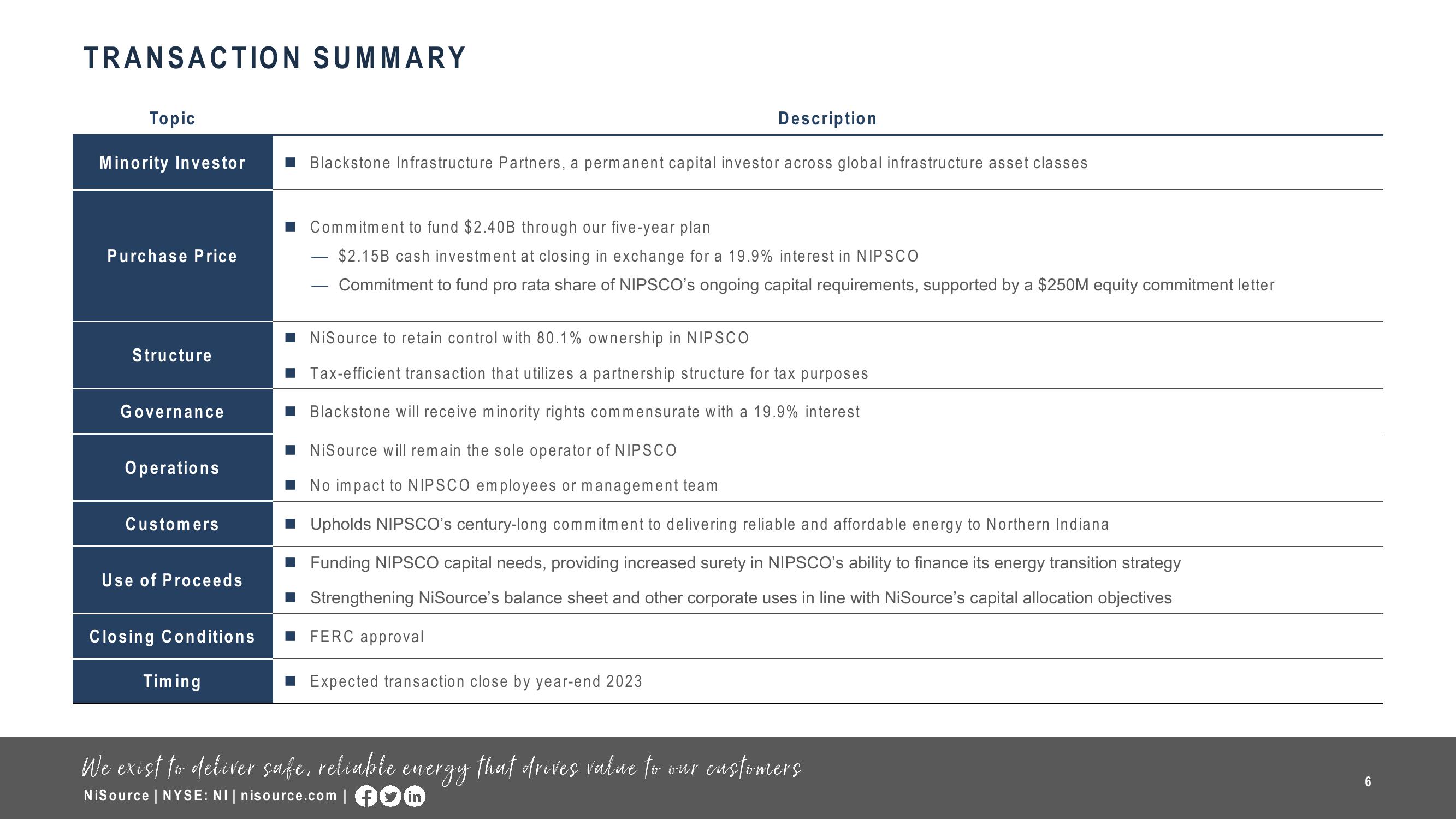

TRANSACTION SUMMARY

Topic

Minority Investor

Purchase Price

Structure

Governance

Operations

Customers

Use of Proceeds

Closing Conditions

Timing

Description

Blackstone Infrastructure Partners, a permanent capital investor across global infrastructure asset classes

Commitment to fund $2.40B through our five-year plan

$2.15B cash investment at closing in exchange for a 19.9% interest in NIPSCO

Commitment to fund pro rata share of NIPSCO's ongoing capital requirements, supported by a $250M equity commitment letter

NiSource to retain control with 80.1% ownership in NIPSCO

Tax-efficient transaction that utilizes a partnership structure for tax purposes

Blackstone will receive minority rights commensurate with a 19.9% interest

NiSource will remain the sole operator of NIPSCO

■ No impact to NIPSCO employees or management team

Upholds NIPSCO's century-long commitment to delivering reliable and affordable energy to Northern Indiana

Funding NIPSCO capital needs, providing increased surety in NIPSCO's ability to finance its energy transition strategy

Strengthening NiSource's balance sheet and other corporate uses in line with NiSource's capital allocation objectives

■FERC approval

Expected transaction close by year-end 2023

We exist to deliver safe, reliable energy that drives value to our customers

NiSource | NYSE: NI| nisource.com | om

6View entire presentation