FY 2023 Second Quarter Earnings Call

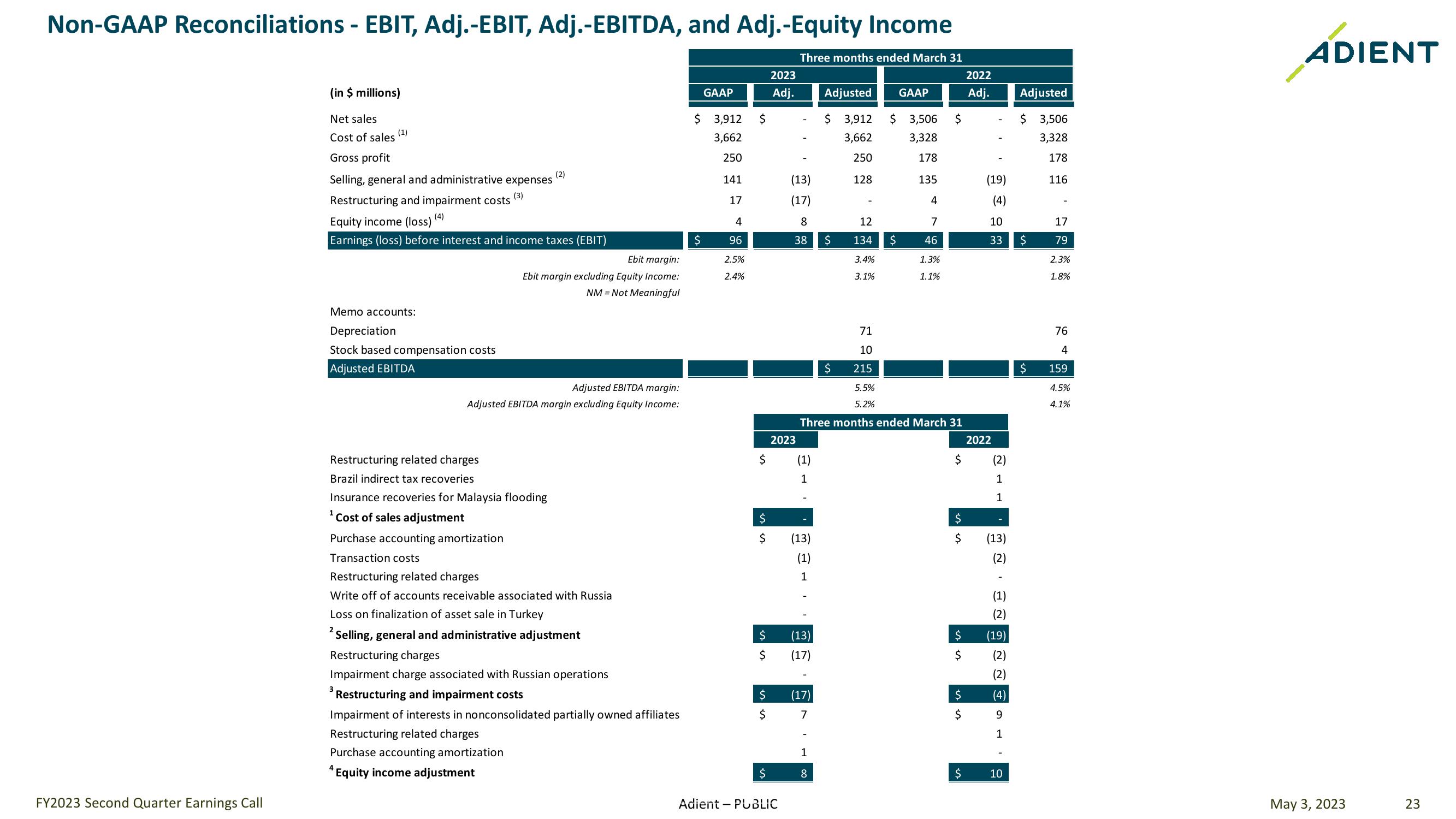

Non-GAAP Reconciliations - EBIT, Adj.-EBIT, Adj.-EBITDA, and Adj.-Equity Income

FY2023 Second Quarter Earnings Call

Three months ended March 31

2023

2022

(in $ millions)

Net sales

Cost of sales

(1)

GAAP

Adj.

Adjusted

GAAP

Adj.

Adjusted

$ 3,912

$

$ 3,912 $ 3,506

$

$ 3,506

3,662

3,662

3,328

3,328

Gross profit

250

250

178

178

Selling, general and administrative expenses

Restructuring and impairment costs

Equity income (loss)

(4)

(3)

Earnings (loss) before interest and income taxes (EBIT)

(2)

141

(13)

128

135

(19)

116

17

(17)

4

(4)

4

8

12

7

10

17

$

96

38

$

134 $ 46

33

$

79

Ebit margin:

2.5%

3.4%

1.3%

2.3%

Ebit margin excluding Equity Income:

NM Not Meaningful

2.4%

3.1%

1.1%

1.8%

Memo accounts:

Depreciation

Stock based compensation costs

Adjusted EBITDA

71

10

$

215

Adjusted EBITDA margin:

Adjusted EBITDA margin excluding Equity Income:

5.5%

5.2%

Three months ended March 31

2023

2022

Restructuring related charges

$

Brazil indirect tax recoveries

(1)

1

ՄԴ

$

(2)

1

Insurance recoveries for Malaysia flooding

1

1

Cost of sales adjustment

$

$

Purchase accounting amortization

$

(13)

$

(13)

Transaction costs

(1)

(2)

Restructuring related charges

1

Write off of accounts receivable associated with Russia

(1)

Loss on finalization of asset sale in Turkey

(2)

Selling, general and administrative adjustment

$

(13)

$

(19)

Restructuring charges

$

(17)

$

(2)

Impairment charge associated with Russian operations

(2)

3 Restructuring and impairment costs

$

(17)

$

(4)

Impairment of interests in nonconsolidated partially owned affiliates

$

7

$

9

Restructuring related charges

1

Purchase accounting amortization

4 Equity income adjustment

1

$

8

$

10

Adient - PUBLIC

76

4

159

4.5%

4.1%

ADIENT

May 3, 2023

23View entire presentation