BlackRock Global Long/Short Credit Absolute Return Credit

Diversifying the Sources of Return

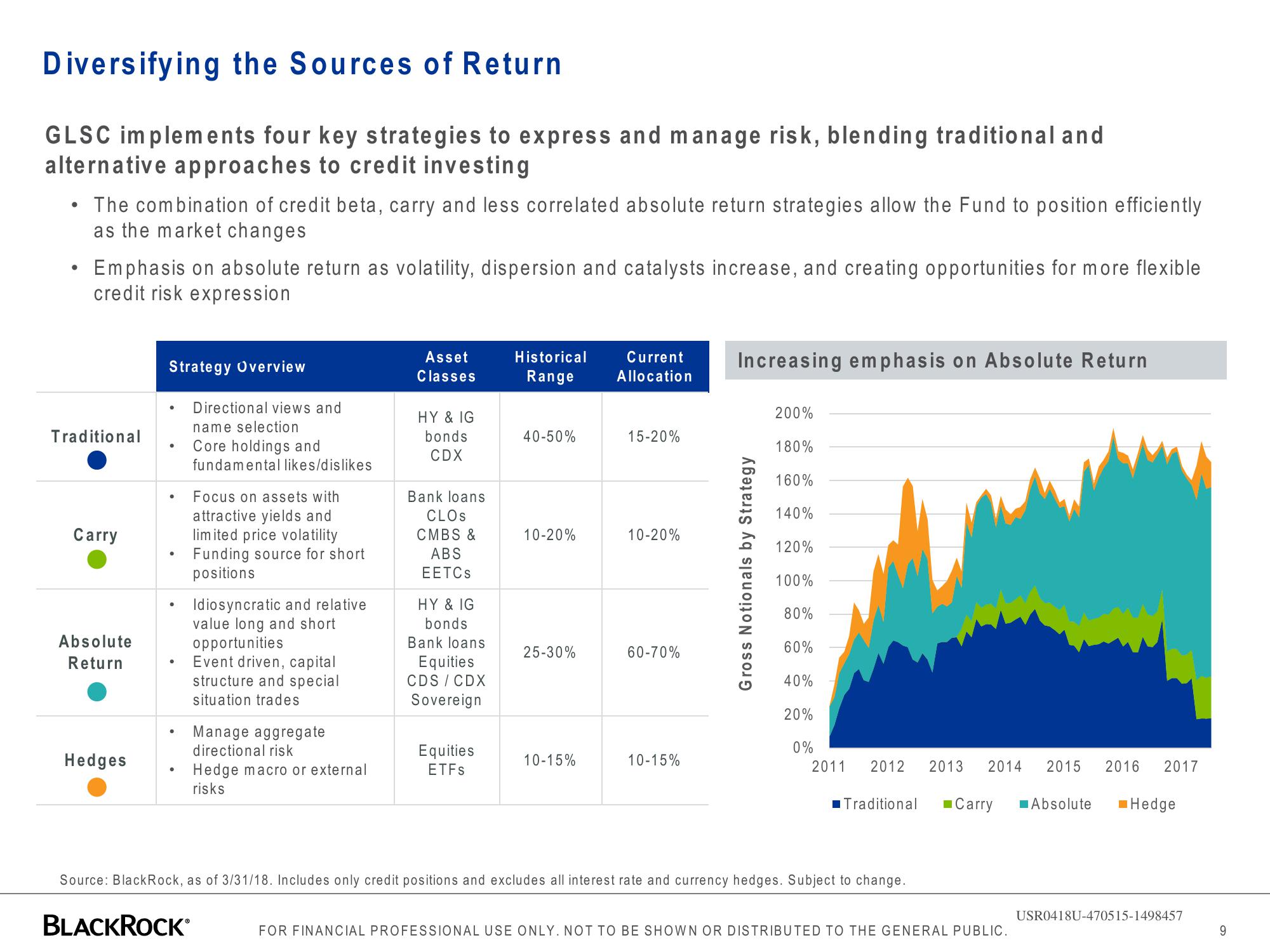

GLSC implements four key strategies to express and manage risk, blending traditional and

alternative approaches to credit investing

●

The combination of credit beta, carry and less correlated absolute return strategies allow the Fund to position efficiently

as the market changes

Emphasis on absolute return as volatility, dispersion and catalysts increase, and creating opportunities for more flexible

credit risk expression

Traditional

Carry

Absolute

Return

Hedges

Strategy Overview

●

●

Directional views and

name selection

Core holdings and

fundamental likes/dislikes

BLACKROCK

Focus on assets with

attractive yields and

limited price volatility

Funding source for short

positions

Idiosyncratic and relative

value long and short

opportunities

Event driven, capital

structure and special

situation trades

Manage aggregate

directional risk

Hedge macro or external

risks

Asset

Classes

HY & IG

bonds

CDX

Bank loans

CLOS

CMBS &

ABS

EETCS

HY & IG

bonds

Bank loans

Equities

CDS/CDX

Sovereign

Equities

ETFs

Historical

Range

40-50%

10-20%

25-30%

10-15%

Current

Allocation

15-20%

10-20%

60-70%

10-15%

Increasing emphasis on Absolute Return

Gross Notionals by Strategy

200%

180%

160%

140%

120%

100%

80%

60%

40%

20%

0%

2011 2012 2013 2014 2015 2016 2017

Traditional ■Carry ■Absolute ■Hedge

Source: BlackRock, as of 3/31/18. Includes only credit positions and excludes all interest rate and currency hedges. Subject to change.

FOR FINANCIAL PROFESSIONAL USE ONLY. NOT TO BE SHOWN OR DISTRIBUTED TO THE GENERAL PUBLIC.

USR0418U-470515-1498457

9View entire presentation