Deutsche Bank Results Presentation Deck

Commercial Real Estate (CRE)

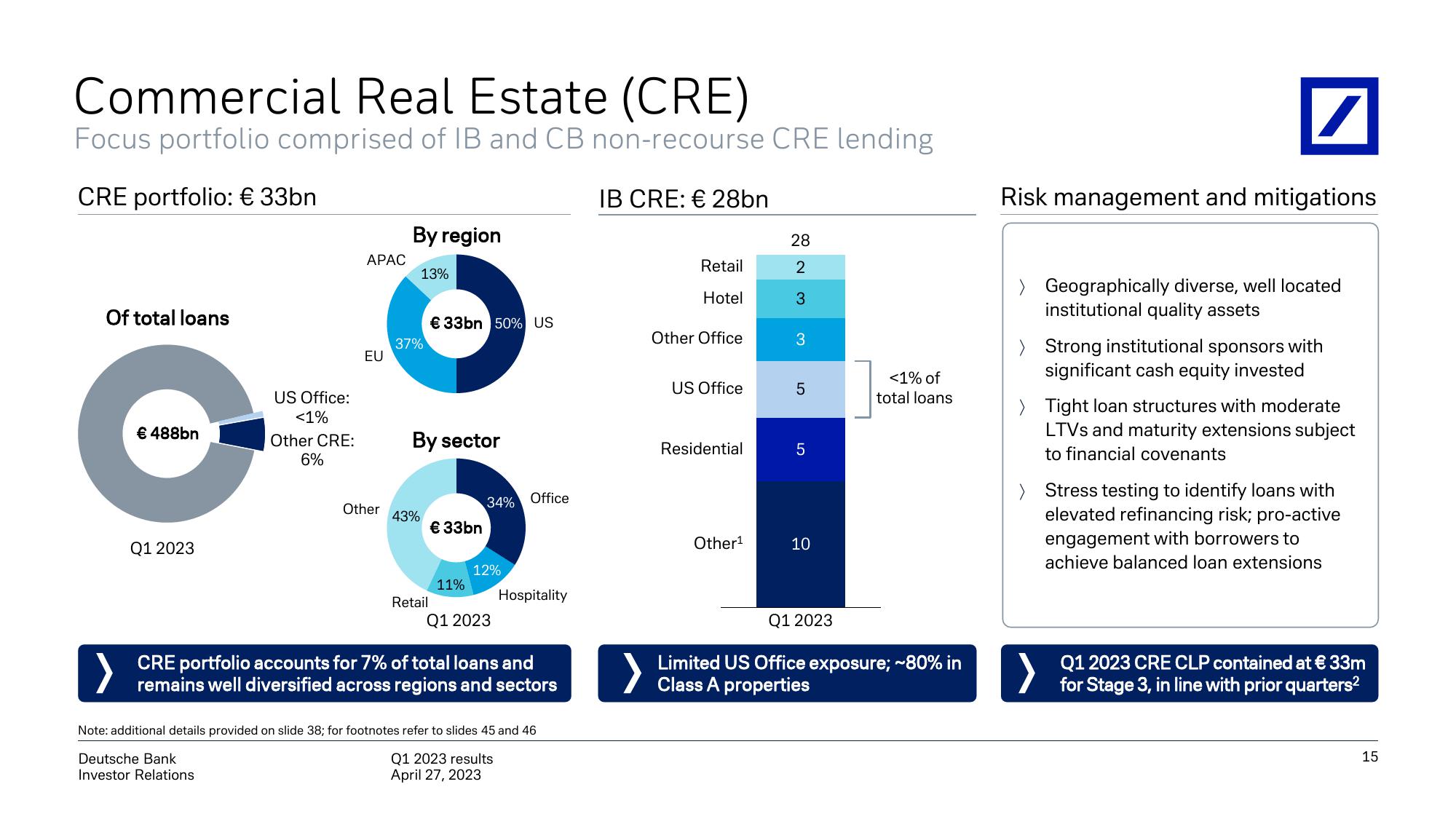

Focus portfolio comprised of IB and CB non-recourse CRE lending

CRE portfolio: € 33bn

Of total loans

>

€ 488bn

Q1 2023

US Office:

<1%

Other CRE:

6%

APAC

EU

Other

By region

13%

37%

43%

By sector

€ 33bn 50% US

Retail

€ 33bn

11%

34% Office

12%

Q1 2023

Hospitality

CRE portfolio accounts for 7% of total loans and

remains well diversified across regions and sectors

Note: additional details provided on slide 38; for footnotes refer to slides 45 and 46

Deutsche Bank

Q1 2023 results

Investor Relations

April 27, 2023

IB CRE: € 28bn

Retail

Hotel

Other Office

US Office

Residential

Other¹

28

2

3

3

5

5

10

<1% of

total loans

Q1 2023

Limited US Office exposure; ~80% in

Class A properties

Risk management and mitigations

> Geographically diverse, well located

institutional quality assets

> Strong institutional sponsors with

significant cash equity invested

> Tight loan structures with moderate

LTVs and maturity extensions subject

to financial covenants

> Stress testing to identify loans with

elevated refinancing risk; pro-active

engagement with borrowers to

achieve balanced loan extensions

>

for Stage 3, in line with prior quarters²

15View entire presentation