Allwyn SPAC Presentation Deck

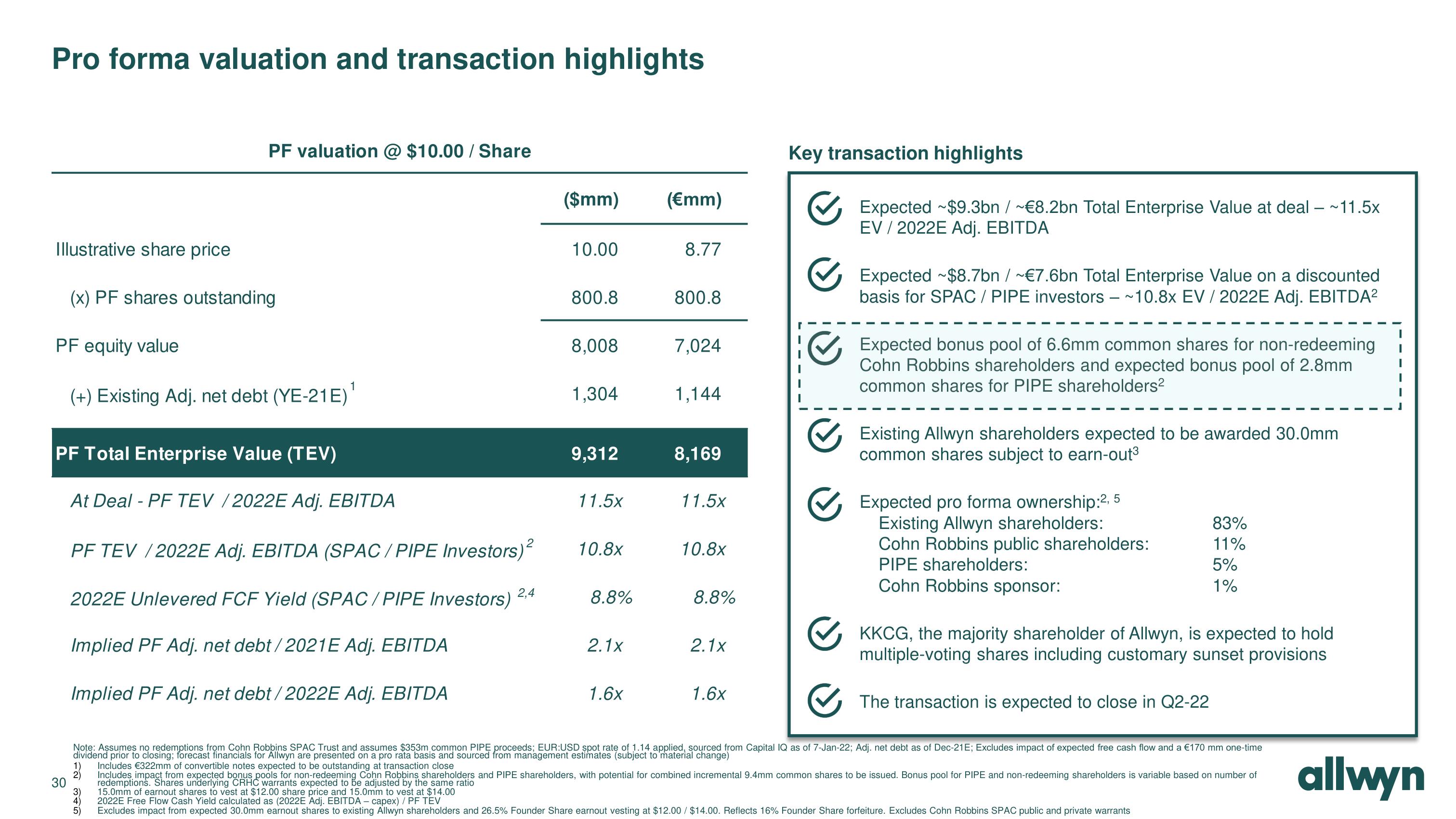

Pro forma valuation and transaction highlights

Illustrative share price

(x) PF shares outstanding

PF equity value

(+) Existing Adj. net debt (YE-21E)1¹

PF Total Enterprise Value (TEV)

At Deal - PF TEV /2022E Adj. EBITDA

PF TEV / 2022E Adj. EBITDA (SPAC/PIPE Investors)²

2022E Unlevered FCF Yield (SPAC/PIPE Investors)

Implied PF Adj. net debt/2021E Adj. EBITDA

Implied PF Adj. net debt/2022E Adj. EBITDA

30

PF valuation @ $10.00/Share

1)

2)

3)

4)

5)

2,4

($mm)

10.00

800.8

8,008

1,304

9,312

11.5x

10.8x

8.8%

2.1x

(€mm)

1.6x

8.77

800.8

7,024

1,144

8,169

11.5x

10.8x

8.8%

2.1x

Key transaction highlights

✔ Expected ~$9.3bn / ~€8.2bn Total Enterprise Value at deal - ~11.5x

EV / 2022E Adj. EBITDA

1.6x

✔ Expected ~$8.7bn / ~€7.6bn Total Enterprise Value on a discounted

basis for SPAC/PIPE investors - ~10.8x EV / 2022E Adj. EBITDA²

✔✔ Expected bonus pool of 6.6mm common shares for non-redeeming

Cohn Robbins shareholders and expected bonus pool of 2.8mm

common shares for PIPE shareholders²

✔✔ Existing Allwyn shareholders expected to be awarded 30.0mm

common shares subject to earn-out³

✔

✔

Note: Assumes no redemptions from Cohn Robbins SPAC Trust and assumes $353m common PIPE proceeds; EUR:USD spot rate of 1.14 applied, sourced from Capital IQ as of 7-Jan-22; Adj. net debt as of Dec-21E; Excludes impact of expected free cash flow and a €170 mm one-time

dividend prior to closing; forecast financials for Allwyn are presented on a pro rata basis and sourced from management estimates (subject to material change)

Expected pro forma ownership:2,5

Existing Allwyn shareholders:

Cohn Robbins public shareholders:

PIPE shareholders:

Cohn Robbins sponsor:

✔KKCG, the majority shareholder of Allwyn, is expected to hold

multiple-voting shares including customary sunset provisions

83%

11%

5%

1%

The transaction is expected to close in Q2-22

Includes €322mm of convertible notes expected to be outstanding at transaction close

Includes impact from expected bonus pools for non-redeeming Cohn Robbins shareholders and PIPE shareholders, with potential for combined incremental 9.4mm common shares to be issued. Bonus pool for PIPE and non-redeeming shareholders is variable based on number of

redemptions. Shares underlying CRHC warrants expected to be adjusted by the same ratio

15.0mm of earnout shares to vest at $12.00 share price and 15.0mm to vest at $14.00

2022E Free Flow Cash Yield calculated as (2022E Adj. EBITDA - capex) / PF TEV

Excludes impact from expected 30.0mm earnout shares to existing Allwyn shareholders and 26.5% Founder Share earnout vesting at $12.00 / $14.00. Reflects 16% Founder Share forfeiture. Excludes Cohn Robbins SPAC public and private warrants

I

I

allwynView entire presentation