HSBC Investor Event Presentation Deck

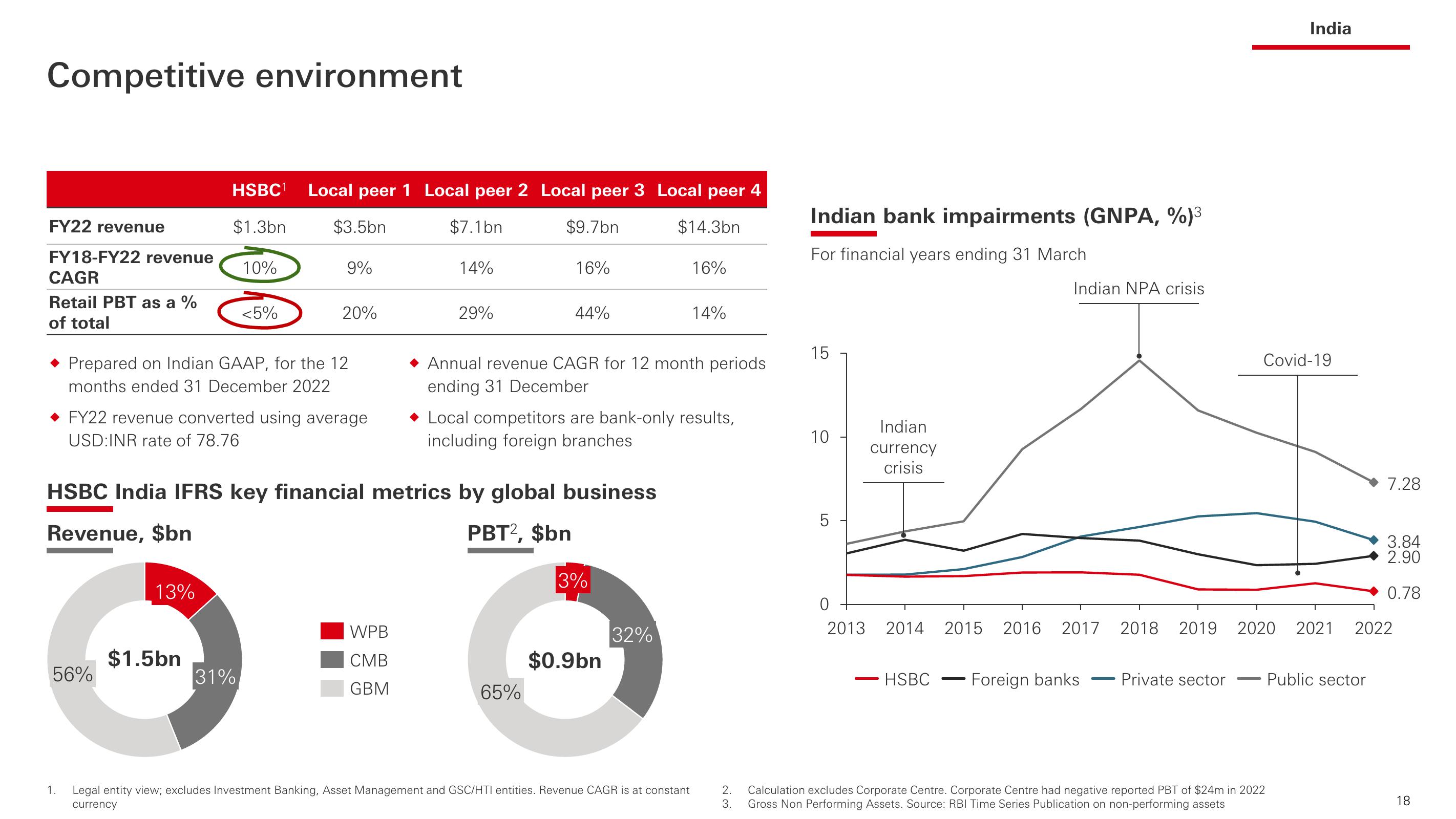

Competitive environment

FY22 revenue

FY18-FY22 revenue

CAGR

Retail PBT as a %

of total

56%

1.

HSBC¹ Local peer 1 Local peer 2 Local peer 3 Local peer 4

$1.3bn

$3.5bn

$7.1bn

$9.7bn

$14.3bn

13%

10%

Prepared on Indian GAAP, for the 12

months ended 31 December 2022

◆ FY22 revenue converted using average

USD:INR rate of 78.76

$1.5bn

<5%

31%

9%

20%

14%

HSBC India IFRS key financial metrics by global business

Revenue, $bn

PBT2, $bn

WPB

CMB

GBM

29%

16%

44%

65%

Annual revenue CAGR for 12 month periods

ending 31 December

Local competitors are bank-only results,

including foreign branches

3%

$0.9bn

16%

32%

14%

Legal entity view; excludes Investment Banking, Asset Management and GSC/HTI entities. Revenue CAGR is at constant

currency

2.

3.

Indian bank impairments (GNPA, %)³

For financial years ending 31 March

15

10

5

0

2013

Indian

currency

crisis

2014 2015 2016

HSBC

Indian NPA crisis

Foreign banks

2017 2018 2019 2020 2021

Private sector

India

Covid-19

Calculation excludes Corporate Centre. Corporate Centre had negative reported PBT of $24m in 2022

Gross Non Performing Assets. Source: RBI Time Series Publication on non-performing assets

7.28

Public sector

3.84

2.90

0.78

2022

18View entire presentation