Apollo Global Management Investor Presentation Deck

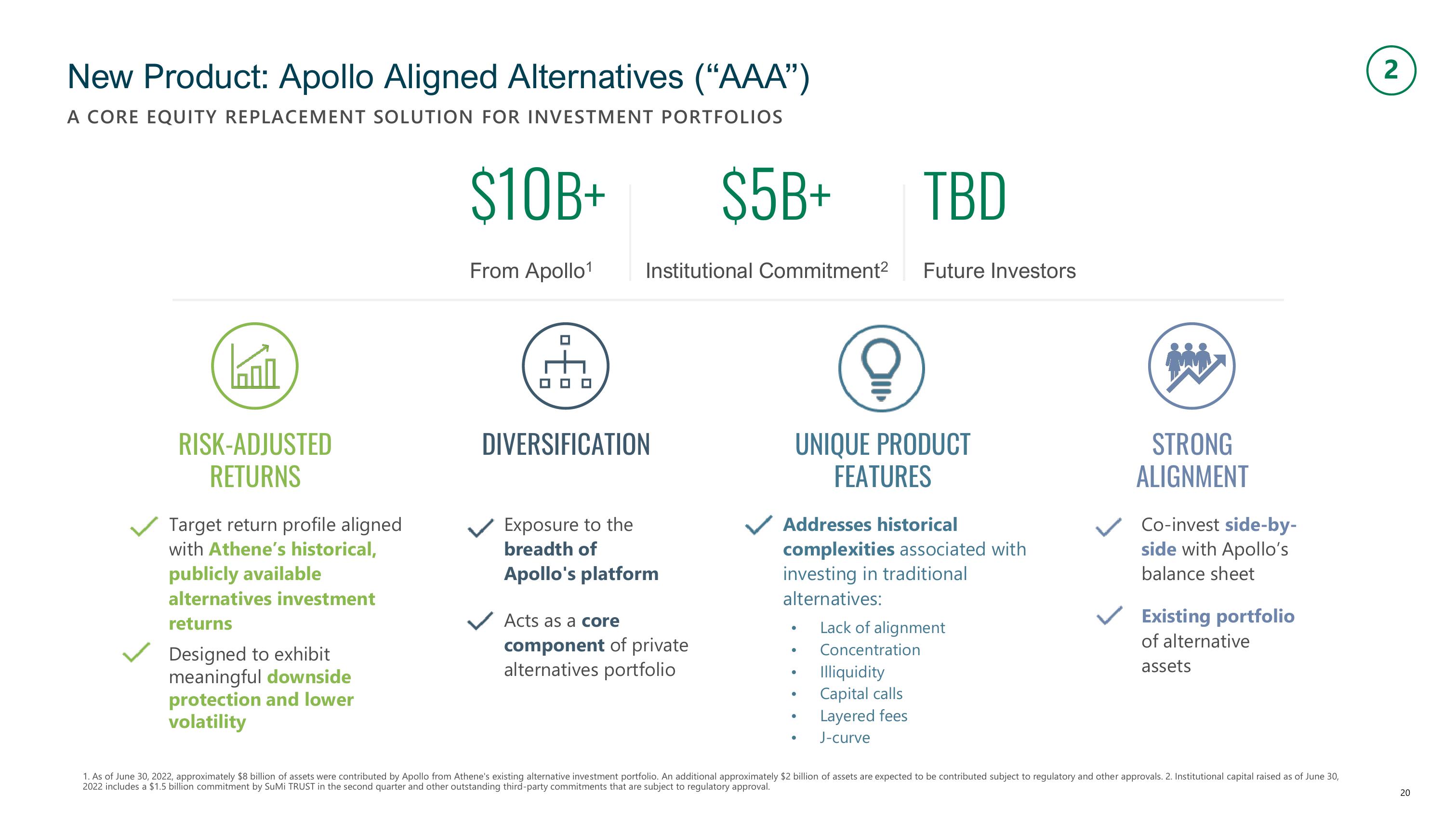

New Product: Apollo Aligned Alternatives ("AAA")

A CORE EQUITY REPLACEMENT SOLUTION FOR INVESTMENT PORTFOLIOS

ܕܐܐ

RISK-ADJUSTED

RETURNS

Target return profile aligned

with Athene's historical,

publicly available

alternatives investment

returns

Designed to exhibit

meaningful downside

protection and lower

volatility

$10B+

From Apollo¹

DIVERSIFICATION

Institutional Commitment² Future Investors

Exposure to the

breadth of

Apollo's platform

$5B+

Acts as a core

component of private

alternatives portfolio

UNIQUE PRODUCT

FEATURES

Addresses historical

complexities associated with

investing in traditional

alternatives:

●

●

●

●

TBD

●

●

Lack of alignment

Concentration

Illiquidity

Capital calls

Layered fees

J-curve

j

STRONG

ALIGNMENT

Co-invest side-by-

side with Apollo's

balance sheet

✓ Existing portfolio

of alternative

assets

1. As of June 30, 2022, approximately $8 billion of assets were contributed by Apollo from Athene's existing alternative investment portfolio. An additional approximately $2 billion of assets are expected to be contributed subject to regulatory and other approvals. 2. Institutional capital raised as of June 30,

2022 includes a $1.5 billion commitment by SuMi TRUST in the second quarter and other outstanding third-party commitments that are subject to regulatory approval.

2

20View entire presentation