Aptiv Overview

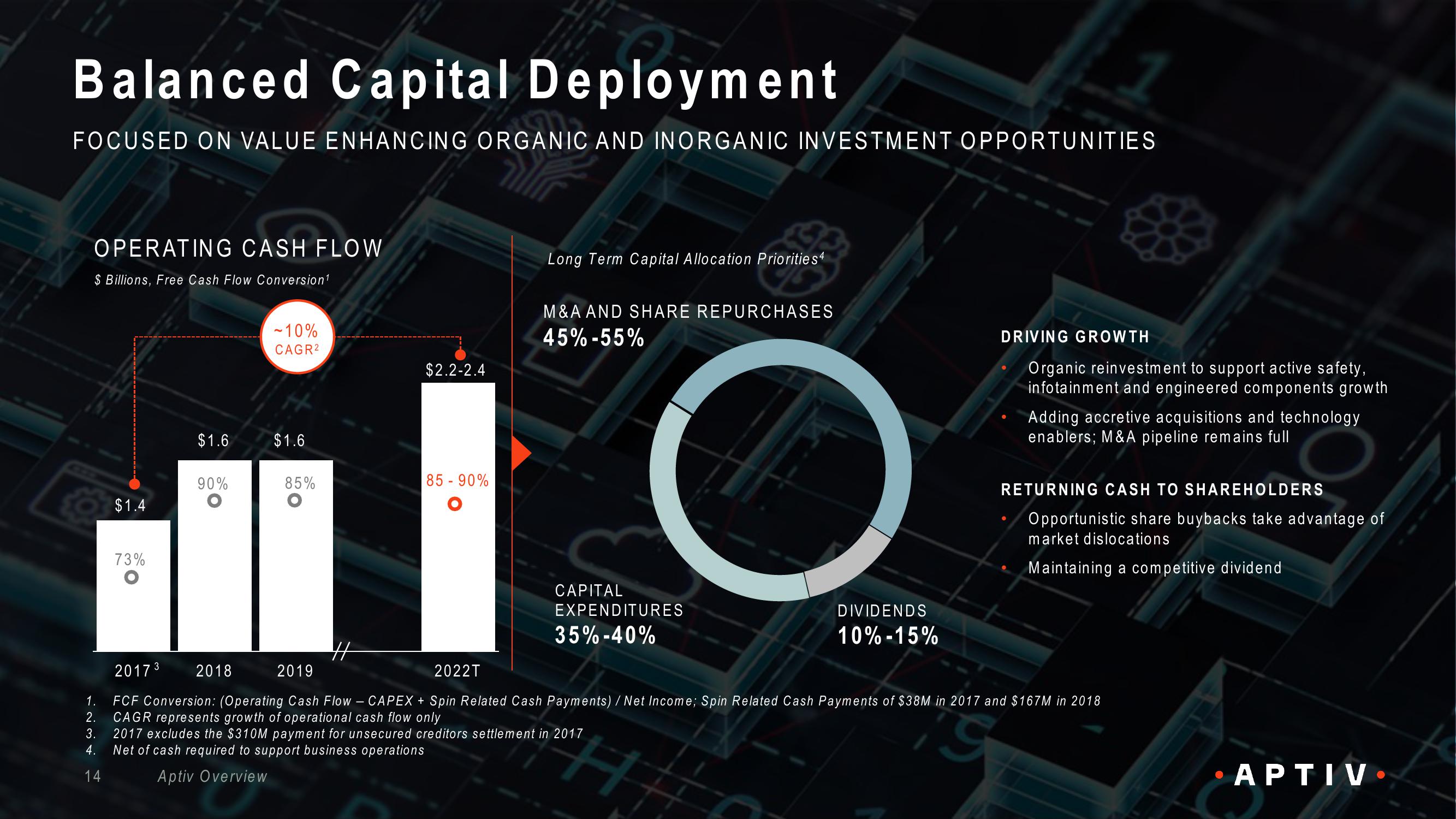

Balanced Capital Deployment

FOCUSED ON VALUE ENHANCING ORGANIC AND INORGANIC INVESTMENT OPPORTUNITIES

OPERATING CASH FLOW

$ Billions, Free Cash Flow Conversion ¹

723

$1.4

73%

$1.6

90%

-10%

CAGR²

$1.6

85%

$2.2-2.4

85-90%

Long Term Capital Allocation Priorities4

M&A AND SHARE REPURCHASES

45% -55%

O

CAPITAL

EXPENDITURES

35% -40%

DIVIDENDS

10%-15%

DRIVING GROWTH

Organic reinvestment to support active safety,

infotainment and engineered components growth

Adding accretive acquisitions and technology

enablers; M&A pipeline remains full

RETURNING CASH TO SHAREHOLDERS

Opportunistic share buybacks take advantage of

market dislocations

Maintaining a competitive dividend

41

2017 3 2018

2019

2022T

1. FCF Conversion: (Operating Cash Flow - CAPEX + Spin Related Cash Payments) / Net Income; Spin Related Cash Payments of $38M in 2017 and $167M in 2018

CAGR represents growth of operational cash flow only

2.

G

3. 2017 excludes the $310M payment for unsecured creditors settlement in 2017

4.

Net of cash required to support business operations

14

Aptiv Overview

APTIV.View entire presentation