Imperial Brands Results Presentation Deck

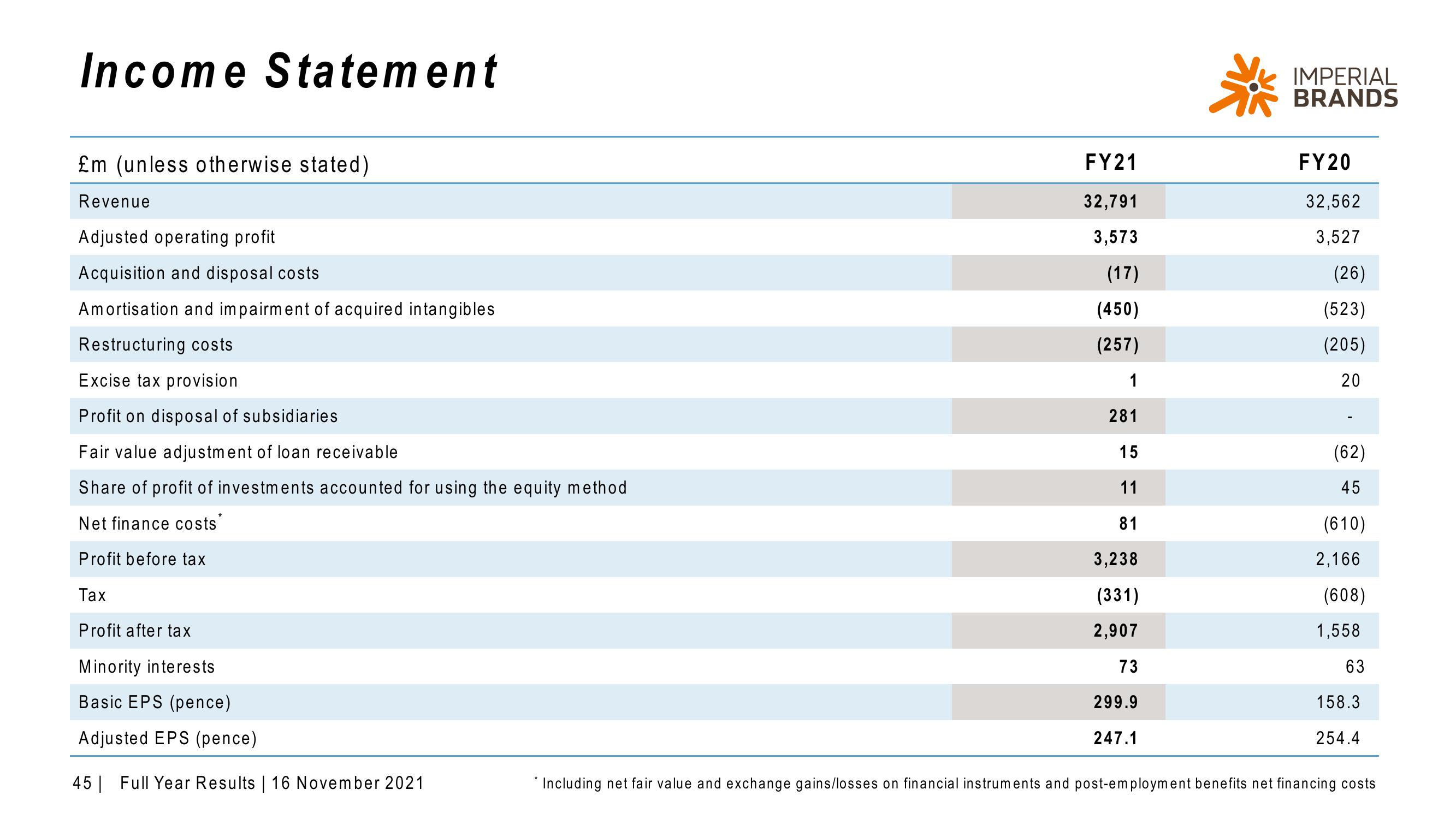

Income Statement

£m (unless otherwise stated)

Revenue

Adjusted operating profit

Acquisition and disposal costs

Amortisation and impairment of acquired intangibles

Restructuring costs

Excise tax provision

Profit on disposal of subsidiaries

Fair value adjustment of loan receivable

Share of profit of investments accounted for using the equity method

Net finance costs

Profit before tax

Tax

Profit after tax

Minority interests

Basic EPS (pence)

Adjusted EPS (pence)

45 Full Year Results | 16 November 2021

FY21

32,791

3,573

(17)

(450)

(257)

1

281

15

11

81

3,238

(331)

2,907

73

299.9

247.1

治

IMPERIAL

BRANDS

FY20

32,562

3,527

(26)

(523)

(205)

20

(62)

45

(610)

2,166

(608)

1,558

63

158.3

254.4

* Including net fair value and exchange gains/losses on financial instruments and post-employment benefits net financing costsView entire presentation