Silicon Valley Bank Results Presentation Deck

Focus Area: Leveraging client liquidity 2013

of

●

●

●

●

Billions

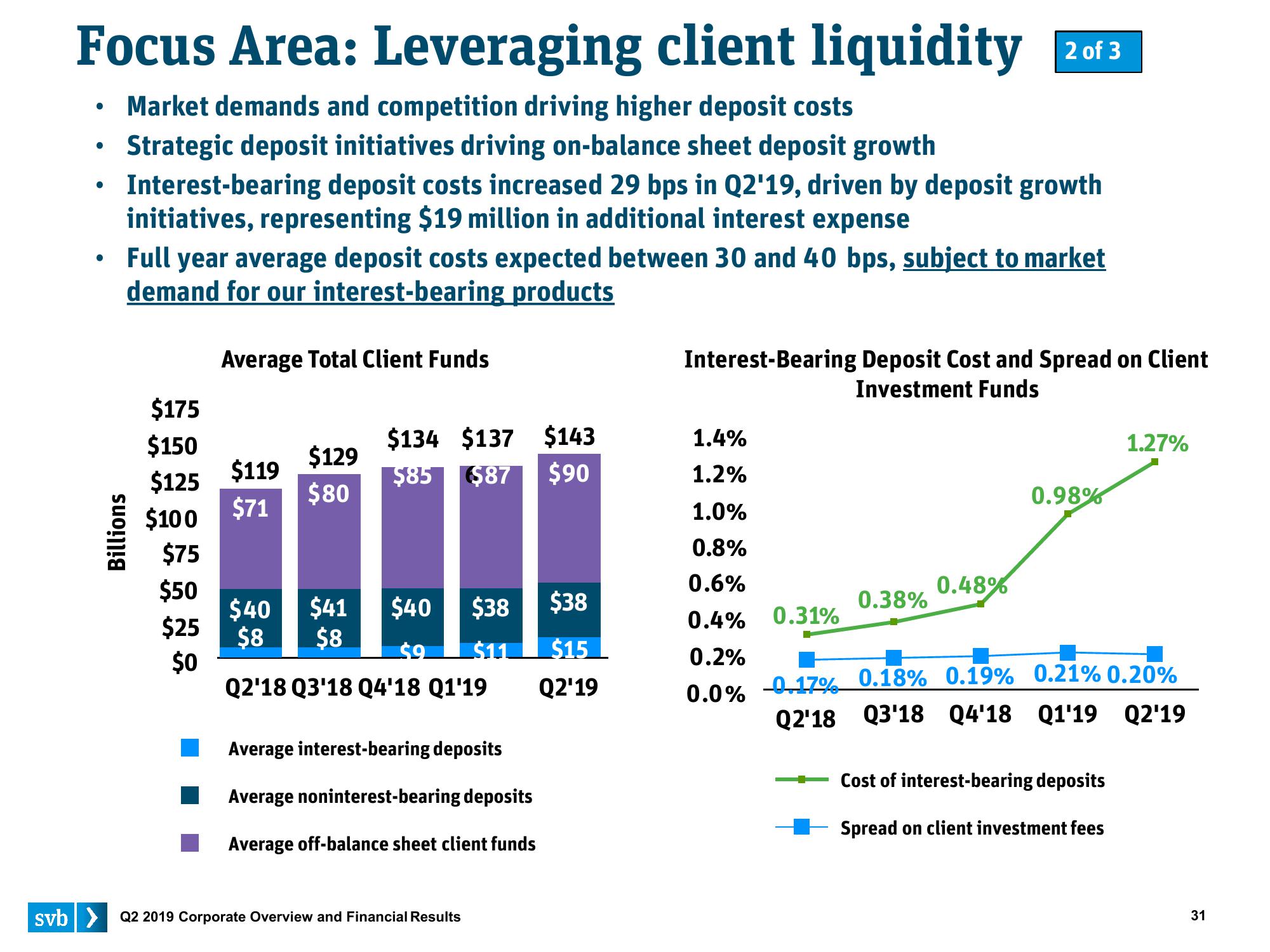

Market demands and competition driving higher deposit costs

Strategic deposit initiatives driving on-balance sheet deposit growth

Interest-bearing deposit costs increased 29 bps in Q2'19, driven by deposit growth

initiatives, representing $19 million in additional interest expense

Full year average deposit costs expected between 30 and 40 bps, subject to market

demand for our interest-bearing products

$175

$150

$125 $119

$71

$100

$75

$50

Average Total Client Funds

$25

$0

$129

$80

$134 $137 $143

$85 $87 $90

$40

$41

$40

$38

$8 $8 $9 $11

Q2'18 Q3'18 Q4'18 Q1'19

Average interest-bearing deposits

Average noninterest-bearing deposits

Average off-balance sheet client funds

svb> Q2 2019 Corporate Overview and Financial Results

$38

$15

Q2'19

Interest-Bearing Deposit Cost and Spread on Client

Investment Funds

1.4%

1.2%

1.0%

0.8%

0.6%

0.4% 0.31%

0.2%

0.0%

0.38%

0.48%

0.98%

1.27%

-0.17%

0.18% 0.19% 0.21% 0.20%

Q2'18 Q3'18 Q4'18 Q1'19 Q2'19

Cost of interest-bearing deposits

Spread on client investment fees

31View entire presentation