J.P.Morgan ESG Presentation Deck

F

Methane

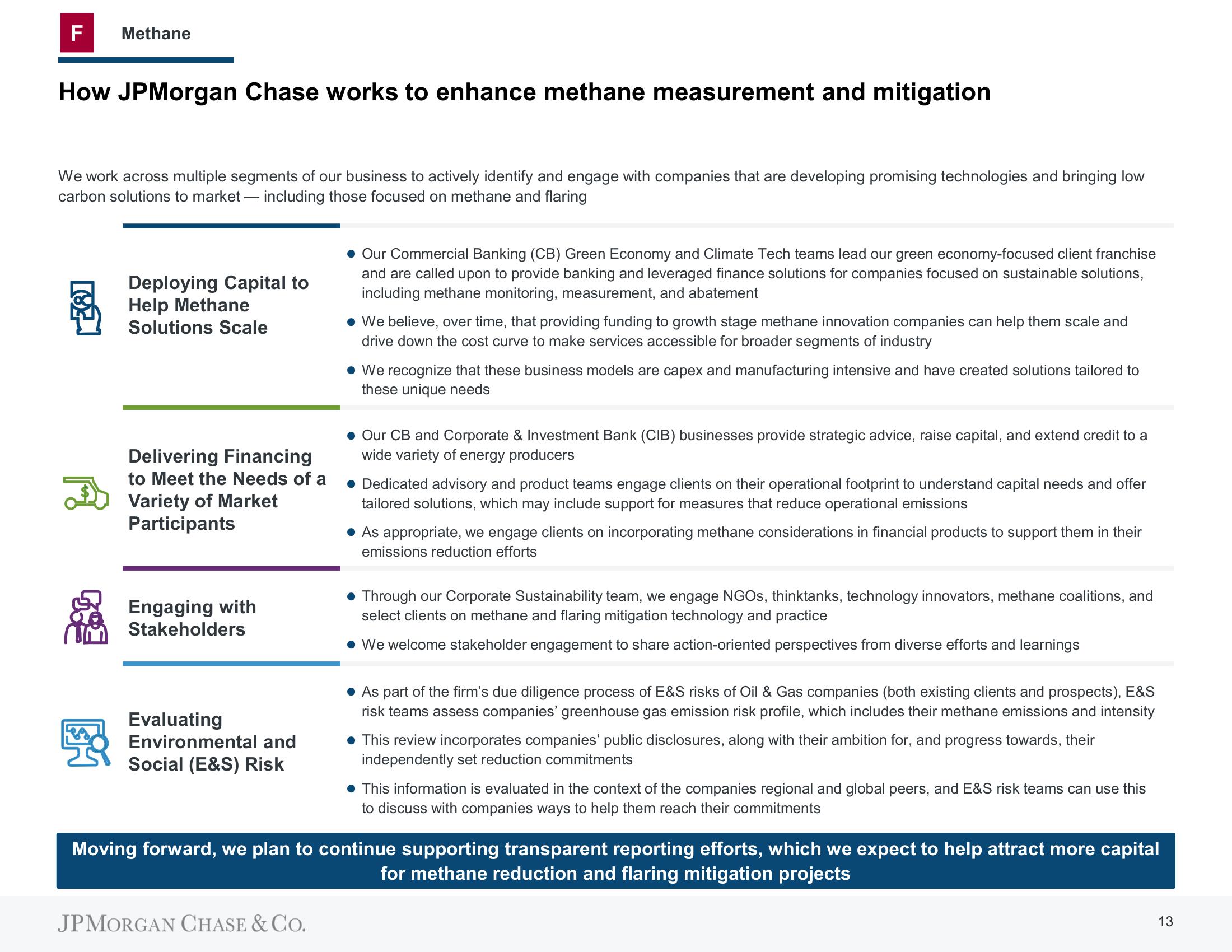

How JPMorgan Chase works to enhance methane measurement and mitigation

We work across multiple segments of our business to actively identify and engage with companies that are developing promising technologies and bringing low

carbon solutions to market — including those focused on methane and flaring

Deploying Capital to

Help Methane

Solutions Scale

Delivering Financing

to Meet the Needs of a

Variety of Market

Participants

Engaging with

Stakeholders

Evaluating

Environmental and

Social (E&S) Risk

• Our Commercial Banking (CB) Green Economy and Climate Tech teams lead our green economy-focused client franchise

and are called upon to provide banking and leveraged finance solutions for companies focused on sustainable solutions,

including methane monitoring, measurement, and abatement

JPMORGAN CHASE & CO.

• We believe, over time, that providing funding to growth stage methane innovation companies can help them scale and

drive down the cost curve to make services accessible for broader segments of industry

• We recognize that these business models are capex and manufacturing intensive and have created solutions tailored to

these unique needs

● Our CB and Corporate & Investment Bank (CIB) businesses provide strategic advice, raise capital, and extend credit to a

wide variety of energy producers

• Dedicated advisory and product teams engage clients on their operational footprint to understand capital needs and offer

tailored solutions, which may include support for measures that reduce operational emissions

● As appropriate, we engage clients on incorporating methane considerations in financial products to support them in their

emissions reduction efforts

● Through our Corporate Sustainability team, we engage NGOs, thinktanks, technology innovators, methane coalitions, and

select clients on methane and flaring mitigation technology and practice

• We welcome stakeholder engagement to share action-oriented perspectives from diverse efforts and learnings

● As part of the firm's due diligence process of E&S risks of Oil & Gas companies (both existing clients and prospects), E&S

risk teams assess companies' greenhouse gas emission risk profile, which includes their methane emissions and intensity

• This review incorporates companies' public disclosures, along with their ambition for, and progress towards, their

independently set reduction commitments

This information is evaluated in the context of the companies regional and global peers, and E&S risk teams can use this

to discuss with companies ways to help them reach their commitments

Moving forward, we plan to continue supporting transparent reporting efforts, which we expect to help attract more capital

for methane reduction and flaring mitigation projects

13View entire presentation