Lyft Results Presentation Deck

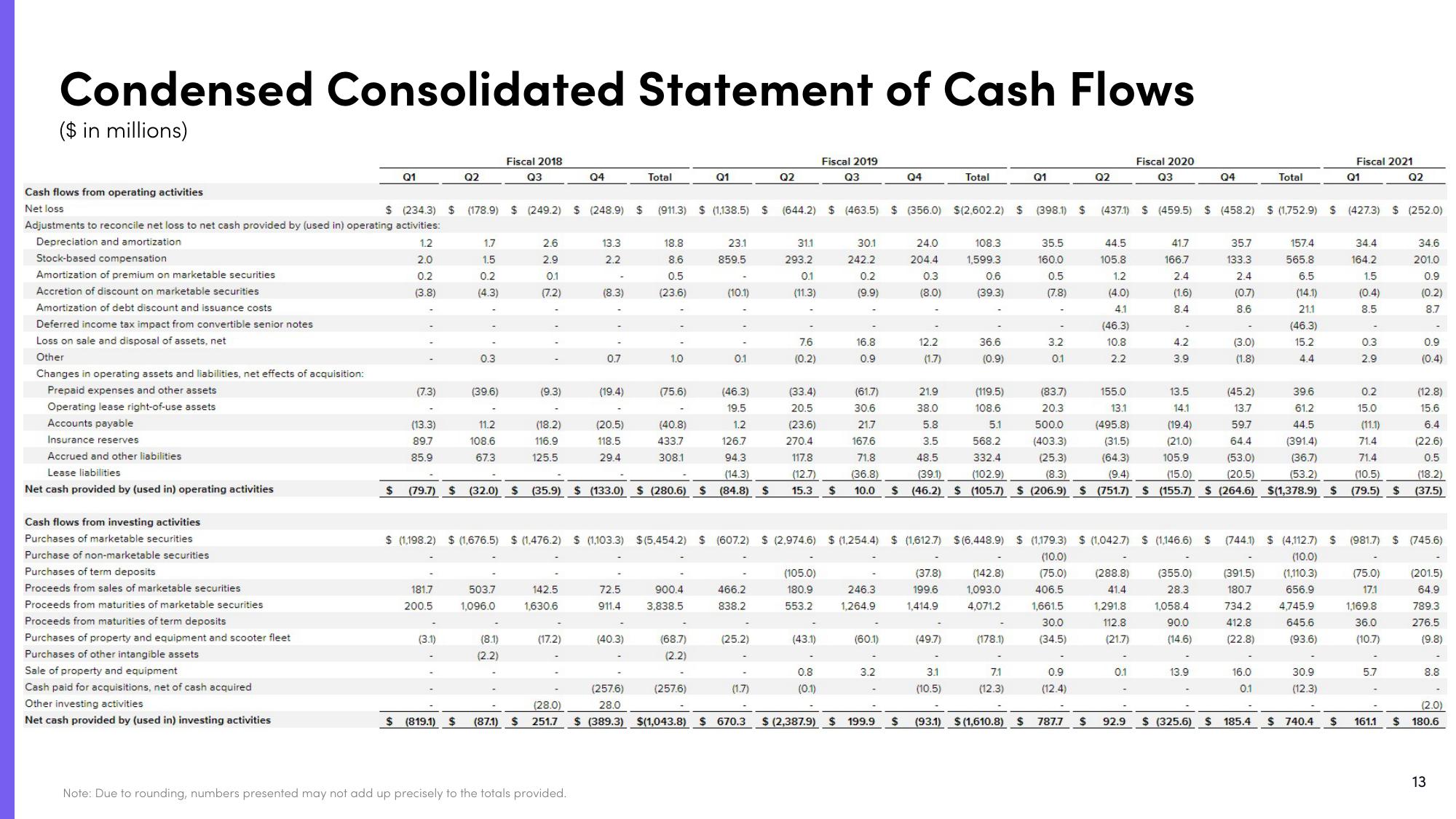

Condensed Consolidated Statement of Cash Flows

($ in millions)

Cash flows from operating activities

Net loss

$ (234.3) $

Adjustments to reconcile net loss to net cash provided by (used in) operating activities:

Depreciation and amortization

Stock-based compensation

Amortization of premium on marketable securities

Accretion of discount on marketable securities

Amortization of debt discount and issuance costs

Deferred income tax impact from convertible senior notes

Loss on sale and disposal of assets, net

Other

Changes in operating assets and liabilities, net effects of acquisition:

Prepaid expenses and other assets

Operating lease right-of-use assets

Accounts payable

Insurance reserves

Accrued and other liabilities

Lease liabilities

Net cash provided by (used in) operating activities

Cash flows from investing activities

Purchases of marketable securities

Purchase of non-marketable securities

Purchases of term deposits

Proceeds from sales of marketable securities

Proceeds from maturities of marketable securities

Proceeds from maturities of term deposits

Purchases of property and equipment and scooter fleet

Purchases of other intangible assets

Sale of property and equipment

Cash paid for acquisitions, net of cash acquired

Q1

Other investing activities

Net cash provided by (used in) investing activities

1.2

2.0

0.2

(3.8)

(7.3)

(13.3)

89.7

85.9

181.7

200.5

Q2

(3.1)

$ (819.1) $

1.7

1.5

0.2

(4.3)

(178.9) $ (249.2) $ (248.9)

0.3

(39.6)

11.2

108.6

67.3

Fiscal 2018

Q3

503.7

1,096.0

(8.1)

(2.2)

2.6

2.9

0.1

(7.2)

(9.3)

(87.1) $

(18.2)

116.9

125.5

$ (79.7) $ (32.0) $ (35.9) $ (133.0)

Q4

142.5

1,630.6

(17.2)

13.3

2.2

(8.3)

Note: Due to rounding, numbers presented may not add up precisely to the totals provided.

0.7

(19.4)

(20.5)

118.5

29.4

72.5

911.4

(40.3)

$

(257.6)

28.0

Total

(911.3)

18.8

8.6

0.5

(23.6)

1.0

(75.6)

(40.8)

433.7

308.1

$ (280.6) $

900.4

3,838.5

(68.7)

(2.2)

Q1

(257.6)

23.1

859.5

(10.1)

$ (1.138.5) $ (644.2) $ (463.5) $ (356.0) $(2,602.2) $

0.1

(46.3)

19.5

1.2

126.7

94.3

(14.3)

(84.8) $

466.2

838.2

(25.2)

Q2

(1.7)

(28.0)

251.7 $ (389.3) $(1,043.8) $670.3

31.1

293.2

0.1

(11.3)

7.6

(0.2)

Fiscal 2019

Q3

(105.0)

180.9

553.2

(43.1)

30.1

242.2

0.2

(9.9)

0.8

(0.1)

16.8

0.9

(61.7)

30.6

246.3

1,264.9

(60.1)

Q4

3.2

$ (1,198.2) $ (1,676.5) $ (1,476.2) $ (1,103.3) $(5,454.2) $ (607.2) $ (2,974.6) $ (1.254.4) $ (1,612.7) $(6.448.9) $ (1,179.3) $ (1,042.7) $ (1,146.6) S (744.1)

(10.0)

(75.0)

406.5

1,661.5

30.0

(34.5)

$ (2,387.9) $ 199.9

24.0

204.4

0.3

(8.0)

$

12.2

(1.7)

21.9

38.0

Total

(37.8)

199.6

1,414.9

(49.7)

108.3

1,599.3

0.6

(39.3)

3.1

(10.5)

36.6

(0.9)

(142.8)

1,093.0

4,071.2

(178.1)

Q1

7.1

(12.3)

(398.1) $

(93.1) S (1,610.8) S

35.5

160.0

0.5

(7.8)

3.2

0.1

(83.7)

20.3

500.0

(403.3)

(25.3)

(8.3)

Q2

(33.4)

20.5

(23.6)

21.7

5.8

(119.5)

108.6

5.1

568.2

332.4

(102.9)

13.5

14.1

(19.4)

(21.0)

105.9

270.4

167.6

3.5

(11.1)

71.4

71.4

(22.6)

117.8

48.5

0.5

71.8

(12.7)

(36.8)

15.3 $ 10.0 $ (46.2) $ (105.7) $ (206.9) $ (751.7) $ (155.7) $ (264.6) $(1,378.9) $ (79.5) $ (37.5)

(39.1)

(15.0)

(10.5)

(18.2)

0.9

(12.4)

(437.1)

787.7 $

44.5

105.8

1.2

(4.0)

4.1

(46.3)

10.8

2.2

155.0

13.1

(495.8)

(31.5)

(64.3)

(9.4)

Fiscal 2020

Q3

(288.8)

41.4

1,291.8

112.8

(21.7)

0.1

41.7

166.7

2.4

(1.6)

8.4

$ (459.5) $ (458.2) $ (1,752.9) $

4.2

3.9

Q4

(355.0)

28.3

1,058.4

90.0

(14.6)

35.7

133.3

2.4

(0.7)

8.6

13.9

(3.0)

(1.8)

(45.2)

13.7

59.7

64.4

(53.0)

(20.5)

Total

16.0

0.1

157.4

565.8

6.5

(14.1)

21.1

(46.3)

15.2

4.4

92.9 $ (325.6) $185.4

39.6

61.2

44.5

(391.4)

(36.7)

(53.2)

Fiscal 2021

Q2

Q1

30.9

(12.3)

(427.3)

34.4

164.2

1.5

(0.4)

8.5

0.3

2.9

0.2

15.0

$ (4,112.7) $ (981.7) $ (745.6)

(10.0)

(391.5) (1,110.3)

180.7

656.9

734.2 4,745.9

412.8

645.6

(22.8)

(93.6)

$ (252.0)

34.6

201.0

0.9

(0.2)

8.7

5.7

0.9

(0.4)

$ 740.4 $ 161.1

(12.8)

15.6

6.4

(75.0) (201.5)

17.1

1,169.8

36.0

64.9

789.3

276.5

(10.7)

(9.8)

8.8

(2.0)

$ 180.6

13View entire presentation