Deutsche Bank Results Presentation Deck

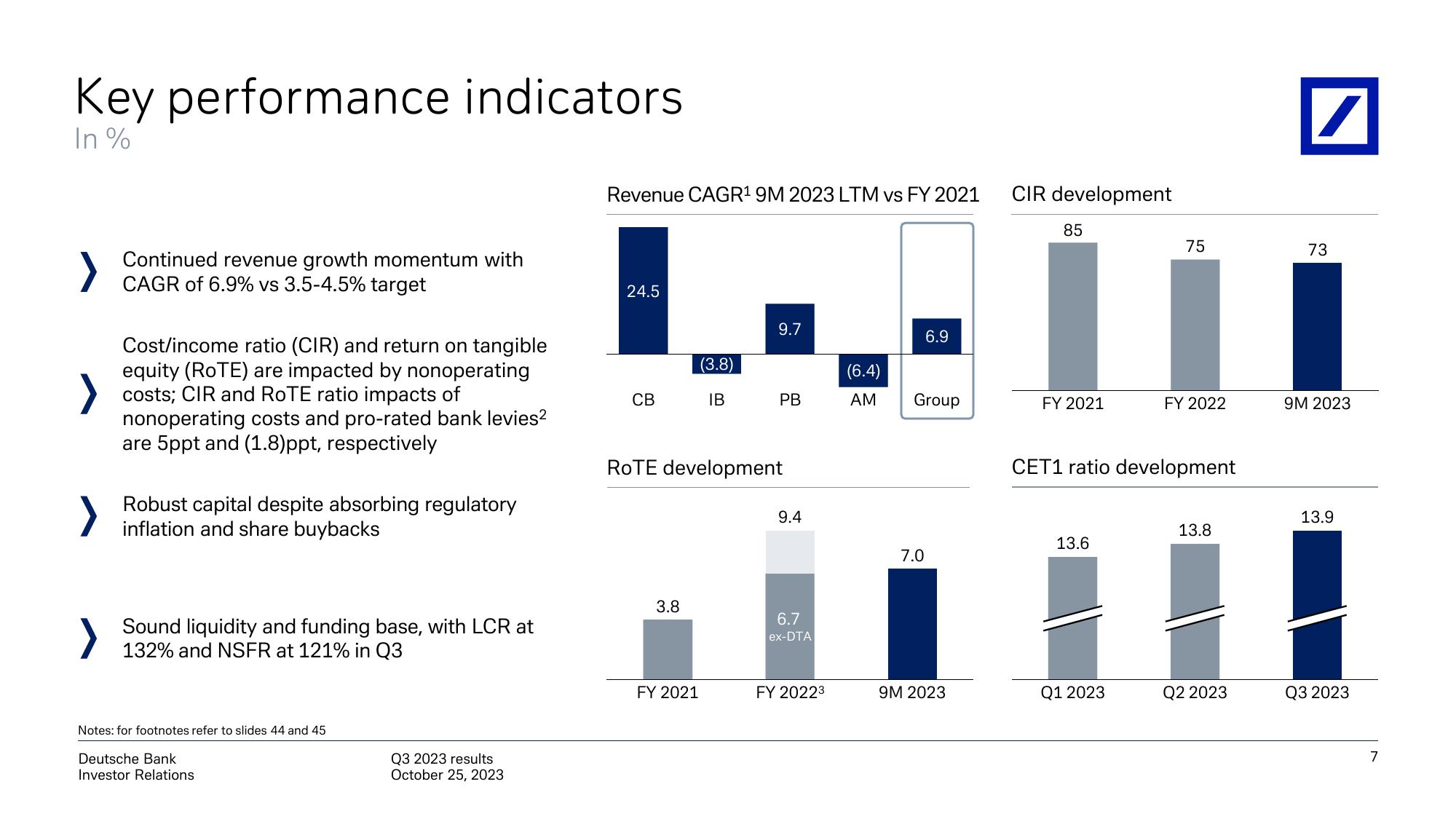

Key performance indicators

In %

>

>

>

Continued revenue growth momentum with

CAGR of 6.9% vs 3.5-4.5% target

Cost/income ratio (CIR) and return on tangible

equity (RoTE) are impacted by nonoperating

costs; CIR and ROTE ratio impacts of

nonoperating costs and pro-rated bank levies²

are 5ppt and (1.8)ppt, respectively

Robust capital despite absorbing regulatory

inflation and share buybacks

Sound liquidity and funding base, with LCR at

132% and NSFR at 121% in Q3

Notes: for footnotes refer to slides 44 and 45

Deutsche Bank

Investor Relations

Q3 2023 results

October 25, 2023

Revenue CAGR¹ 9M 2023 LTM vs FY 2021

24.5

CB

3.8

(3.8)

IB

FY 2021

9.7

ROTE development

PB

9.4

6.7

ex-DTA

FY 20223

(6.4)

AM

6.9

Group

7.0

9M 2023

CIR development

85

FY 2021

13.6

75

CET1 ratio development

Q1 2023

FY 2022

13.8

Q2 2023

/

73

9M 2023

13.9

Q3 2023

7View entire presentation