Paysafe Results Presentation Deck

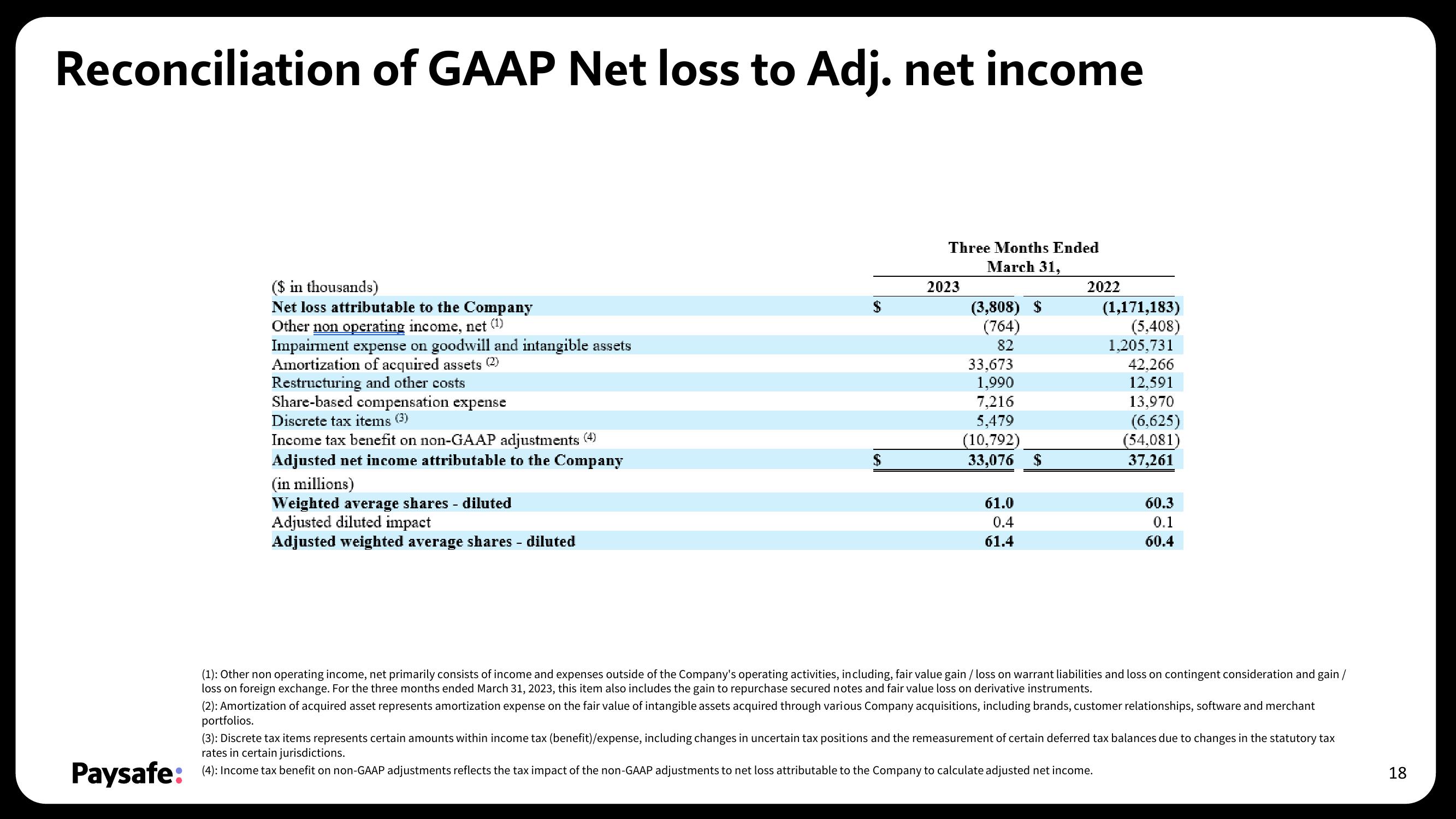

Reconciliation of GAAP Net loss to Adj. net income

($ in thousands)

Net loss attributable to the Company

Other non operating income, net (1)

Impairment expense on goodwill and intangible assets

Amortization of acquired assets (2)

Restructuring and other costs

Share-based compensation expense

Discrete tax items (3)

Income tax benefit on non-GAAP adjustments

Adjusted net income attributable to the Company

(in millions)

Weighted average shares - diluted

Adjusted diluted impact

Adjusted weighted average shares - diluted

$

Three Months Ended

March 31,

2023

(3,808) S

(764)

82

33,673

1,990

7,216

5,479

(10,792)

33,076 $

61.0

0.4

61.4

2022

(1,171,183)

(5,408)

1,205,731

42,266

12,591

13,970

(6,625)

(54,081)

37,261

Paysafe: (4): Income tax benefit on non-GAAP adjustments reflects the tax impact of the non-GAAP adjustments to net loss attributable to the Company to calculate adjusted net income.

60.3

0.1

60.4

(1): Other non operating income, net primarily consists of income and expenses outside of the Company's operating activities, including, fair value gain / loss on warrant liabilities and loss on contingent consideration and gain /

loss on foreign exchange. For the three months ended March 31, 2023, this item also includes the gain to repurchase secured notes and fair value loss on derivative instruments.

(2): Amortization of acquired asset represents amortization expense on the fair value of intangible assets acquired through various Company acquisitions, including brands, customer relationships, software and merchant

portfolios.

(3): Discrete tax items represents certain amounts within income tax (benefit)/expense, including changes in uncertain tax positions and the remeasurement of certain deferred tax balances due to changes in the statutory tax

rates in certain jurisdictions.

18View entire presentation