Houlihan Lokey Investor Presentation Deck

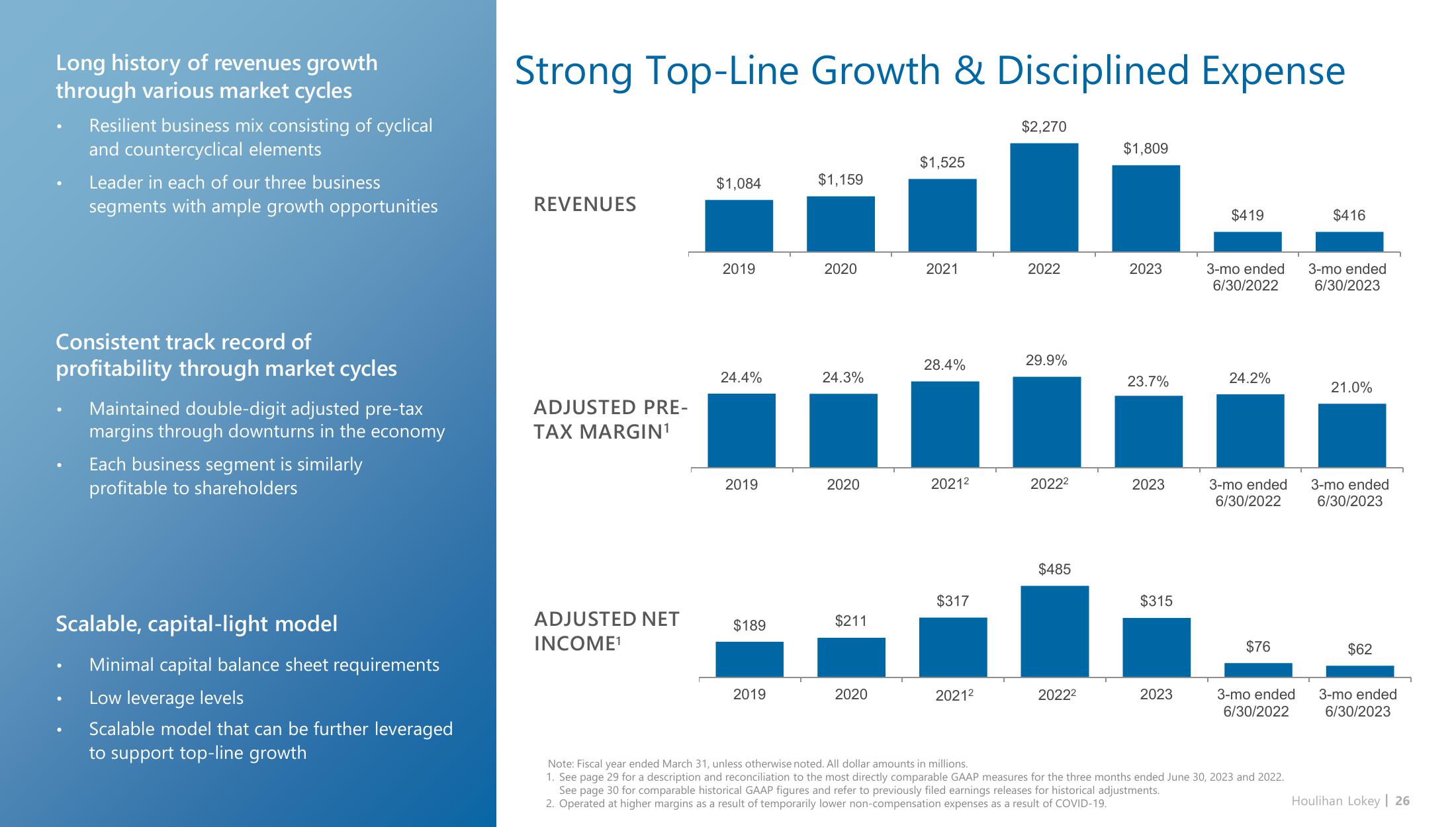

Long history of revenues growth

through various market cycles

Resilient business mix consisting of cyclical

and countercyclical elements

Leader in each of our three business

segments with ample growth opportunities

Consistent track record of

profitability through market cycles

Maintained double-digit adjusted pre-tax

margins through downturns in the economy

Each business segment is similarly

profitable to shareholders

Scalable, capital-light model

Minimal capital balance sheet requirements

Low leverage levels

Scalable model that can be further leveraged

to support top-line growth

Strong Top-Line Growth & Disciplined Expense

REVENUES

ADJUSTED PRE-

TAX MARGIN¹

ADJUSTED NET

INCOME¹

$1,084

2019

24.4%

2019

$189

2019

$1,159

2020

24.3%

2020

$211

2020

$1,525

2021

28.4%

2021²

$317

2021²

$2,270

2022

29.9%

2022²

$485

2022²

$1,809

2023

23.7%

2023

$315

2023

$419

3-mo ended

6/30/2022

24.2%

3-mo ended

6/30/2022

$76

3-mo ended

6/30/2022

Note: Fiscal year ended March 31, unless otherwise noted. All dollar amounts in millions.

1. See page 29 for a description and reconciliation to the most directly comparable GAAP measures for the three months ended June 30, 2023 and 2022.

See page 30 for comparable historical GAAP figures and refer to previously filed earnings releases for historical adjustments.

2. Operated at higher margins as a result of temporarily lower non-compensation expenses as a result of COVID-19.

$416

3-mo ended

6/30/2023

21.0%

3-mo ended

6/30/2023

$62

3-mo ended

6/30/2023

Houlihan Lokey | 26View entire presentation