Bank of America Investment Banking Pitch Book

QIA and Brookfield's Acquisition of Songbird which

owned 69% of Canary Wharf

Chronology of Events

(1) November 6, 2014- Initial Offer (295 pence per share)

* 295 pence per share initial offer from Qatar and Brookfield

Songbird owned 69% of Canary Wharf; Qatar owned 28% of

Songbird

* Nov 7: Songbird rejects offer

2 November 25, 2014 - 2nd Offer

* Brookfield / Qatar expressed willingness to offer 325 - 330

pence per share

3 December 4, 2014-3nd and Final Proposal (350 pence per

share)

* Brookfield /Qatar increased offer to 350 pence per share

* If accepted, Brookfield and Qatar would make offer for

additional 31% of Canary Wharf shares at equivalent price

• Offer rejected

4 December 8, 2014 - Madison Accepts Offer

* Madison International indicates that it plans to accept

Brookfield's takeover offer

* Madison held 12% of free float and 2.5% of total shares

outstanding

5 December 10, 2014 - EMS Capital Accepts Offer

* EMS Capital indicates that it plans to accept QJA / Brookfield's

takeover offer

* EMS Capital held 3.2% of free float and 0.7% of total shares

outstanding

Source: FoctSet, public filings and press releases.

30

(6) December 30, 2014 - Franklin Mutual encourages Songbird to

Accept

* Franklin Mutual Advisers encourages Songbird to accept

QIA/Brookfield proposal

* Franklin Mutual held 7% shares outstanding

Songbird reiterated objections

January 12, 2015 - Songbird's Board Rejects

Songbird board reiterates objections

•

8) January 28, 2015 - Offer Accepted (350 pence per share)

* Songbird's major shareholders indicate intention to accept 350

pence per share

April 20, 2015 - Transaction Closed

Brookfield / QIA closed acquisition of Songbird/Canary Wharf

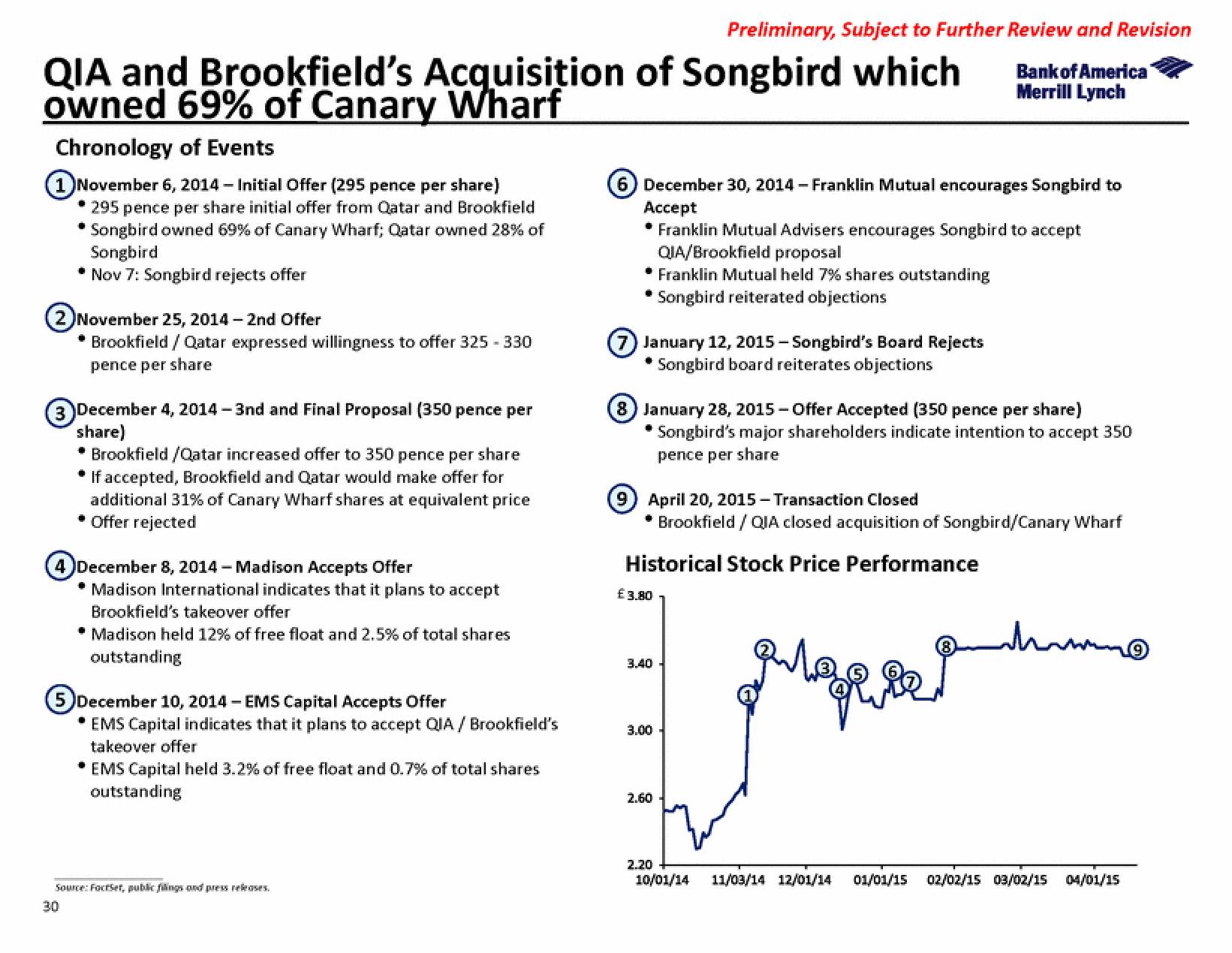

Historical Stock Price Performance

€ 3.80

Preliminary, Subject to Further Review and Revision

Bank of America

Merrill Lynch

3.40

3.00

2.60

2.20

10/01/14

(8)

when

11/03/14 12/01/14 01/01/15 02/02/15 03/02/15 04/01/15View entire presentation