J.P.Morgan 4Q23 Earnings Results

JPMORGAN CHASE & CO.

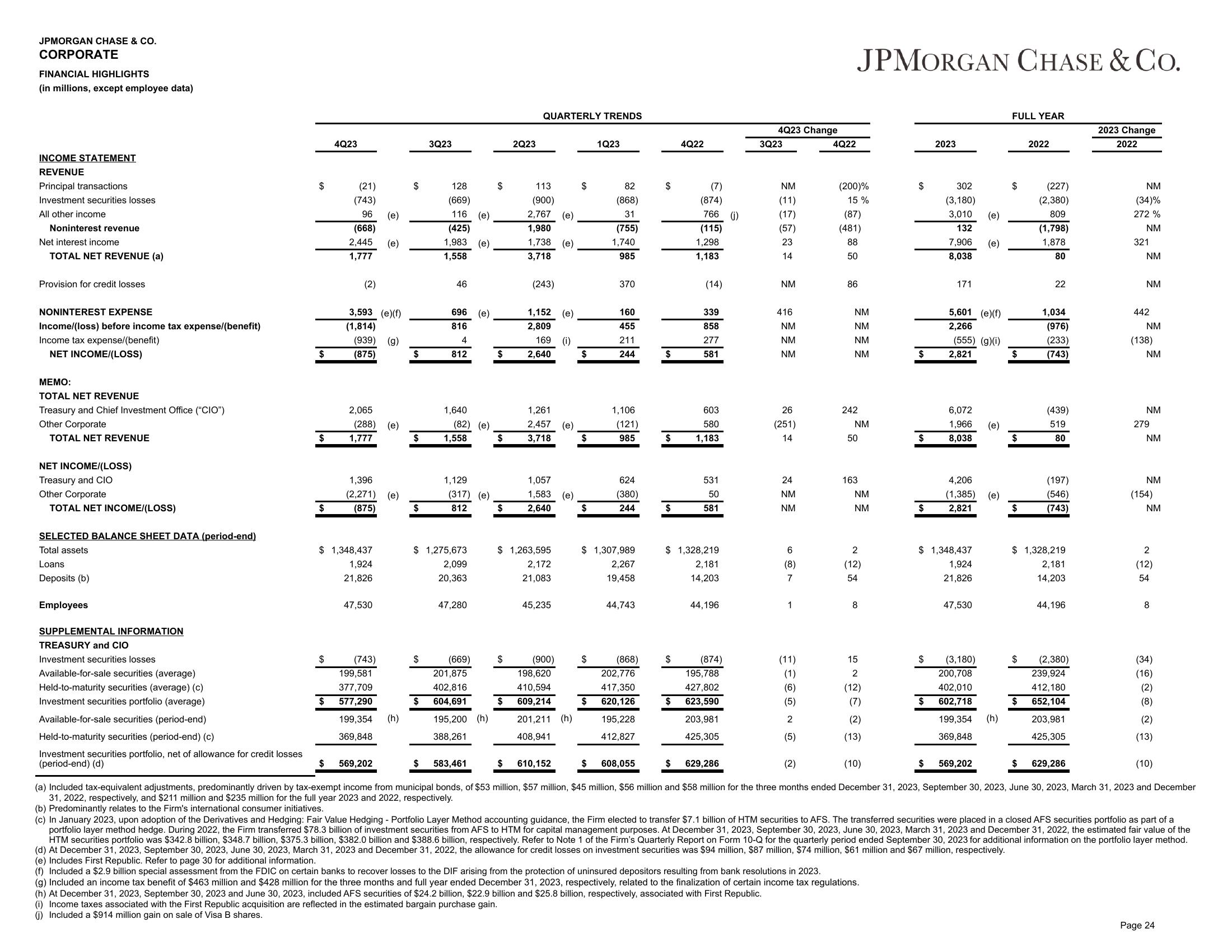

CORPORATE

FINANCIAL HIGHLIGHTS

(in millions, except employee data)

INCOME STATEMENT

REVENUE

Principal transactions

Investment securities losses

All other income

Noninterest revenue

Net interest income

TOTAL NET REVENUE (a)

Provision for credit losses

NONINTEREST EXPENSE

Income/(loss) before income tax expense/(benefit)

Income tax expense/(benefit)

NET INCOME/(LOSS)

MEMO:

TOTAL NET REVENUE

Treasury and Chief Investment Office ("CIO")

Other Corporate

TOTAL NET REVENUE

NET INCOME/(LOSS)

Treasury and CIO

Other Corporate

TOTAL NET INCOME/(LOSS)

SELECTED BALANCE SHEET DATA (period-end)

Total assets

Loans

Deposits (b)

Employees

SUPPLEMENTAL INFORMATION

TREASURY and CIO

Investment securities losses

Available-for-sale securities (average)

Held-to-maturity securities (average) (c)

Investment securities portfolio (average)

Available-for-sale securities (period-end)

Held-to-maturity securities (period-end) (c)

Investment securities portfolio, net of allowance for credit losses

(period-end) (d)

$

$

$

$

$

$

4Q23

$

(21)

(743)

96 (e)

(668)

2,445 (e)

1,777

(2)

3,593 (e)(f)

(1,814)

(939) (g)

(875)

$ 1,348,437

1,924

21,826

2,065

(288) (e)

1,777

1,396

(2,271) (e)

(875)

47,530

(743)

199,581

377,709

577,290

199,354

369,848

(h)

$

$

$

$

$

3Q23

$

128

(669)

116

(425)

1,983

1,558

46

696

816

4

812

$ 1,275,673

2,099

20,363

(e)

(e)

1,640

(82) (e)

1,558

47,280

(e)

1,129

(317) (e)

812

(669)

201,875

402,816

604,691

195,200 (h)

388,261

$

$

$

$

$

2Q23

$

QUARTERLY TRENDS

113

(900)

2,767 (e)

1,980

1,738

3,718

(243)

1,152

2,809

169 (i)

2,640

1,261

2,457

3,718

$ 1,263,595

2,172

21,083

(e)

45,235

(e)

1,057

1,583 (e)

2,640

(e)

(900)

198,620

410,594

609,214

201,211 (h)

408,941

$

$

$

$

$

$

1Q23

$

82

(868)

31

(755)

1,740

985

370

160

455

211

244

1,106

$ 1,307,989

2,267

19,458

(121)

985

624

(380)

244

44,743

(868)

202,776

417,350

620,126

195,228

412,827

$

$

$

$

$

4Q22

$

(7)

(874)

766 (j)

(115)

1,298

1,183

(14)

339

858

277

581

603

580

1,183

$ 1,328,219

2,181

14,203

531

50

581

44,196

(874)

195,788

427,802

623,590

203,981

425,305

629,286

4Q23 Change

3Q23

NM

(11)

(17)

(57)

23

14

(h) At December 31, 2023, September 30, 2023 and June 30, 2023, included AFS securities of $24.2 billion, $22.9 billion and $25.8 billion, respectively, associated with First Republic.

(i) Income taxes associated with the First Republic acquisition are reflected in the estimated bargain purchase gain.

(i) Included a $914 million gain on sale of Visa B shares.

NM

416

NM

NM

NM

26

(251)

14

24

NM

NM

6

(8)

7

1

(11)

(6)

(5)

2

(5)

4Q22

JPMORGAN CHASE & CO.

(200)%

15%

(87)

(481)

88

50

86

NM

NM

NM

NM

242

NM

50

163

NM

NM

2

(12)

54

8

15

2

(12)

(7)

(2)

(13)

(f) Included a $2.9 billion special assessment from the FDIC on certain banks to recover losses to the DIF arising from the protection of uninsured depositors resulting from bank resolutions in 2023.

(g) Included an income tax benefit of $463 million and $428 million for the three months and full year ended December 31, 2023, respectively, related to the finalization of certain income tax regulations.

$

$

$

2023

$

302

(3,180)

3,010 (e)

132

7,906

8,038

171

5,601 (e)(f)

2,266

(555) (g)(i)

2,821

6,072

1,966

8,038

$ 1,348,437

1,924

21,826

(e)

4,206

(1,385) (e)

2,821

47,530

(3,180)

200,708

402,010

$ 602,718

199,354

369,848

569,202

(e)

(h)

FULL YEAR

$

$

$

$

$

$

2022

$

(227)

(2,380)

809

(1,798)

1,878

80

22

1,034

(976)

(233)

(743)

$ 1,328,219

2,181

14,203

(439)

519

80

(197)

(546)

(743)

44,196

(2,380)

239,924

412,180

652,104

203,981

425,305

629,286

2023 Change

2022

NM

(34)%

272 %

NM

321

NM

NM

442

NM

(138)

NM

NM

279

NM

NM

(154)

NM

2

(12)

54

569,202

$ 583,461

$ 610,152

608,055

(2)

(10)

(10)

(a) Included tax-equivalent adjustments, predominantly driven by tax-exempt income from municipal bonds, of $53 million, $57 million, $45 million, $56 million and $58 million for the three months ended December 31, 2023, September 30, 2023, June 30, 2023, March 31, 2023 and December

31, 2022, respectively, and $211 million and $235 million for the full year 2023 and 2022, respectively.

(b) Predominantly relates to the Firm's international consumer initiatives.

(c) In January 2023, upon adoption of the Derivatives and Hedging: Fair Value Hedging - Portfolio Layer Method accounting guidance, the Firm elected to transfer $7.1 billion of HTM securities to AFS. The transferred securities were placed in a closed AFS securities portfolio as part of a

portfolio layer method hedge. During 2022, the Firm transferred $78.3 billion of investment securities from AFS to HTM for capital management purposes. At December 31, 2023, September 30, 2023, June 30, 2023, March 31, 2023 and December 31, 2022, the estimated fair value of the

HTM securities portfolio was $342.8 billion, $348.7 billion, $375.3 billion, $382.0 billion and $388.6 billion, respectively. Refer to Note 1 of the Firm's Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2023 for additional information on the portfolio layer method.

(d) At December 31, 2023, September 30, 2023, June 30, 2023, March 31, 2023 and December 31, 2022, the allowance for credit losses on investment securities was $94 million, $87 million, $74 million, $61 million and $67 million, respectively.

(e) Includes First Republic. Refer to page 30 for additional information.

8

(34)

(16)

(2)

(8)

(2)

(13)

Page 24View entire presentation