Pathward Financial Results Presentation Deck

INTEREST RATE RISK MANAGEMENT DECEMBER 31, 2023

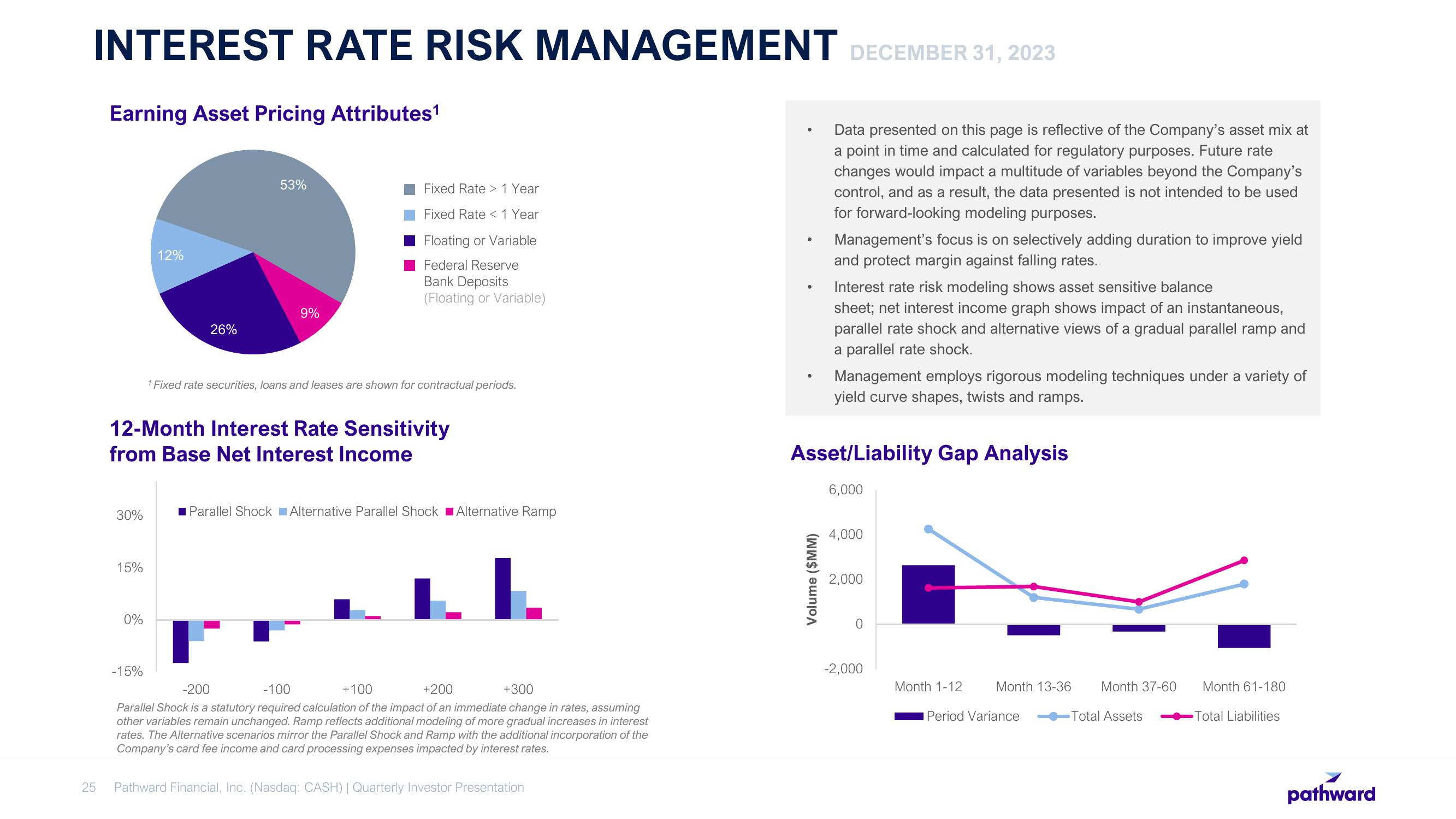

Earning Asset Pricing Attributes¹

30%

15%

0%

12%

-15%

26%

53%

12-Month Interest Rate Sensitivity

from Base Net Interest Income

9%

Fixed Rate > 1 Year

Fixed Rate < 1 Year

Floating or Variable

Federal Reserve

Bank Deposits

(Floating or Variable)

¹ Fixed rate securities, loans and leases are shown for contractual periods.

Parallel Shock Alternative Parallel Shock Alternative Ramp

-100

+100

+200

+300

-200

Parallel Shock is a statutory required calculation of the impact of an immediate change in rates, assuming

other variables remain unchanged. Ramp reflects additional modeling of more gradual increases in interest

rates. The Alternative scenarios mirror the Parallel Shock and Ramp with the additional incorporation of the

Company's card fee income and card processing expenses impacted by interest rates.

25 Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation

●

Data presented on this page is reflective of the Company's asset mix at

a point in time and calculated for regulatory purposes. Future rate

changes would impact a multitude of variables beyond the Company's

control, and as a result, the data presented is not intended to be used

for forward-looking modeling purposes.

Volume ($MM)

Management's focus is on selectively adding duration to improve yield

and protect margin against falling rates.

Interest rate risk modeling shows asset sensitive balance

sheet; net interest income graph shows impact of an instantaneous,

parallel rate shock and alternative views of a gradual parallel ramp and

a parallel rate shock.

Management employs rigorous modeling techniques under a variety of

yield curve shapes, twists and ramps.

Asset/Liability Gap Analysis

6,000

4,000

2,000

-2,000

Month 1-12

Month 13-36

Period Variance

Month 37-60

-Total Assets

Month 61-180

Total Liabilities

pathwardView entire presentation