Main Street Capital Fixed Income Presentation Deck

Conservative Leverage - Regulatory

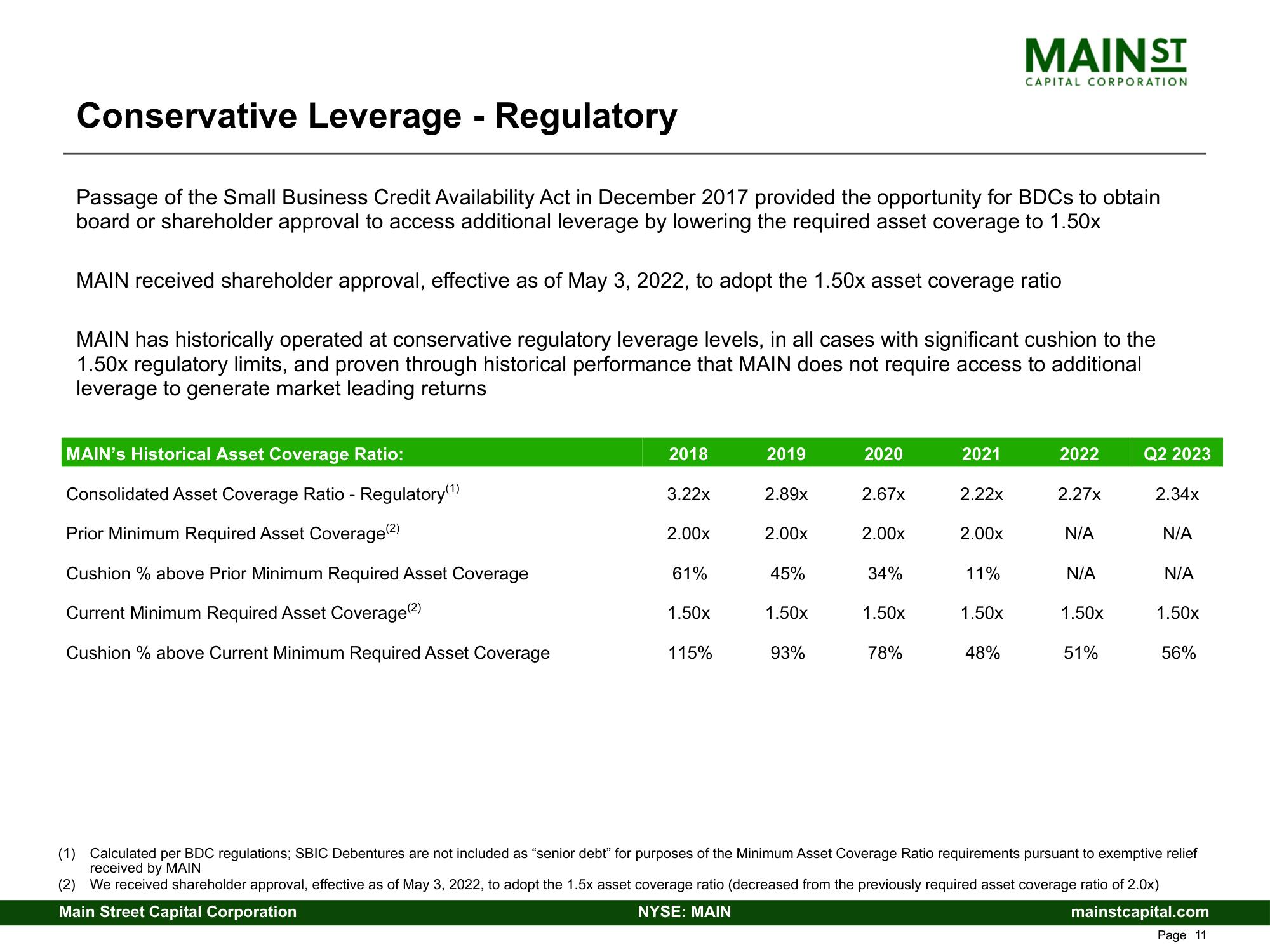

Passage of the Small Business Credit Availability Act in December 2017 provided the opportunity for BDCs to obtain

board or shareholder approval to access additional leverage by lowering the required asset coverage to 1.50x

MAIN received shareholder approval, effective as of May 3, 2022, to adopt the 1.50x asset coverage ratio

MAIN has historically operated at conservative regulatory leverage levels, in all cases with significant cushion to the

1.50x regulatory limits, and proven through historical performance that MAIN does not require access to additional

leverage to generate market leading returns

MAIN's Historical Asset Coverage Ratio:

Consolidated Asset Coverage Ratio - Regulatory(¹)

Prior Minimum Required Asset Coverage (2)

Cushion % above Prior Minimum Required Asset Coverage

Current Minimum Required Asset Coverage (²)

Cushion % above Current Minimum Required Asset Coverage

2018

3.22x

2.00x

61%

1.50x

115%

2019

2.89x

2.00x

45%

1.50x

93%

2020

2.67x

2.00x

34%

1.50x

78%

2021

2.22x

2.00x

11%

1.50x

MAIN ST

CAPITAL CORPORATION

48%

2022

2.27x

N/A

N/A

1.50x

51%

Q2 2023

2.34x

N/A

N/A

1.50x

56%

(1) Calculated per BDC regulations; SBIC Debentures are not included as "senior debt" for purposes of the Minimum Asset Coverage Ratio requirements pursuant to exemptive relief

received by MAIN

(2) We received shareholder approval, effective as of May 3, 2022, to adopt the 1.5x asset coverage ratio (decreased from the previously required asset coverage ratio of 2.0x)

Main Street Capital Corporation

NYSE: MAIN

mainstcapital.com

Page 11View entire presentation