Vulcan Materials Investor Day Presentation Deck

Appendix -Non-GAAP Reconciliations

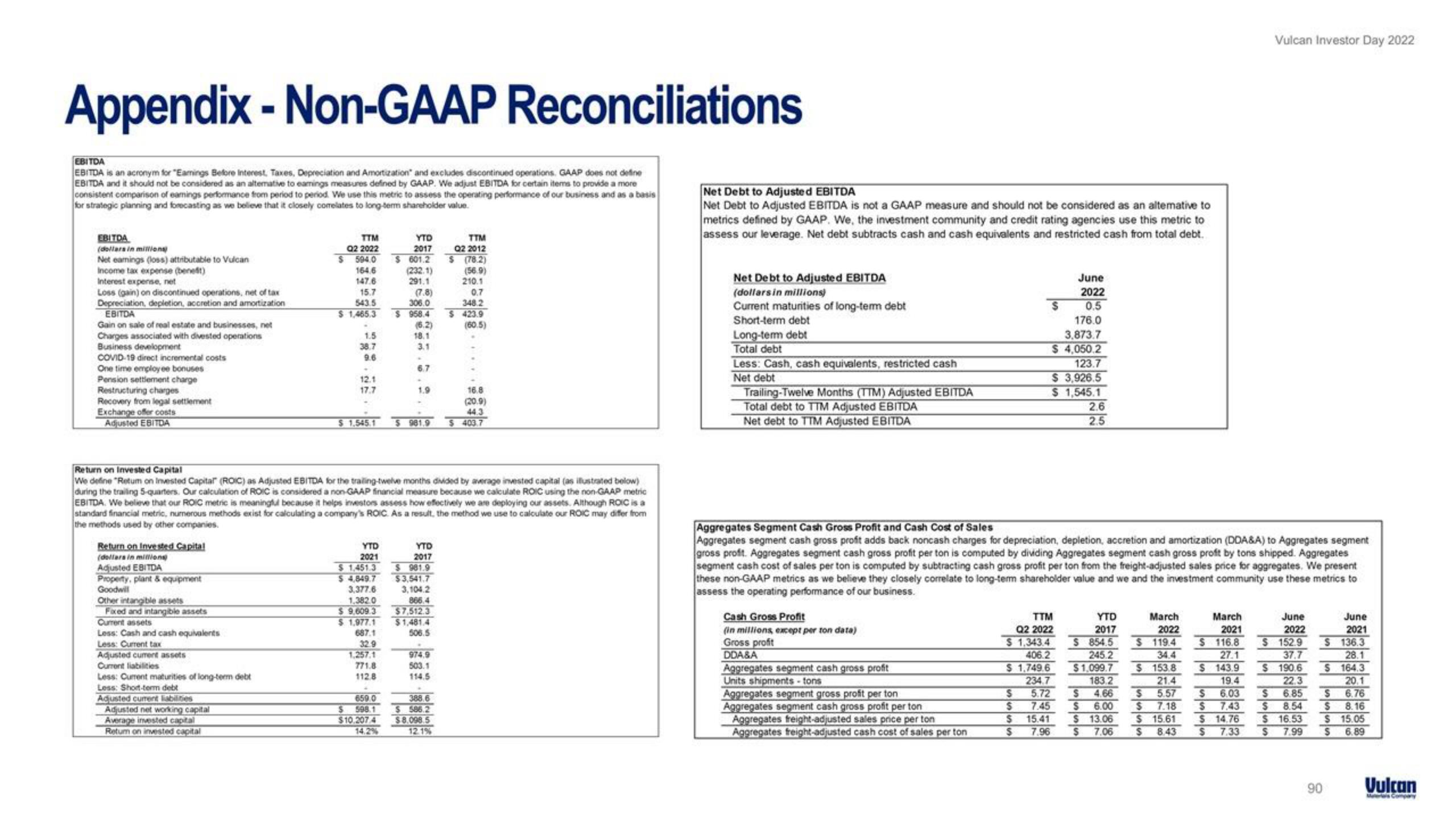

EBITDA

EBITDA is an acronym for "Earnings Before Interest, Taxes, Depreciation and Amortization and excludes discontinued operations. GAAP does not define

EBITDA and it should not be considered as an alternative to earings measures defined by GAAP. We adjust EBITDA for certain items to provide a more

consistent comparison of eamings performance from period to period. We use this metric to assess the operating performance of our business and as a basis

for strategic planning and forecasting as we believe that it closely correlates to long-term shareholder value.

EBITDA

(dollars in millions)

Net eamings (loss) attributable to Vulcan

Income tax expense (benefit)

Interest expense, net

Loss (gain) on discontinued operations, net of tax

Depreciation, depletion, accretion and amortization

EBITDA

Gain on sale of real estate and businesses, net

Charges associated with divested operations

Business development

COVID-19 direct incremental costs

One time employee bonuses

Pension settlement charge

Restructuring charges

Recovery from legal settlement

Exchange offer costs

Adjusted EBITDA

Return on Invested Capital

(dollars in millions)

Adjusted EBITDA

Property, plant & equipment

Goodwill

Other intangible assets

Fixed and intangible assets

Current assets

Less: Cash and cash equivalents

Less: Current tax

Adjusted current assets

Current liabilities

Less: Current maturities of long-term debt

Less: Short-term debt

Adjusted current liabilities

Adjusted net working capital

Average invested capital

non invested capital

TTM

Q2 2022

$ 594.0

164.6

147.6

15.7

543.5

$ 1,465.3 $958.4

1.5

38.7

9.6

12.1

17.7

$1.545.1

YTD

2021

$1.451.3

$4,849.7

3,377.6

1.382.0

$9,609.3

$ 1,977.1

687.1

Return on Invested Capital

We define "Retum on Invested Capital (ROIC) as Adjusted EBITDA for the trailing-twelve months divided by average invested capital (as illustrated below)

during the trailing 5-quarters. Our calculation of ROIC is considered a non-GAAP financial measure because we calculate ROIC using the non-GAAP metric

EBITDA. We believe that our ROIC metric is meaningful because it helps investors assess how effectively we are deploying our assets. Although ROIC is a

standard financial metric, numerous methods exist for calculating a company's ROIC. As a result, the method we use to calculate our ROIC may differ from

the methods used by other companies.

32.9

YTD

2017

1,257.1

771.8

112.8

659.0

$ 598.1

$10.2074

14.2%

$601.2

(232.1)

291.1

(7.8)

306.0

(6.2)

18.1

3.1

6.7

1.9

$981.9

YTD

2017

$981.9

$3,541.7

3,104.2

866.4

$7,512.3

$1,481.4

506.5

974.9

503.1

114.5

TTM

Q2 2012

388.6

$ 586.2

$8.098.5

12.1%

S (78.2)

(56.9)

210.1

0.7

348.2

$423.9

(60.5)

16.8

(20.9)

44.3

$403.7

Net Debt to Adjusted EBITDA

Net Debt to Adjusted EBITDA is not a GAAP measure and should not be considered as an alterative to

metrics defined by GAAP. We, the investment community and credit rating agencies use this metric to

assess our leverage. Net debt subtracts cash and cash equivalents and restricted cash from total debt.

Net Debt to Adjusted EBITDA

(dollars in millions)

Current maturities of long-term debt

Short-term debt

Long-term debt

Total debt

Less: Cash, cash equivalents, restricted cash

Net debt

Trailing-Twelve Months (TTM) Adjusted EBITDA

Total debt to TTM Adjusted EBITDA

Net debt to TTM Adjusted EBITDA

Cash Gross Profit

(in millions, except per ton data)

Gross profit

DDA&A

Aggregates segment cash gross profit

Units shipments-tons

June

2022

0.5

176.0

3,873.7

$ 4,050.2

123.7

$ 3,926.5

$ 1,545.1

Aggregates segment gross profit per ton

Aggregates segment cash gross profit per ton

Aggregates freight-adjusted sales price per ton

Aggregates freight-adjusted cash cost of sales per ton

$

Aggregates Segment Cash Gross Profit and Cash Cost of Sales

Aggregates segment cash gross profit adds back noncash charges for depreciation, depletion, accretion and amortization (DDA&A) to Aggregates segment

gross profit. Aggregates segment cash gross profit per ton is computed by dividing Aggregates segment cash gross proft by tons shipped. Aggregates

segment cash cost of sales per ton is computed by subtracting cash gross profit per ton from the freight-adjusted sales price for aggregates. We present

these non-GAAP metrics as we believe they closely correlate to long-term shareholder value and we and the investment community use these metrics to

assess the operating performance of our business.

TTM

Q2 2022

2.6

2.5

$ 1,343.4

406.2

$ 1,749.6

234.7

$ 5.72

$

7.45

15.41

$

$

YTD

2017

S 854.5

245.2

$1,099.7

183.2

$ 4.66

$ 6.00

$ 13.06

$ 7.0

March

2022

$ 119.4

34.4

$ 153.8

21.4

$ 5.57

$ 7.18

$15.61

Vulcan Investor Day 2022

March

2021

$116.8

27.1

$143.9

19.4

$ 6.03

$ 7.43

$ 14.76

June

2022

$ 152.9

37.7

$190.6

22.3

$ 6.85

$ 8.54

$16.53

June

2021

S 136.3

28.1

$164.3

20.1

$ 6.76

$ 8.16

$15.05

6.89

90

Vulcan

Mas CompanyView entire presentation