J.P.Morgan 2Q23 Investor Results

JPMORGAN CHASE & CO.

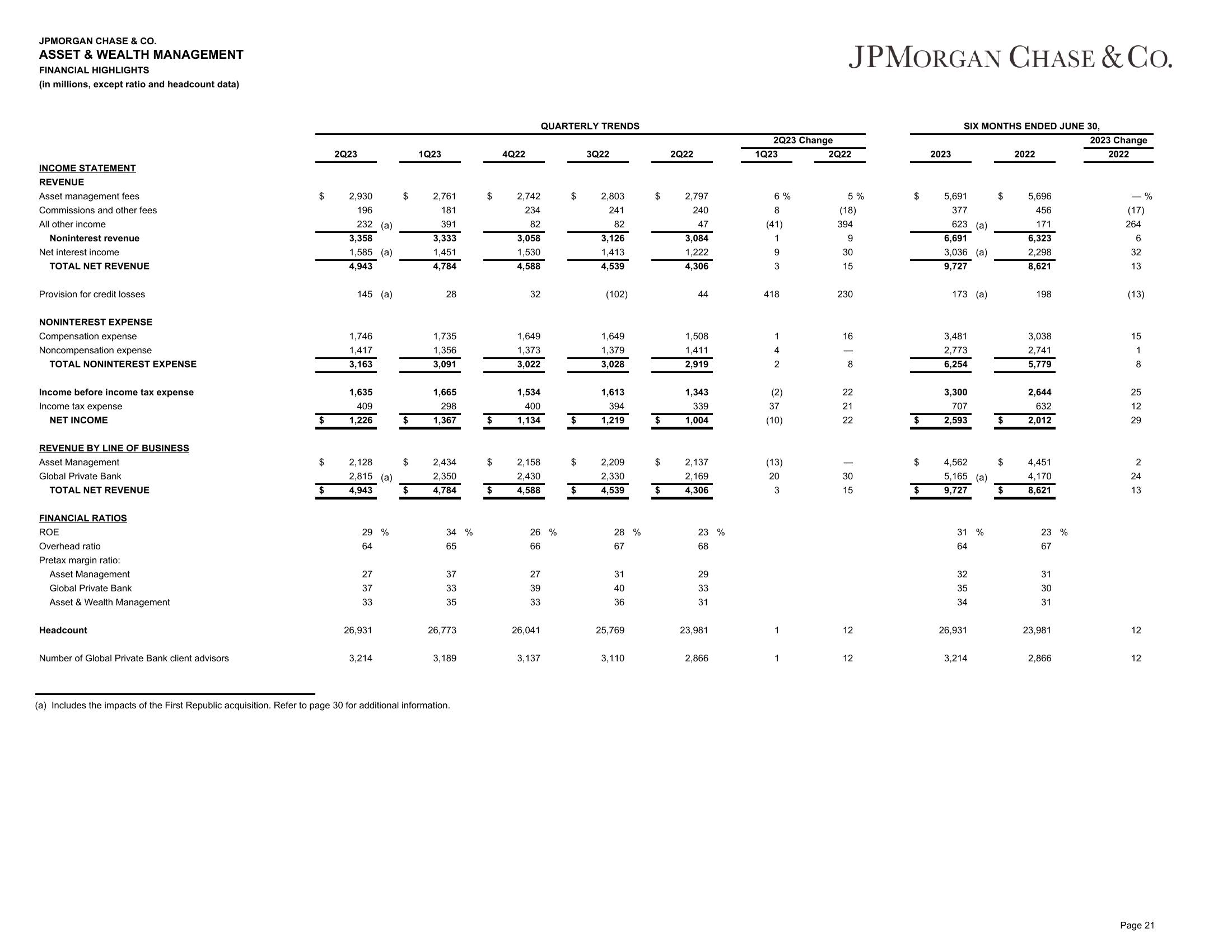

ASSET & WEALTH MANAGEMENT

FINANCIAL HIGHLIGHTS

(in millions, except ratio and headcount data)

INCOME STATEMENT

REVENUE

Asset management fees

Commissions and other fees

All other income

Noninterest revenue

Net interest income

TOTAL NET REVENUE

Provision for credit losses

NONINTEREST EXPENSE

Compensation expense

Noncompensation expense

TOTAL NONINTEREST EXPENSE

Income before income tax expense

Income tax expense

NET INCOME

REVENUE BY LINE OF BUSINESS

Asset Management

Global Private Bank

TOTAL NET REVENUE

FINANCIAL RATIOS

ROE

Overhead ratio

Pretax margin ratio:

Asset Management

Global Private Bank

Asset & Wealth Management

Headcount

Number of Global Private Bank client advisors

$

$

$

$

2Q23

2,930

196

232 (a)

3,358

1,585 (a)

4,943

145 (a)

1,746

1,417

3,163

1,635

409

1,226

2,128

2,815 (a)

4,943

29 %

64

27

37

33

26,931

3,214

$

$

$

$

1Q23

2,761

181

391

3,333

1,451

4,784

28

1,735

1,356

3,091

1,665

298

1,367

2,434

2,350

4,784

34 %

65

37

33

35

26,773

3,189

(a) Includes the impacts of the First Republic acquisition. Refer to page 30 for additional information.

$

4Q22

2,742

234

82

3,058

1,530

4,588

32

1,649

1,373

3,022

QUARTERLY TRENDS

1,534

400

1,134

$ 2,158

2,430

$ 4,588

26 %

66

27

39

33

26,041

3,137

$

$

$

$

3Q22

2,803

241

82

3,126

1,413

4,539

(102)

1,649

1,379

3,028

1,613

394

1,219

2,209

2,330

4,539

28 %

67

31

40

36

25,769

3,110

$ 2,797

240

47

3,084

1,222

4,306

$

2Q22

$

44

1,508

1,411

2,919

1,343

339

1,004

2,137

2,169

4,306

23 %

68

29

33

31

23,981

2,866

2Q23 Change

1Q23

6%

8

(41)

1

9

3

418

142

(2)

37

(10)

(13)

20

3

1

1

JPMORGAN CHASE & Co.

2Q22

5%

(18)

394

9

30

15

230

16

8

22

21

22

30

15

12

12

$

$

$

$

2023

SIX MONTHS ENDED JUNE 30,

5,691

377

623 (a)

6,691

3,036 (a)

9,727

173 (a)

3,481

2,773

6,254

3,300

707

2,593

4,562

5,165 (a)

9,727

31 %

64

32

35

34

26,931

3,214

$

$

$

2022

5,696

456

171

6,323

2,298

8,621

198

3,038

2,741

5,779

2,644

632

2,012

4,451

4,170

8,621

23 %

67

31

30

31

23,981

2,866

2023 Change

2022

(17)

264

6

32

13

(13)

15

1

8

25

12

29

2

24

13

%

12

12

Page 21View entire presentation