Credit Suisse Investment Banking Pitch Book

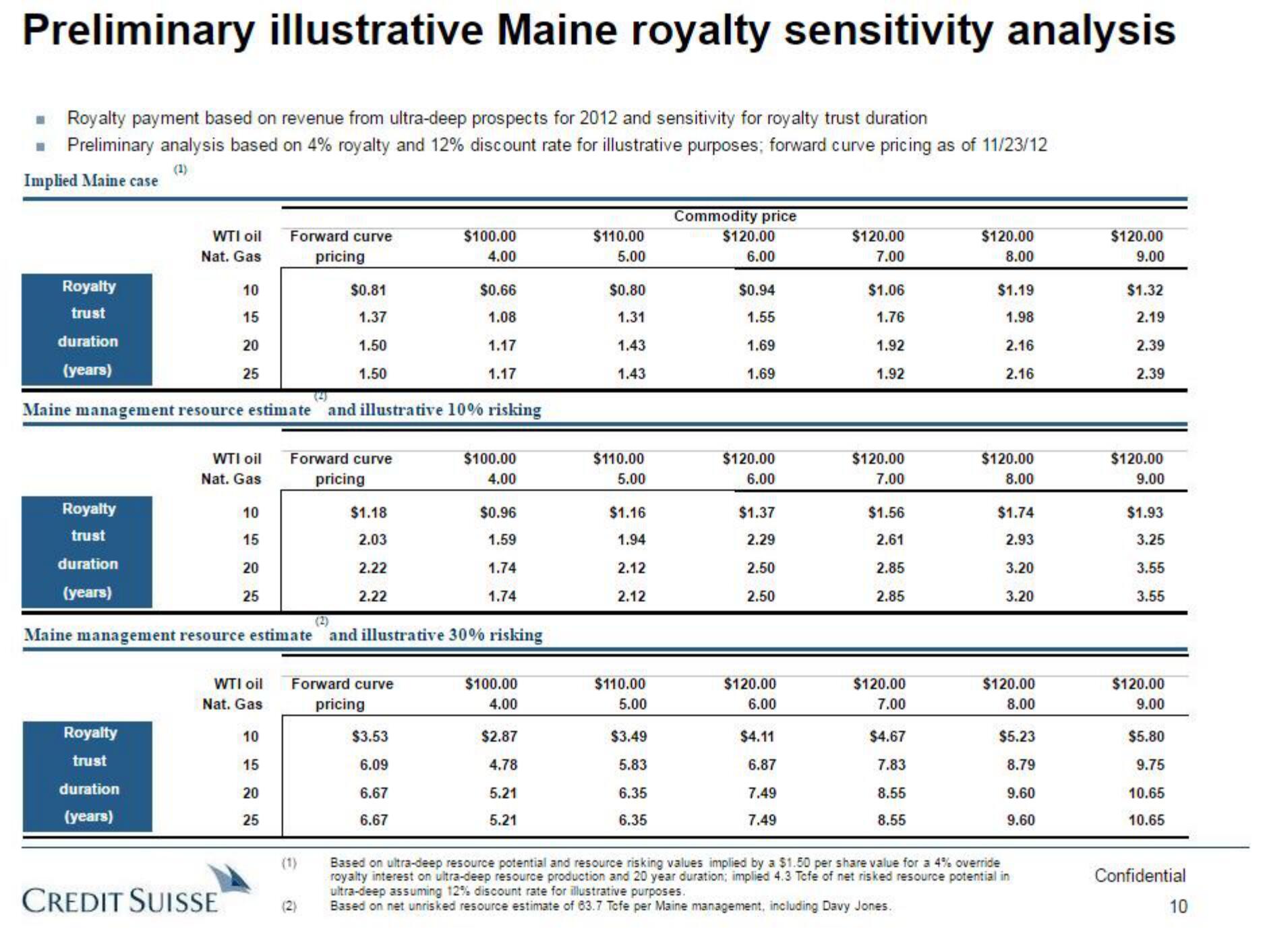

Preliminary illustrative Maine royalty sensitivity analysis

Royalty payment based on revenue from ultra-deep prospects for 2012 and sensitivity for royalty trust duration

■ Preliminary analysis based on 4% royalty and 12% discount rate for illustrative purposes; forward curve pricing as of 11/23/12

Implied Maine case

Royalty

trust

duration

(years)

Royalty

trust

duration

(years)

WTI oil

Nat. Gas

Royalty

trust

duration

(years)

10

15

20

25

Maine management resource estimate and illustrative 10% risking

WTI oil

Nat. Gas

10

15

20

25

CREDIT SUISSE

Forward curve

pricing

10

15

20

25

$0.81

1.37

1.50

1.50

Forward curve

pricing

WTI oil Forward curve

Nat. Gas

pricing

Maine management resource estimate and illustrative 30% risking

(1)

$1.18

2.03

2.22

2.22

(2)

$100.00

4.00

$0.66

1.08

1.17

1.17

$3.53

6.09

6.67

6.67

$100.00

4.00

$0.96

1.59

1.74

1.74

$100.00

4.00

$2.87

4.78

5.21

5.21

$110.00

5.00

$0.80

1.31

1.43

1.43

$110.00

5.00

$1.16

1.94

2.12

2.12

$110.00

5.00

$3.49

5.83

6.35

6.35

Commodity price

$120.00

6.00

$0.94

1.55

1.69

1.69

$120.00

6.00

$1.37

2.29

2.50

2.50

$120.00

6.00

$4.11

6.87

7.49

7.49

$120.00

7.00

$1.06

1.76

1.92

1.92

$120.00

7.00

$1.56

2.61

2.85

2.85

$120.00

7.00

$4.67

7.83

8.55

8.55

$120.00

8.00

$1.19

1.98

2.16

2.16

$120.00

8.00

$1.74

2.93

3.20

3.20

$120.00

8.00

$5.23

8.79

9.60

9.60

Based on ultra-deep resource potential and resource risking values implied by a $1.50 per share value for a 4% override

royalty interest on ultra-deep resource production and 20 year duration; implied 4.3 Tcfe of net risked resource potential in

ultra-deep assuming 12% discount rate for illustrative purposes.

Based on net unrisked resource estimate of 63.7 Tofe per Maine management, including Davy Jones.

$120.00

9.00

$1.32

2.19

2.39

2.39

$120.00

9.00

$1.93

3.25

3.55

3.55

$120.00

9.00

$5.80

9.75

10.65

10.65

Confidential

10View entire presentation