TPG Results Presentation Deck

Pro Forma Non-GAAP Financial Measures

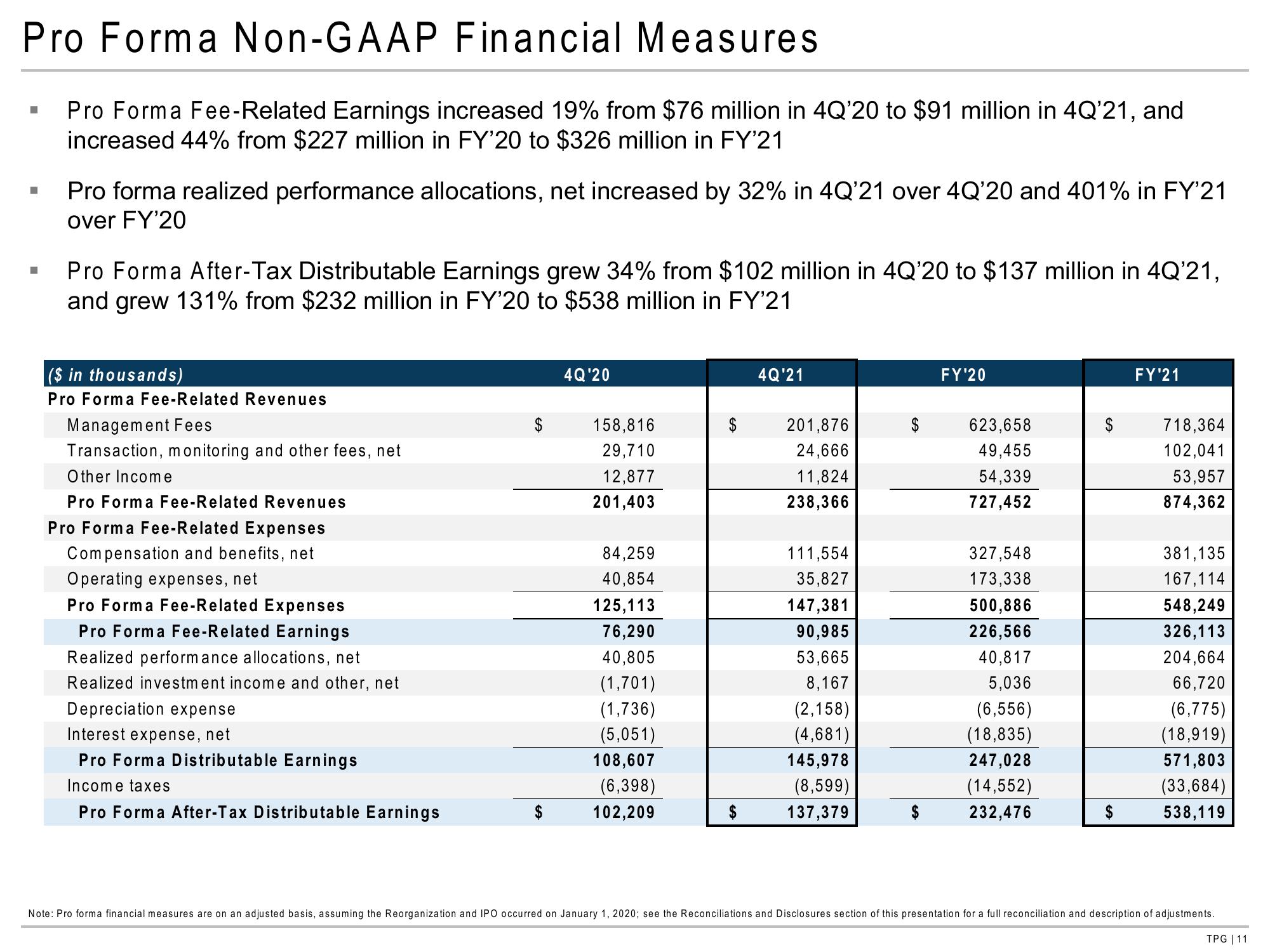

Pro Forma Fee-Related Earnings increased 19% from $76 million in 4Q'20 to $91 million in 4Q'21, and

increased 44% from $227 million in FY'20 to $326 million in FY'21

■

■

■

Pro forma realized performance allocations, net increased by 32% in 4Q'21 over 4Q'20 and 401% in FY'21

over FY'20

Pro Forma After-Tax Distributable Earnings grew 34% from $102 million in 4Q'20 to $137 million in 4Q'21,

and grew 131% from $232 million in FY'20 to $538 million in FY'21

($ in thousands)

Pro Forma Fee-Related Revenues

Management Fees

Transaction, monitoring and other fees, net

Other Income

Pro Forma Fee-Related Revenues

Pro Forma Fee-Related Expenses

Compensation and benefits, net

Operating expenses, net

Pro Forma Fee-Related Expenses

Pro Forma Fee-Related Earnings

Realized performance allocations, net

Realized investment income and other, net

Depreciation expense

Interest expense, net

Pro Forma Distributable Earnings

Income taxes

Pro Forma After-Tax Distributable Earnings

4Q'20

158,816

29,710

12,877

201,403

84,259

40,854

125,113

76,290

40,805

(1,701)

(1,736)

(5,051)

108,607

(6,398)

102,209

$

4Q'21

201,876

24,666

11,824

238,366

111,554

35,827

147,381

90,985

53,665

8,167

(2,158)

(4,681)

145,978

(8,599)

137,379

FY'20

623,658

49,455

54,339

727,452

327,548

173,338

500,886

226,566

40,817

5,036

(6,556)

(18,835)

247,028

(14,552)

232,476

$

$

FY'21

718,364

102,041

53,957

874,362

381,135

167,114

548,249

326,113

204,664

66,720

(6,775)

(18,919)

571,803

(33,684)

538,119

Note: Pro forma financial measures are on an adjusted basis, assuming the Reorganization and IPO occurred on January 1, 2020; see the Reconciliations and Disclosures section of this presentation for a full reconciliation and description of adjustments.

TPG | 11View entire presentation