Disney Shareholder Engagement Presentation Deck

Trian's TFCF transaction analysis is fundamentally flawed

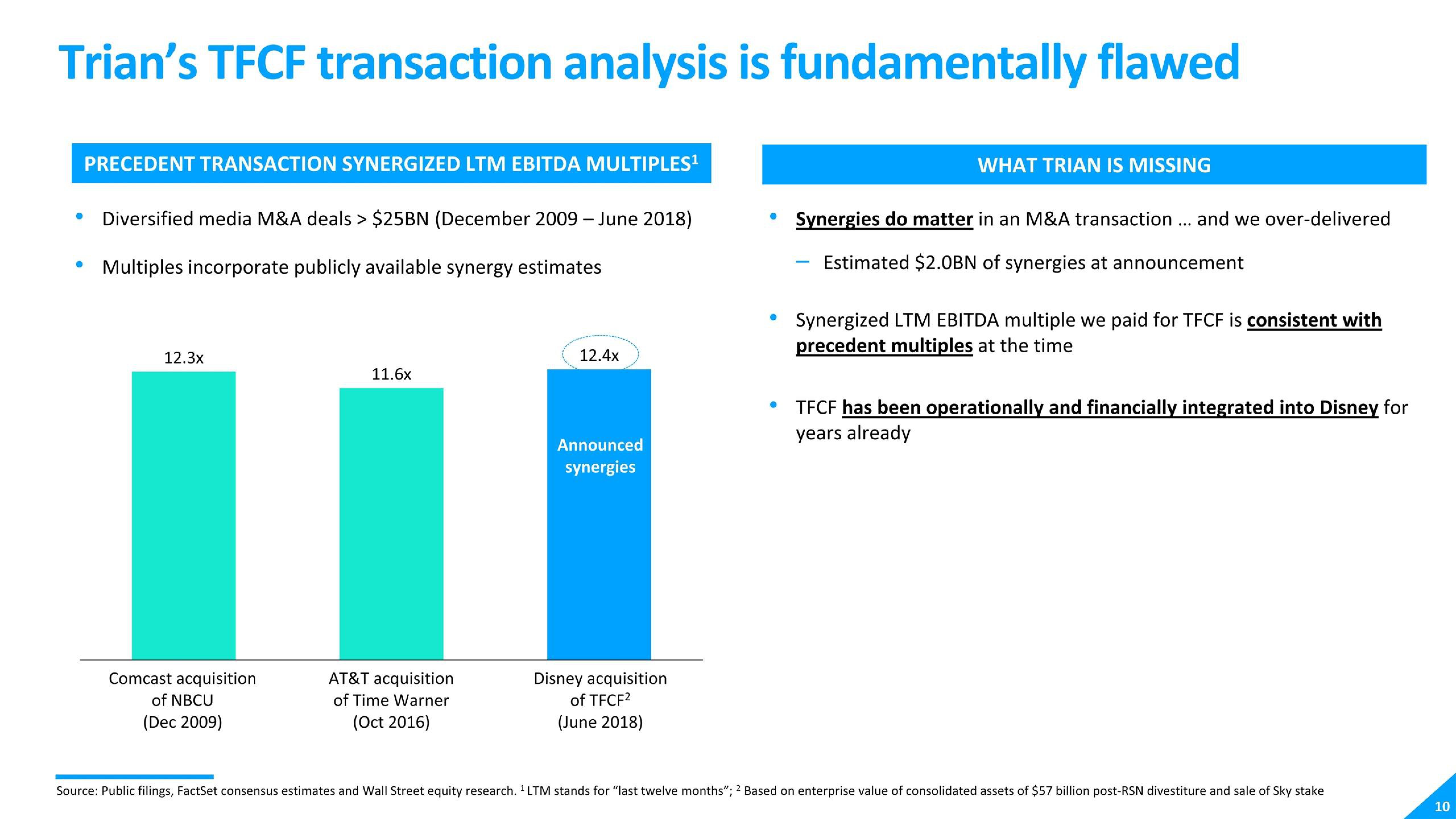

PRECEDENT TRANSACTION SYNERGIZED LTM EBITDA MULTIPLES¹

●

●

Diversified media M&A deals > $25BN (December 2009 - June 2018)

Multiples incorporate publicly available synergy estimates

12.3x

11.6x

11

Comcast acquisition

of NBCU

(Dec 2009)

AT&T acquisition

of Time Warner

(Oct 2016)

12.4x

Announced

synergies

Disney acquisition

of TFCF²

(June 2018)

●

WHAT TRIAN IS MISSING

Synergies do matter in an M&A transaction ... and we over-delivered

Estimated $2.0BN of synergies at announcement

Synergized LTM EBITDA multiple we paid for TFCF is consistent with

precedent multiples at the time

TFCF has been operationally and financially integrated into Disney for

years already

Source: Public filings, FactSet consensus estimates and Wall Street equity research. ¹LTM stands for "last twelve months"; 2 Based on enterprise value of consolidated assets of $57 billion post-RSN divestiture and sale of Sky stake

10View entire presentation