Pershing Square Activist Presentation Deck

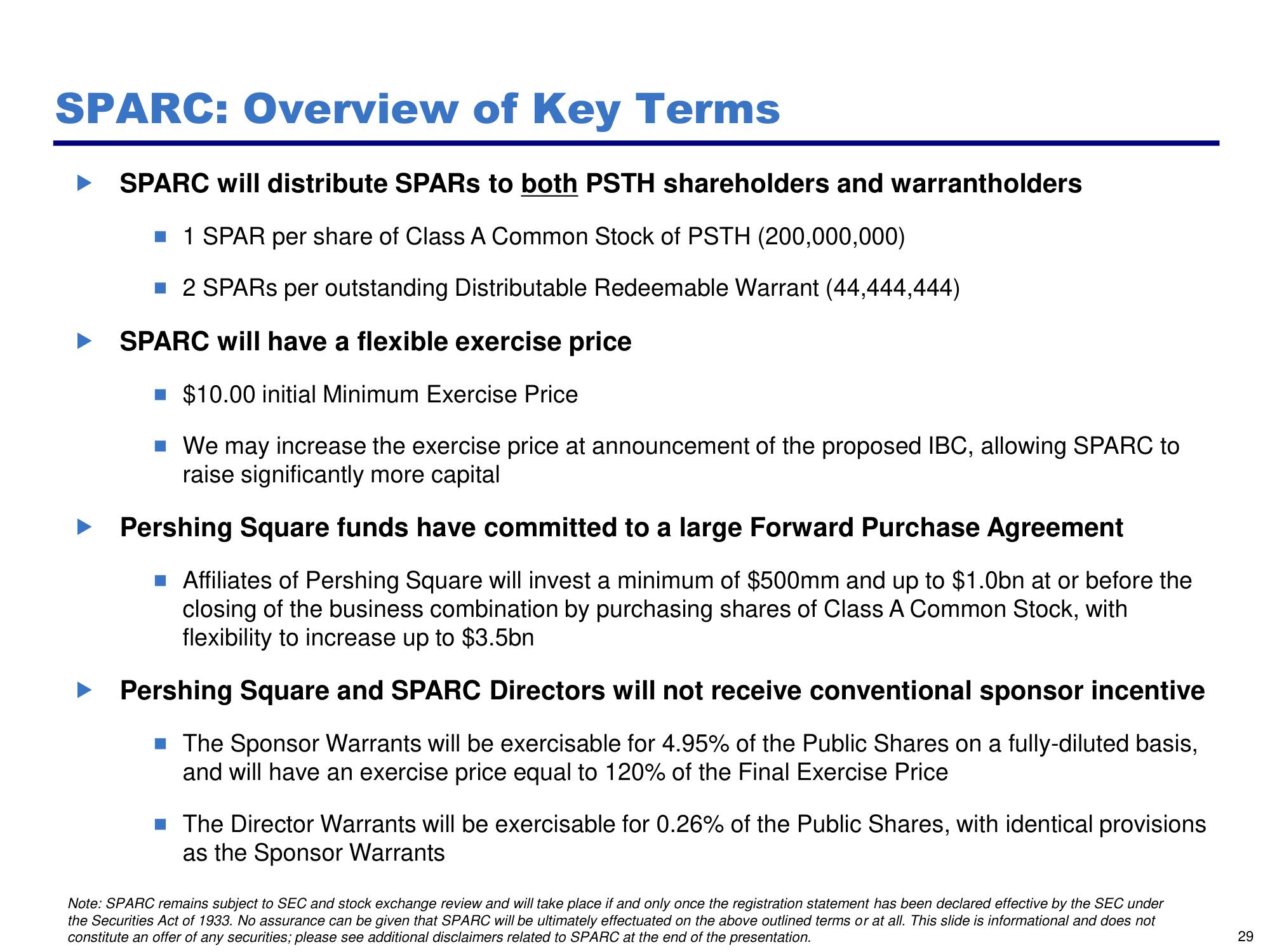

SPARC: Overview of Key Terms

SPARC will distribute SPARS to both PSTH shareholders and warrantholders

■ 1 SPAR per share of Class A Common Stock of PSTH (200,000,000)

■2 SPARS per outstanding Distributable Redeemable Warrant (44,444,444)

SPARC will have a flexible exercise price

■ $10.00 initial Minimum Exercise Price

We may increase the exercise price at announcement of the proposed IBC, allowing SPARC to

raise significantly more capital

Pershing Square funds have committed to a large Forward Purchase Agreement

Affiliates of Pershing Square will invest a minimum of $500mm and up to $1.0bn at or before the

closing of the business combination by purchasing shares of Class A Common Stock, with

flexibility to increase up to $3.5bn

► Pershing Square and SPARC Directors will not receive conventional sponsor incentive

■ The Sponsor Warrants will be exercisable for 4.95% of the Public Shares on a fully-diluted basis,

and will have an exercise price equal to 120% of the Final Exercise Price

■ The Director Warrants will be exercisable for 0.26% of the Public Shares, with identical provisions

as the Sponsor Warrants

Note: SPARC remains subject to SEC and stock exchange review and will take place if and only once the registration statement has been declared effective by the SEC under

the Securities Act of 1933. No assurance can be given that SPARC will be ultimately effectuated on the above outlined terms or at all. This slide is informational and does not

constitute an offer of any securities; please see additional disclaimers related to SPARC at the end of the presentation.

29View entire presentation