Avantor Results Presentation Deck

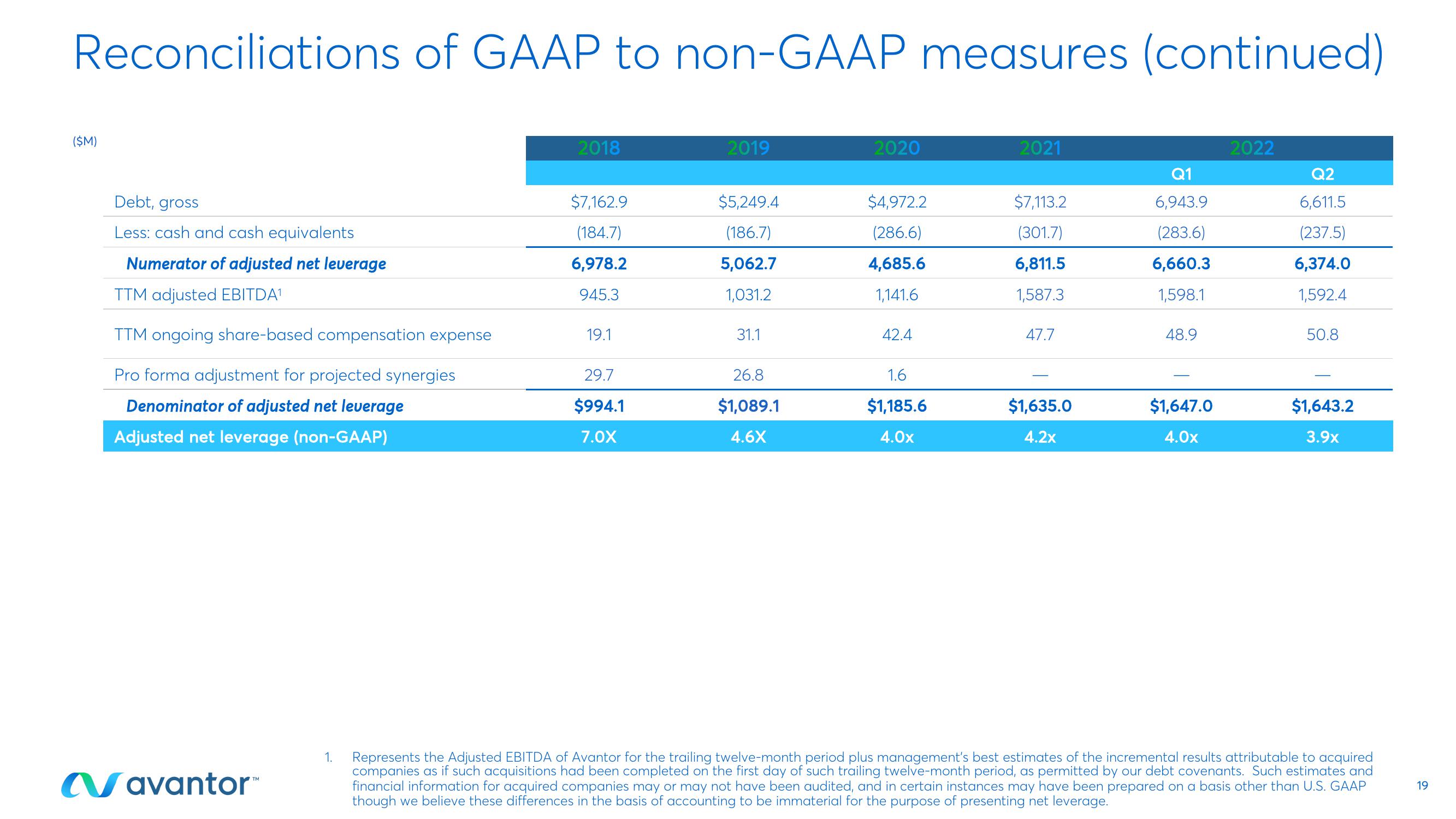

Reconciliations of GAAP to non-GAAP measures (continued)

($M)

Debt, gross

Less: cash and cash equivalents

Numerator of adjusted net leverage

TTM adjusted EBITDA¹

TTM ongoing share-based compensation expense

Pro forma adjustment for projected synergies

Denominator of adjusted net leverage

Adjusted net leverage (non-GAAP)

Navantor™

1.

2018

$7,162.9

(184.7)

6,978.2

945.3

19.1

29.7

$994.1

7.0X

2019

$5,249.4

(186.7)

5,062.7

1,031.2

31.1

26.8

$1,089.1

4.6X

2020

$4,972.2

(286.6)

4,685.6

1,141.6

42.4

1.6

$1,185.6

4.0x

2021

$7,113.2

(301.7)

6,811.5

1,587.3

47.7

$1,635.0

4.2x

Q1

6,943.9

(283.6)

6,660.3

1,598.1

48.9

$1,647.0

4.0x

2022

Q2

6,611.5

(237.5)

6,374.0

1,592.4

50.8

$1,643.2

3.9x

Represents the Adjusted EBITDA of Avantor for the trailing twelve-month period plus management's best estimates of the incremental results attributable to acquired

companies as if such acquisitions had been completed on the first day of such trailing twelve-month period, as permitted by our debt covenants. Such estimates and

financial information for acquired companies may or may not have been audited, and in certain instances may have been prepared on a basis other than U.S. GAAP

though we believe these differences in the basis of accounting to be immaterial for the purpose of presenting net leverage.

19View entire presentation