Credit Suisse Investment Banking Pitch Book

CONFIDENTIAL

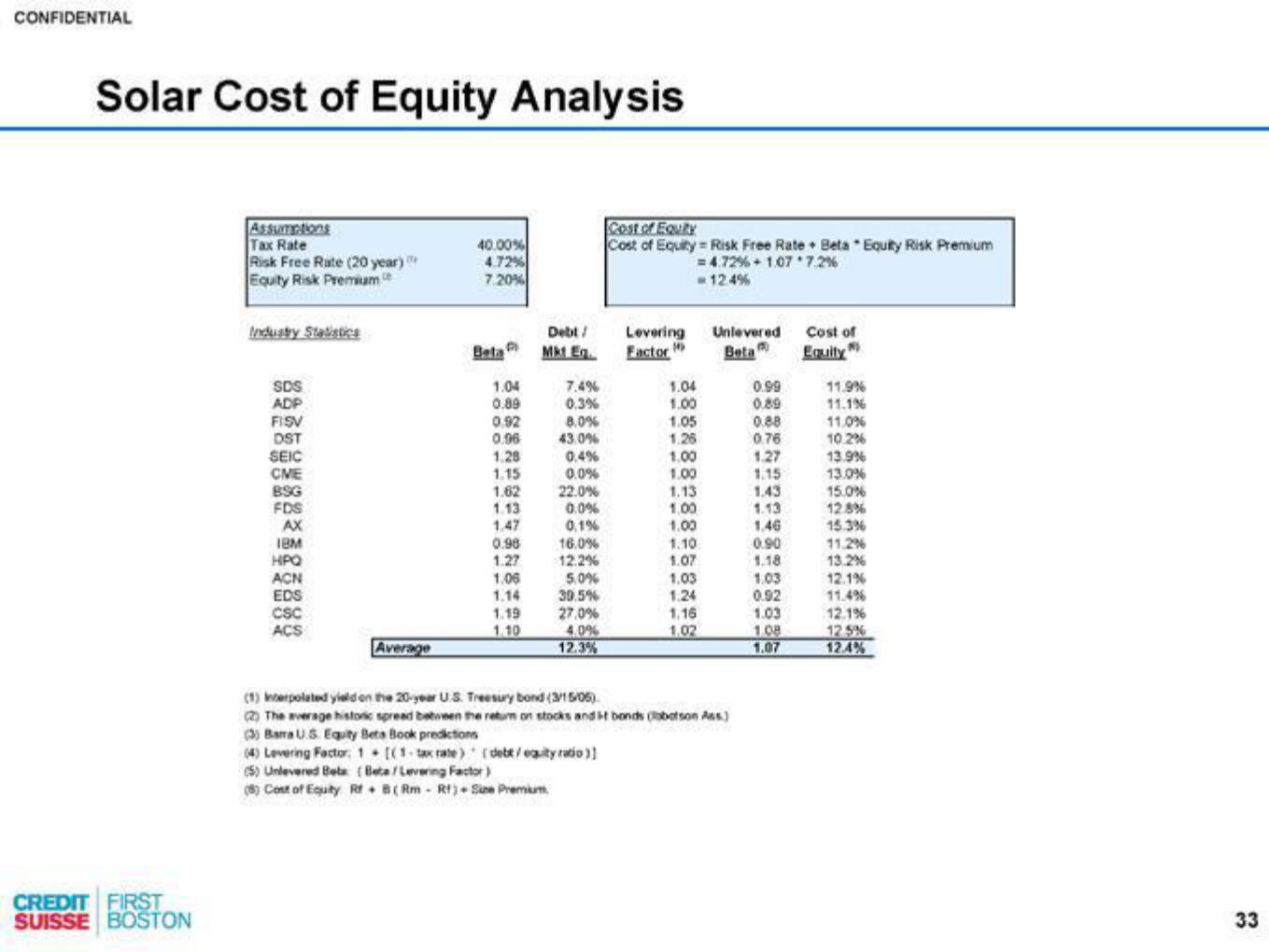

Solar Cost of Equity Analysis

CREDIT FIRST

SUISSE BOSTON

Assumptions

Tax Rate

Risk Free Rate (20 year)

Equity Risk Premium

Industry Statistics

SDS

ADP

FISV

DST

SEIC

CME

BSG

FDS

AX

18M

HPQ

ACN

EDS

CSC

ACS

Average

40.00%

4.72%

7.20%

Beta

1.04

0.89

7.4%

0.3%

8.0%

43.0%

0.4%

0.0%

1.62 22.0%

1.13

0.0%

1.47

0.1%

0.98

1.27

1.06

1.14

1.19

1.10

0.92

0.96

Debt /

Mkt Eg

1.28

1.15

16.0%

12.2%

5.0%

39.5%

27,0%

4,0%

12.3%

Cost of Equity

Cost of Equity

(1-tax rate) [debt/equity ratio)]

Levering

Factor M

Risk Free Rate+ Beta Equity Risk Premium

=4.72 % +1.07 7.2%

-12.4%

1.04

1.00

1.05

1.00

1.00

1.13

1,00

1.00

1.10

1.07

1.03

1.24

1.16

1.02

Unlevered

Beta

(1) Interpolated yield on the 20-year U.S. Treasury bond (3/15/05)

(2) The average historic spread between the return on stocks and it bonds (obotson Ass.)

(3) Bama U.S. Equity Beta Book predictions

(4) Levering Factor 1

(5) Unlevered Beta (Beta/Levering Factor)

(8) Cost of Equity Rt B(Rm Rf)+ Size Premium

0.99

0.89

0.88

0.76

1.27

1.15

1.43

1.13

1.46

0.90

1.18

1.03

0.92

1.03

1.08

1.07

Cost of

Equity

11.9%

11.1%

11.0%

10.2%

13.9%

13.0%

15.0%

12.8%

15.3%

11.2%

13.2%

12.1%

11.4%

12.1%

12.5%

12.4%

33View entire presentation