Cameco IPO Presentation Deck

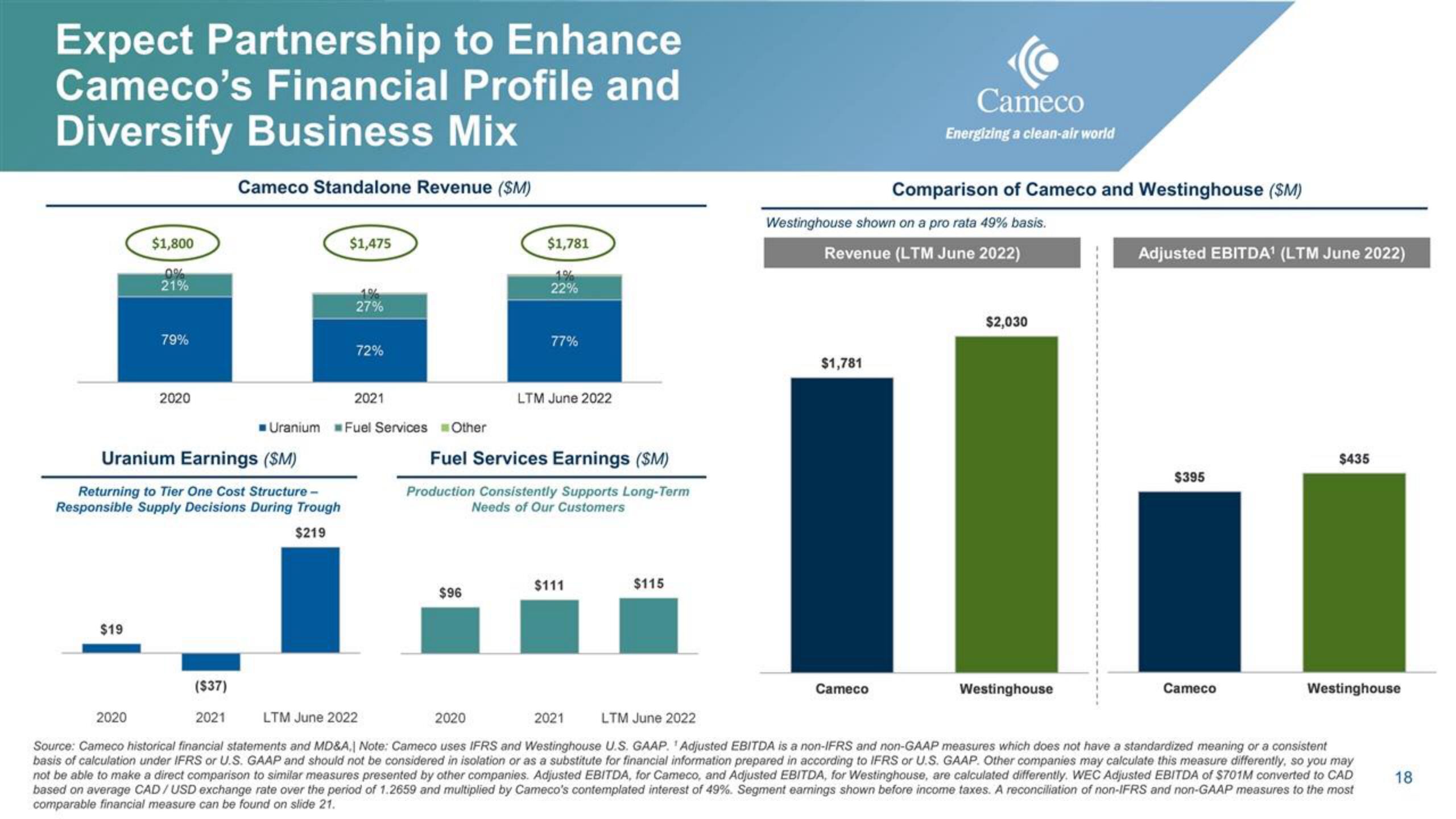

Expect Partnership to Enhance

Cameco's Financial Profile and

Diversify Business Mix

Cameco Standalone Revenue (SM)

$1,800

$19

0%

21%

79%

2020

Uranium Earnings (SM)

Returning to Tier One Cost Structure-

Responsible Supply Decisions During Trough

$219

$1,475

1%

27%

72%

2021

Uranium Fuel Services Other

$1,781

$96

22%

77%

LTM June 2022

Fuel Services Earnings (SM)

Production Consistently Supports Long-Term

Needs of Our Customers

$111

$115

$1,781

Cameco

Energizing a clean-air world

Westinghouse shown on a pro rata 49% basis.

Revenue (LTM June 2022)

Comparison of Cameco and Westinghouse (SM)

Cameco

$2,030

Adjusted EBITDA¹ (LTM June 2022)

Westinghouse

$395

($37)

LTM June 2022

2020

2021

LTM June 2022

2020

2021

Source: Cameco historical financial statements and MD&A,| Note: Cameco uses IFRS and Westinghouse U.S. GAAP. 'Adjusted EBITDA is a non-IFRS and non-GAAP measures which does not have a standardized meaning or a consistent

basis of calculation under IFRS or U.S. GAAP and should not be considered in isolation or as a substitute for financial information prepared in according to IFRS or U.S. GAAP. Other companies may calculate this measure differently, so you may

not be able to make a direct comparison to similar measures presented by other companies. Adjusted EBITDA, for Cameco, and Adjusted EBITDA, for Westinghouse, are calculated differently. WEC Adjusted EBITDA of $701M converted to CAD

based on average CAD/USD exchange rate over the period of 1.2659 and multiplied by Cameco's contemplated interest of 49%. Segment earnings shown before income taxes. A reconciliation of non-IFRS and non-GAAP measures to the most

comparable financial measure can be found on slide 21.

$435

Cameco

Westinghouse

18View entire presentation