Waldencast 2Q22 Investor Results

Net sales

($mm)

Gross profit

($mm)

Pro Forma

Adj. EBITDA

($mm)

OBAGI

Milk

Waldencast

OBAGI

GM %

Milk

GM %

Waldencast

GM %

OBAGI

Adj EBITDA %

Milk

Adj EBITDA %

Central costs ²

Adj EBITDA %

Waldencast

Adj EBITDA %

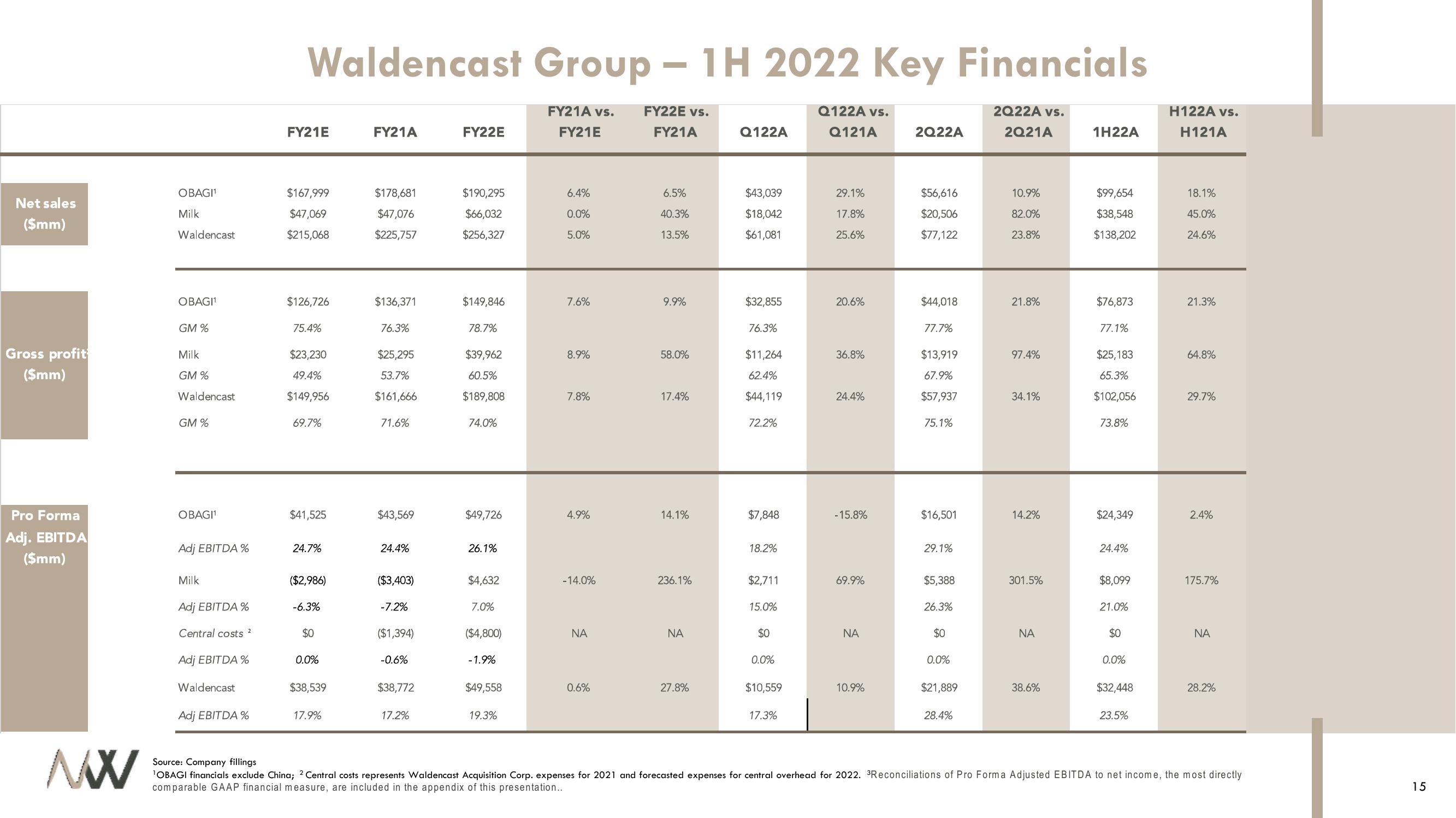

Waldencast Group - 1H 2022 Key Financials

FY21A vs.

FY21E

FY22E vs.

FY21A

FY21E

$167,999

$47,069

$215,068

$126,726

75.4%

$23,230

49.4%

$149,956

69.7%

$41,525

24.7%

($2,986)

-6.3%

$0

0.0%

$38,539

17.9%

FY21A

$178,681

$47,076

$225,757

$136,371

76.3%

$25,295

53.7%

$161,666

71.6%

$43,569

24.4%

($3,403)

-7.2%

($1,394)

-0.6%

$38,772

17.2%

FY22E

$190,295

$66,032

$256,327

$149,846

78.7%

$39,962

60.5%

$189,808

74.0%

$49,726

26.1%

$4,632

7.0%

($4,800)

-1.9%

$49,558

19.3%

6.4%

0.0%

5.0%

7.6%

8.9%

7.8%

4.9%

-14.0%

ΝΑ

0.6%

6.5%

40.3%

13.5%

9.9%

58.0%

17.4%

14.1%

236.1%

ΝΑ

27.8%

Q122A

$43,039

$18,042

$61,081

$32,855

76.3%

$11,264

62.4%

$44,119

72.2%

$7,848

18.2%

$2,711

15.0%

$0

0.0%

$10,559

17.3%

Q122A vs.

Q121A

29.1%

17.8%

25.6%

20.6%

36.8%

24.4%

- 15.8%

69.9%

ΝΑ

10.9%

2Q22A

$56,616

$20,506

$77,122

$44,018

77.7%

$13,919

67.9%

$57,937

75.1%

$16,501

29.1%

$5,388

26.3%

$0

0.0%

$21,889

28.4%

2Q22A vs.

2Q21A

10.9%

82.0%

23.8%

21.8%

97.4%

34.1%

14.2%

301.5%

NA

38.6%

1H22A

$99,654

$38,548

$138,202

$76,873

77.1%

$25,183

65.3%

$102,056

73.8%

$24,349

24.4%

$8,099

21.0%

$0

0.0%

$32,448

23.5%

H122A vs.

H121A

18.1%

45.0%

24.6%

21.3%

64.8%

29.7%

2.4%

175.7%

ΝΑ

28.2%

MX

Source: Company fillings

¹OBAGI financials exclude China; 2 Central costs represents Waldencast Acquisition Corp. expenses for 2021 and forecasted expenses for central overhead for 2022. ³Reconciliations of Pro Forma Adjusted EBITDA to net income, the most directly

comparable GAAP financial measure, are included in the appendix of this presentation..

15View entire presentation