FlexJet SPAC Presentation Deck

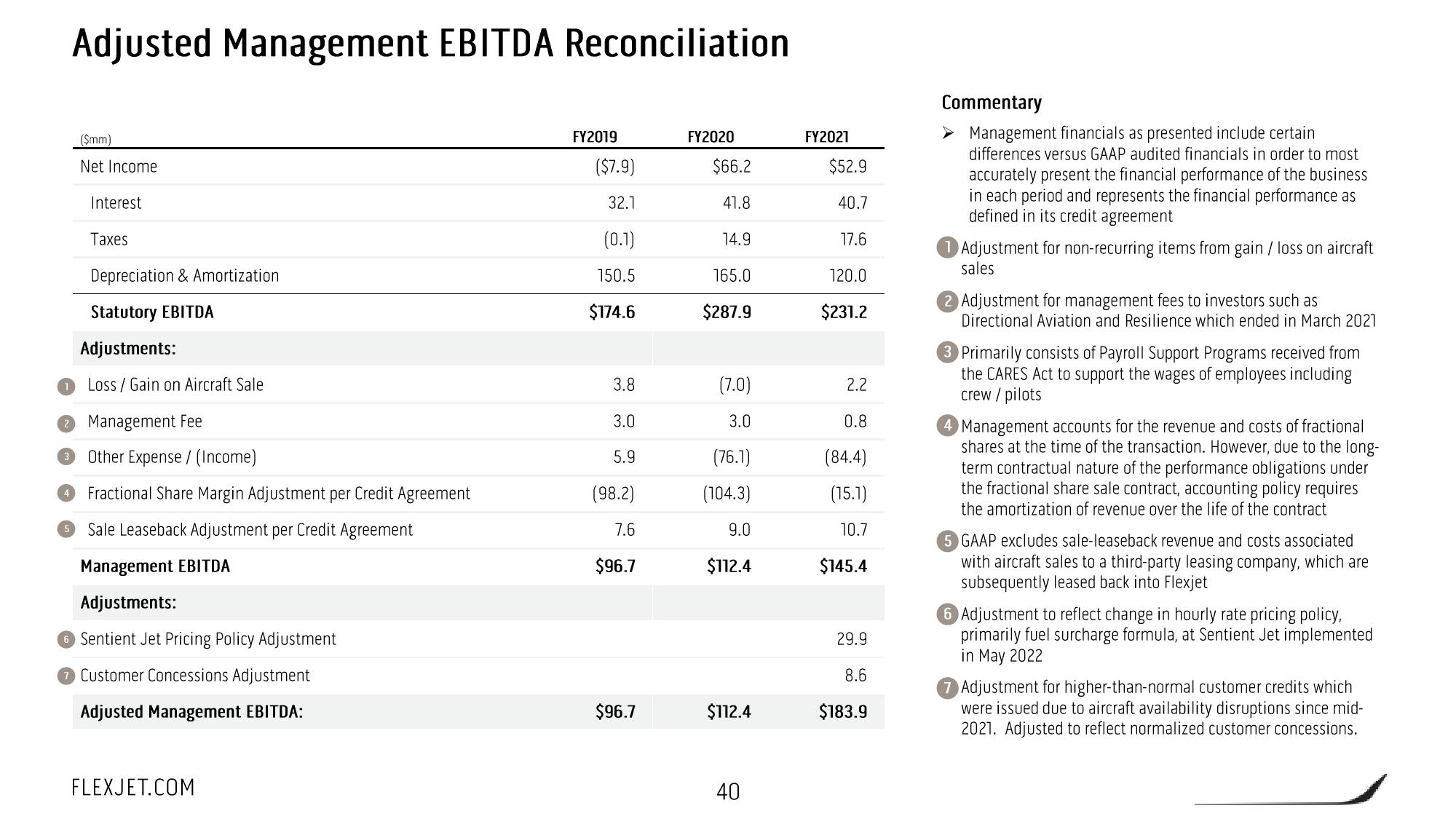

Adjusted Management EBITDA Reconciliation

1

($mm)

Net Income

Interest

Taxes

Depreciation & Amortization

Statutory EBITDA

Adjustments:

Loss/ Gain on Aircraft Sale

2 Management Fee

3 Other Expense/ (Income)

Fractional Share Margin Adjustment per Credit Agreement

5 Sale Leaseback Adjustment per Credit Agreement

Management EBITDA

Adjustments:

6 Sentient Jet Pricing Policy Adjustment

Customer Concessions Adjustment

Adjusted Management EBITDA:

FLEXJET.COM

FY2019

($7.9)

32.1

(0.1)

150.5

$174.6

3.8

3.0

5.9

(98.2)

7.6

$96.7

$96.7

FY2020

$66.2

41.8

14.9

165.0

$287.9

(7.0)

3.0

(76.1)

(104.3)

9.0

$112.4

$112.4

40

FY2021

$52.9

40.7

17.6

120.0

$231.2

2.2

0.8

(84.4)

(15.1)

10.7

$145.4

29.9

8.6

$183.9

Commentary

Management financials as presented include certain

differences versus GAAP audited financials in order to most

accurately present the financial performance of the business

in each period and represents the financial performance as

defined in its credit agreement

1 Adjustment for non-recurring items from gain / loss on aircraft

sales

2 Adjustment for management fees to investors such as

Directional Aviation and Resilience which ended in March 2021

3 Primarily consists of Payroll Support Programs received from

the CARES Act to support the wages of employees including

crew / pilots

4 Management accounts for the revenue and costs of fractional

shares at the time of the transaction. However, due to the long-

term contractual nature of the performance obligations under

the fractional share sale contract, accounting policy requires

the amortization of revenue over the life of the contract

5 GAAP excludes sale-leaseback revenue and costs associated

with aircraft sales to a third-party leasing company, which are

subsequently leased back into Flexjet

6 Adjustment to reflect change in hourly rate pricing policy,

primarily fuel surcharge formula, at Sentient Jet implemented

in May 2022

Adjustment for higher-than-normal customer credits which

were issued due to aircraft availability disruptions since mid-

2021. Adjusted to reflect normalized customer concessions.View entire presentation