Main Street Capital Fixed Income Presentation Deck

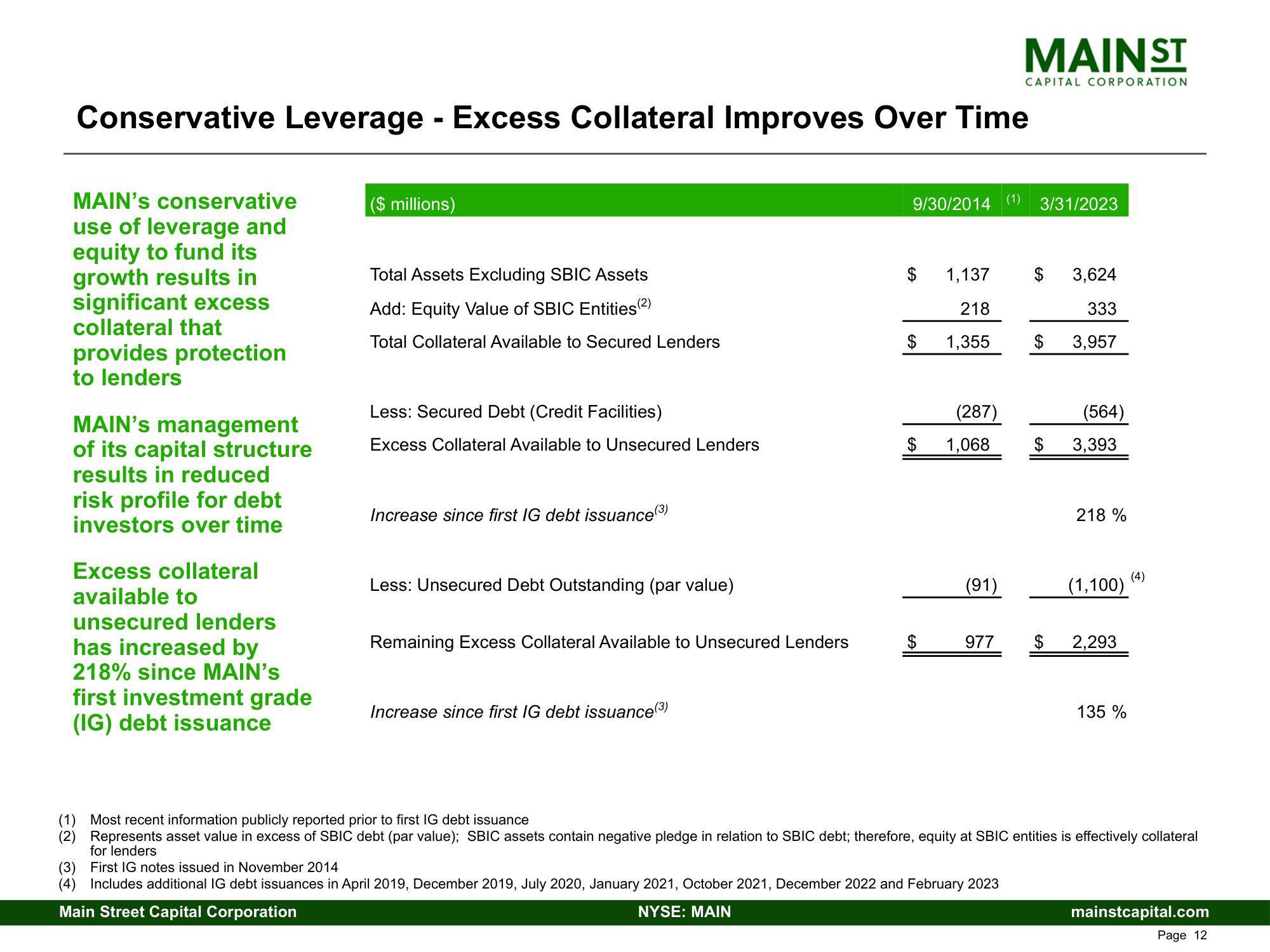

Conservative Leverage - Excess Collateral Improves Over Time

MAIN's conservative

use of leverage and

equity to fund its

growth results in

significant excess

collateral that

provides protection

to lenders

MAIN's management

of its capital structure

results in reduced

risk profile for debt

investors over time

Excess collateral

available to

unsecured lenders

has increased by

218% since MAIN's

first investment grade

(IG) debt issuance

($ millions)

Total Assets Excluding SBIC Assets

Add: Equity Value of SBIC Entities (2)

Total Collateral Available to Secured Lenders

Less: Secured Debt (Credit Facilities)

Excess Collateral Available to Unsecured Lenders

Increase since first IG debt issuance(3)

Less: Unsecured Debt Outstanding (par value)

Remaining Excess Collateral Available to Unsecured Lenders

Increase since first IG debt issuance(3)

9/30/2014 (1) 3/31/2023

$ 1,137

218

1,355

$

$

$

(287)

1,068

(91)

MAIN ST

CAPITAL CORPORATION

977

(2)

(3) First IG notes issued in November 2014

(4) Includes additional IG debt issuances in April 2019, December 2019, July 2020, January 2021, October 2021, December 2022 and February 2023

Main Street Capital Corporation

NYSE: MAIN

$

$

$

3,624

333

3,957

(564)

3,393

218 %

(1,100)

2,293

135 %

(4)

Most recent information publicly reported prior to first IG debt issuance

Represents asset value in excess of SBIC debt (par value); SBIC assets contain negative pledge in relation to SBIC debt; therefore, equity at SBIC entities is effectively collateral

for lenders

mainstcapital.com

Page 12View entire presentation