Appreciate SPAC Presentation Deck

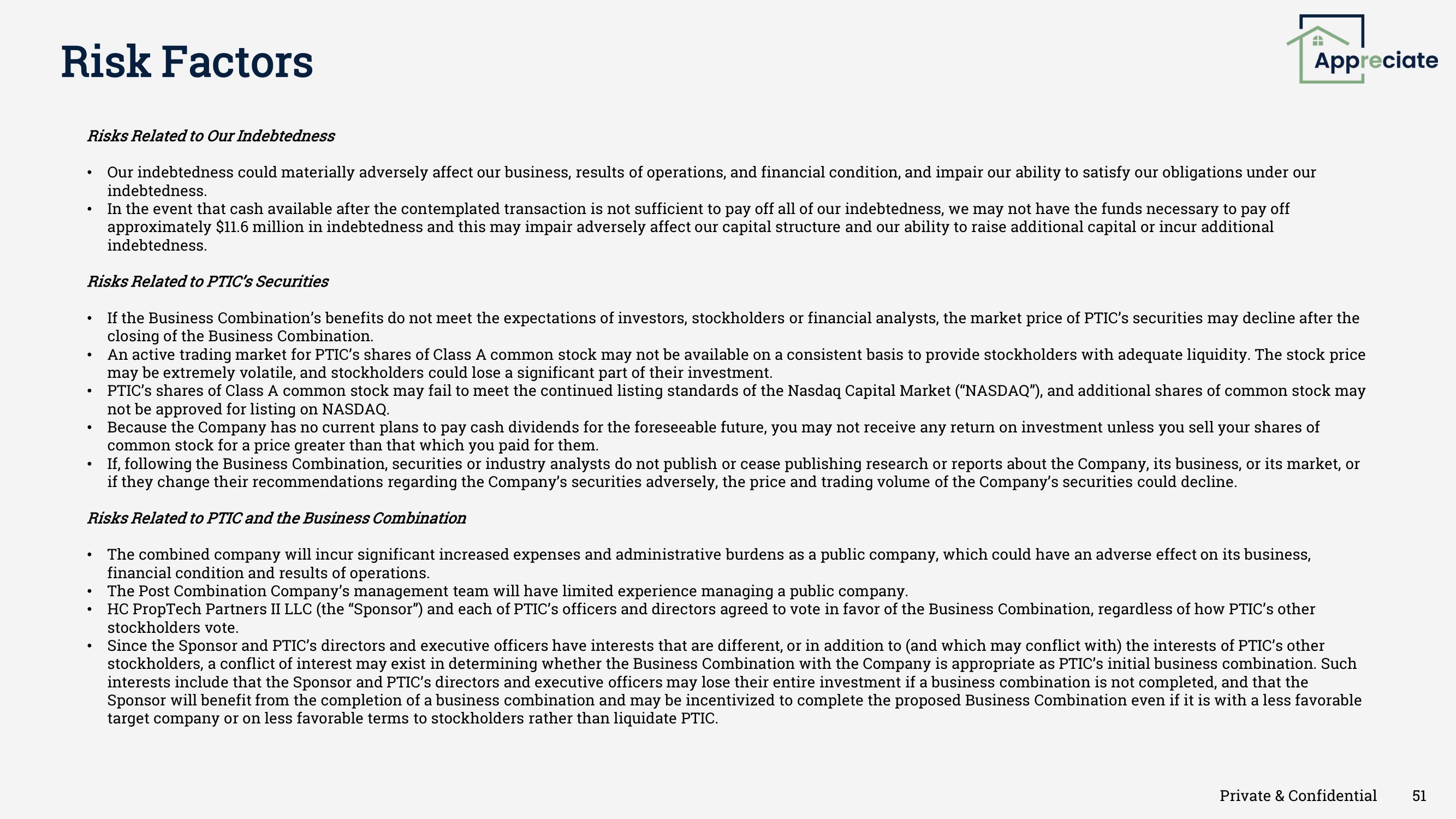

Risk Factors

●

Risks Related to Our Indebtedness

Our indebtedness could materially adversely affect our business, results of operations, and financial condition, and impair our ability to satisfy our obligations under our

indebtedness.

In the event that cash available after the contemplated transaction is not sufficient to pay off all of our indebtedness, we may not have the funds necessary to pay off

approximately $11.6 million in indebtedness and this may impair adversely affect our capital structure and our ability to raise additional capital or incur additional

indebtedness.

Risks Related to PTIC's Securities

●

●

●

An active trading market for PTIC's shares of Class A common stock may not be available on a consistent basis to provide stockholders with adequate liquidity. The stock price

may be extremely volatile, and stockholders could lose a significant part of their investment.

PTIC's shares of Class A common stock may fail to meet the continued listing standards of the Nasdaq Capital Market ("NASDAQ"), and additional shares of common stock may

not be approved for listing on NASDAQ.

Because the Company has no current plans to pay cash dividends for the foreseeable future, you may not receive any return on investment unless you sell your shares of

common stock for a price greater than that which you paid for them.

If, following the Business Combination, securities or industry analysts do not publish or cease publishing research or reports about the Company, its business, or its market, or

if they change their recommendations regarding the Company's securities adversely, the price and trading volume of the Company's securities could decline.

Risks Related to PTIC and the Business Combination

●

●

●

●

4

ww

●

●

Appreciate

If the Business Combination's benefits do not meet the expectations of investors, stockholders or financial analysts, the market price of PTIC's securities may decline after the

closing of the Business Combination.

The combined company will incur significant increased expenses and administrative burdens as a public company, which could have an adverse effect on its business,

financial condition and results of operations.

The Post Combination Company's management team will have limited experience managing a public company.

HC PropTech Partners II LLC (the "Sponsor") and each of PTIC's officers and directors agreed to vote in favor of the Business Combination, regardless of how PTIC's other

stockholders vote.

Since the Sponsor and PTIC's directors and executive officers have interests that are different, or in addition to (and which may conflict with) the interests of PTIC's other

stockholders, a conflict of interest may exist in determining whether the Business Combination with the Company is appropriate as PTIC's initial business combination. Such

interests include that the Sponsor and PTIC's directors and executive officers may lose their entire investment if a business combination is not completed, and that the

Sponsor will benefit from the completion of a business combination and may be incentivized to complete the proposed Business Combination even if it is with a less favorable

target company or on less favorable terms to stockholders rather than liquidate PTIC.

Private & Confidential

51View entire presentation