Nikola SPAC Presentation Deck

DISCOUNTED FUTURE

VALUE OF NIKOLA NORTH

AMERICA TRUCKCO

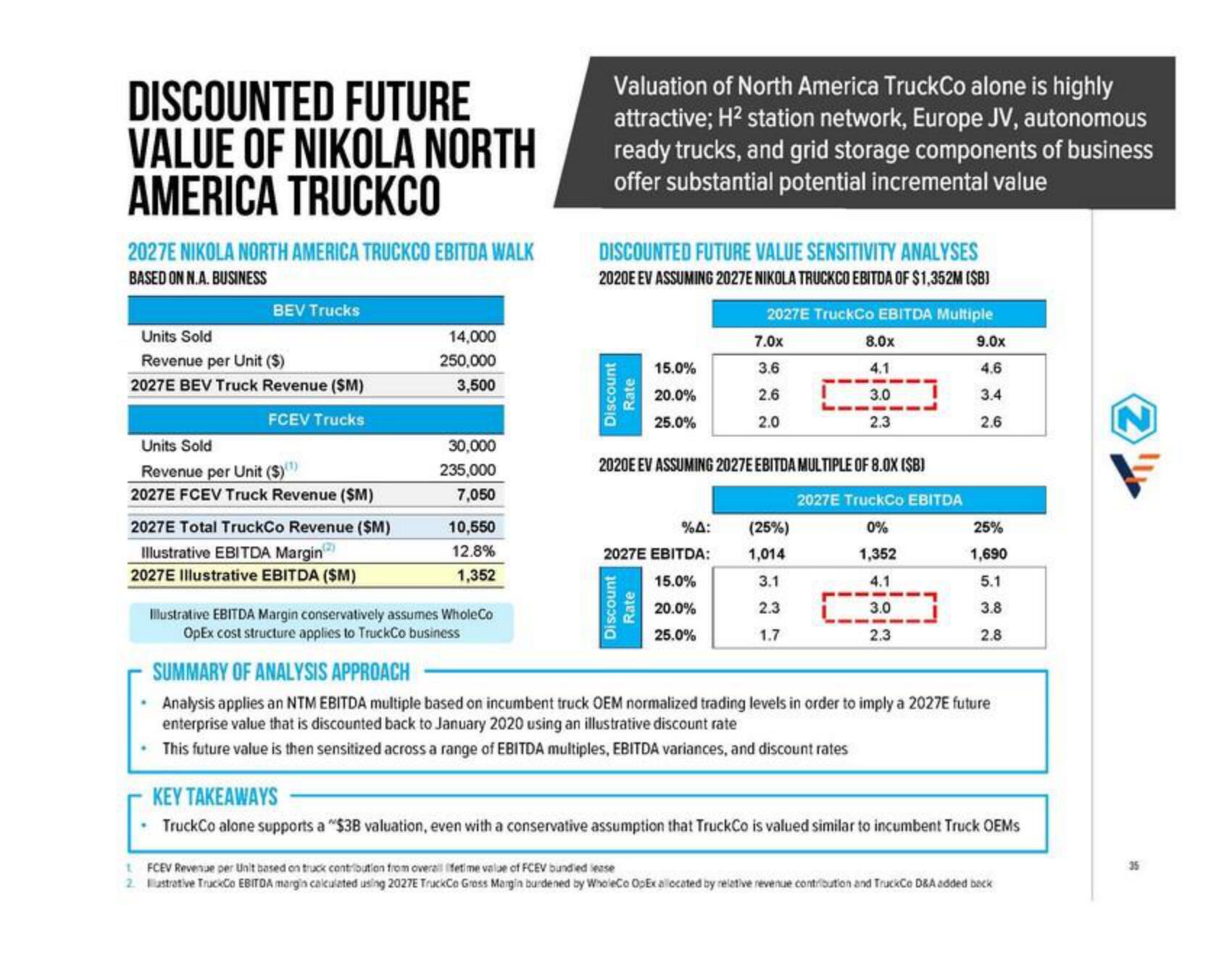

2027E NIKOLA NORTH AMERICA TRUCKCO EBITDA WALK

BASED ON N.A. BUSINESS

BEV Trucks

Units Sold

Revenue per Unit ($)

2027E BEV Truck Revenue (SM)

FCEV Trucks

Units Sold

Revenue per Unit ($)(¹)

2027E FCEV Truck Revenue (SM)

2027E Total TruckCo Revenue ($M)

Illustrative EBITDA Margin

2027E Illustrative EBITDA (SM)

14,000

250,000

3,500

30,000

235,000

7,050

10,550

12.8%

1,352

Illustrative EBITDA Margin conservatively assumes WholeCo

OpEx cost structure applies to TruckCo business

Valuation of North America TruckCo alone is highly

attractive; H² station network, Europe JV, autonomous

ready trucks, and grid storage components of business

offer substantial potential incremental value

DISCOUNTED FUTURE VALUE SENSITIVITY ANALYSES

2020E EV ASSUMING 2027E NIKOLA TRUCKCO EBITDA OF $1,352M (SB)

2027E TruckCo EBITDA Multiple

7.0x

3.6

2.6

2.0

Discount

Rate

15.0%

20.0%

25.0%

2020E EV ASSUMING 2027E EBITDA MULTIPLE OF 8.0X (SB)

%A:

2027E EBITDA:

15.0%

20.0%

25.0%

Discount

Rate

8.0x

4.1

3.0

2.3

(25%)

1,014

3.1

2.3

1.7

2027E TruckCo EBITDA

0%

1,352

4.1

3.0

2.3

9.0x

4.6

3.4

2.6

25%

1,690

5.1

3.8

2.8

SUMMARY OF ANALYSIS APPROACH

Analysis applies an NTM EBITDA multiple based on incumbent truck OEM normalized trading levels in order to imply a 2027E future

enterprise value that is discounted back to January 2020 using an illustrative discount rate

This future value is then sensitized across a range of EBITDA multiples, EBITDA variances, and discount rates

KEY TAKEAWAYS

TruckCo alone supports a "$3B valuation, even with a conservative assumption that TruckCo is valued similar to incumbent Truck OEMs

t FCEV Revenue per Unit based on truck contribution from overall fetime value of FCEV bundled lease

2 ustrative TruckCo EBITDA margin calculated using 2027E TruckCo Gross Margin burdened by WholeCo OpEx allocated by relative revenue contribution and TruckCo D&A added back

35View entire presentation