Goldman Sachs Investment Banking Pitch Book

Goldman

Sachs

US M&A Market Update

$1,059

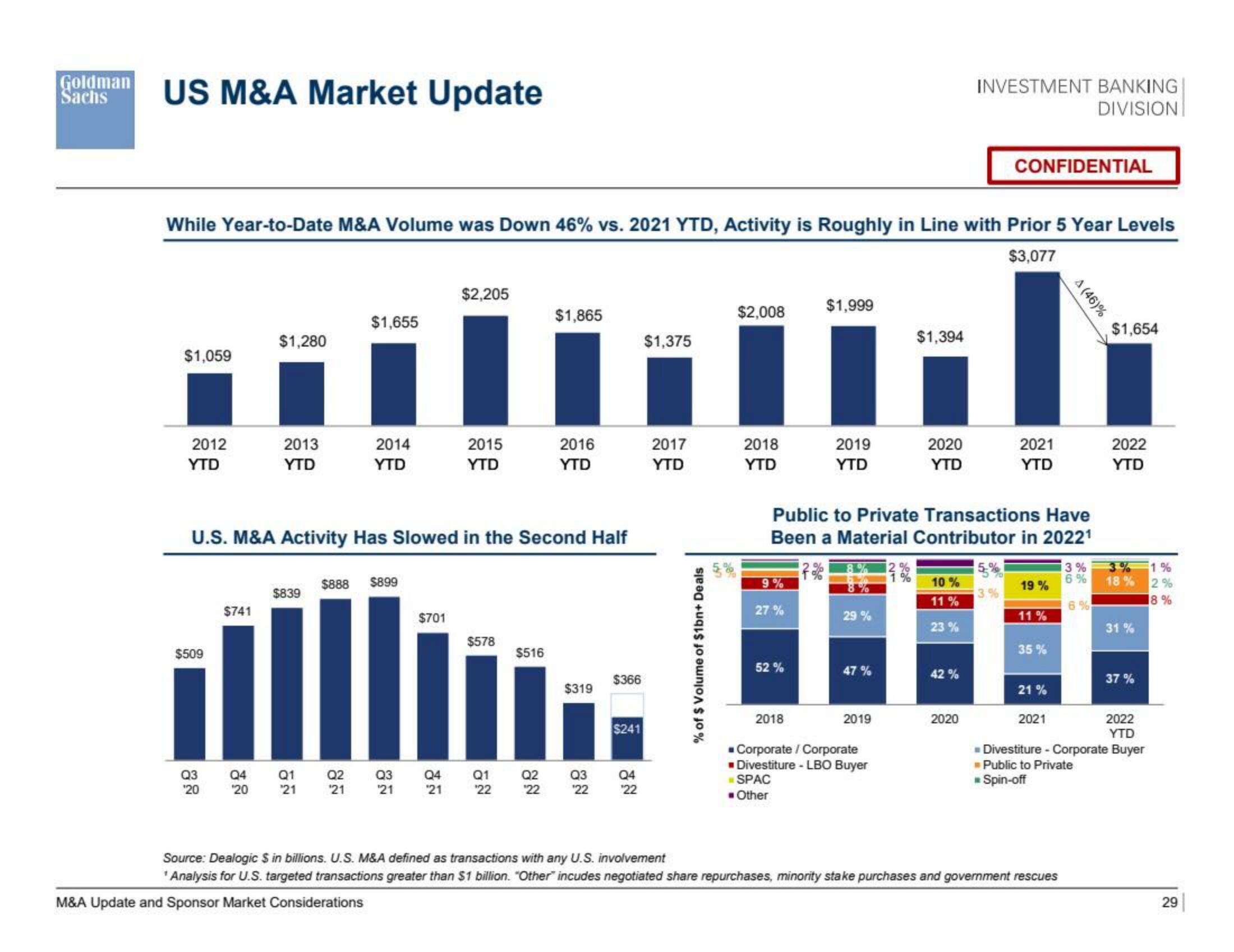

While Year-to-Date M&A Volume was Down 46% vs. 2021 YTD, Activity is Roughly in Line with Prior 5 Year Levels

$3,077

2012

YTD

$509

$741

$1,280

Q3

Q4

¹20 ¹20

2013

YTD

$839

Q1

U.S. M&A Activity Has Slowed in the Second Half

21

$1,655

2014

YTD

Q2

'21

$888 $899

$701

$2,205

Q3

Q4

21 ¹21

2015

YTD

$578

Q1

¹22

$516

$1,865

Q2

¹22

2016

YTD

$319

Q3

¹22

$366

$241

| ៩ន

Q4

$1,375

2017

YTD

% of $ Volume of $1bn+ Deals

$2,008

2018

YTD

%

27%

52%

$1,999

2018

2019

YTD

8%

Public to Private Transactions Have

Been a Material Contributor in 2022¹

7%

29%

47%

2019

$1,394

■ Corporate / Corporate

■ Divestiture - LBO Buyer

☐ SPAC

■ Other

2020

YTD

10%

11%

23%

INVESTMENT BANKING

DIVISION

42 %

2020

CONFIDENTIAL

5%

3%

2021

YTD

19%

11%

35%

21%

2021

A (46)%

Source: Dealogic $ in billions. U.S. M&A defined as transactions with any U.S. involvement

'Analysis for U.S. targeted transactions greater than $1 billion. "Other" incudes negotiated share repurchases, minority stake purchases and government rescues

M&A Update and Sponsor Market Considerations

%

6%

6%

$1,654

2022

YTD

18%

31%

37%

2022

YTD

%

2%

18%

Divestiture - Corporate Buyer

> Public to Private

RR Spin-off

29View entire presentation