Main Street Capital Investor Presentation Deck

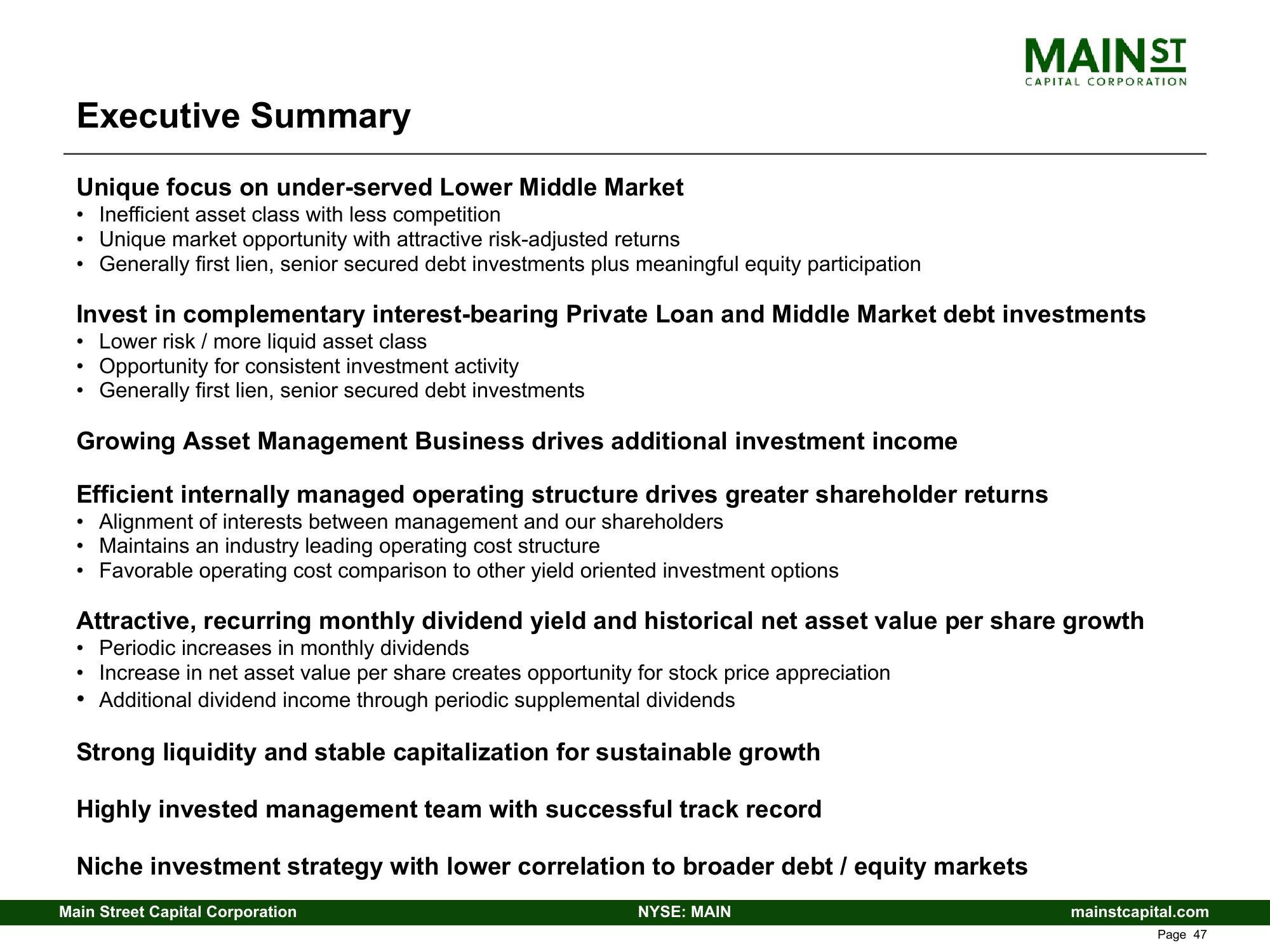

Executive Summary

Unique focus on under-served Lower Middle Market

Inefficient asset class with less competition

Unique market opportunity with attractive risk-adjusted returns

Generally first lien, senior secured debt investments plus meaningful equity participation

●

●

●

●

Invest in complementary interest-bearing Private Loan and Middle Market debt investments

• Lower risk / more liquid asset class

Opportunity for consistent investment activity

Generally first lien, senior secured debt investments

Growing Asset Management Business drives additional investment income

Efficient internally managed operating structure drives greater shareholder returns

Alignment of interests between management and our shareholders

Maintains an industry leading operating cost structure

Favorable operating cost comparison to other yield oriented investment options

●

●

●

●

Attractive, recurring monthly dividend yield and historical net asset value per share growth

Periodic increases in monthly dividends

Increase in net asset value per share creates opportunity for stock price appreciation

Additional dividend income through periodic supplemental dividends

Strong liquidity and stable capitalization for sustainable growth

Highly invested management team with successful track record

Niche investment strategy with lower correlation to broader debt / equity markets

Main Street Capital Corporation

●

MAIN ST

●

CAPITAL CORPORATION

NYSE: MAIN

mainstcapital.com

Page 47View entire presentation