Bird Investor Presentation Deck

Significant progress in profitability roadmap in Q3

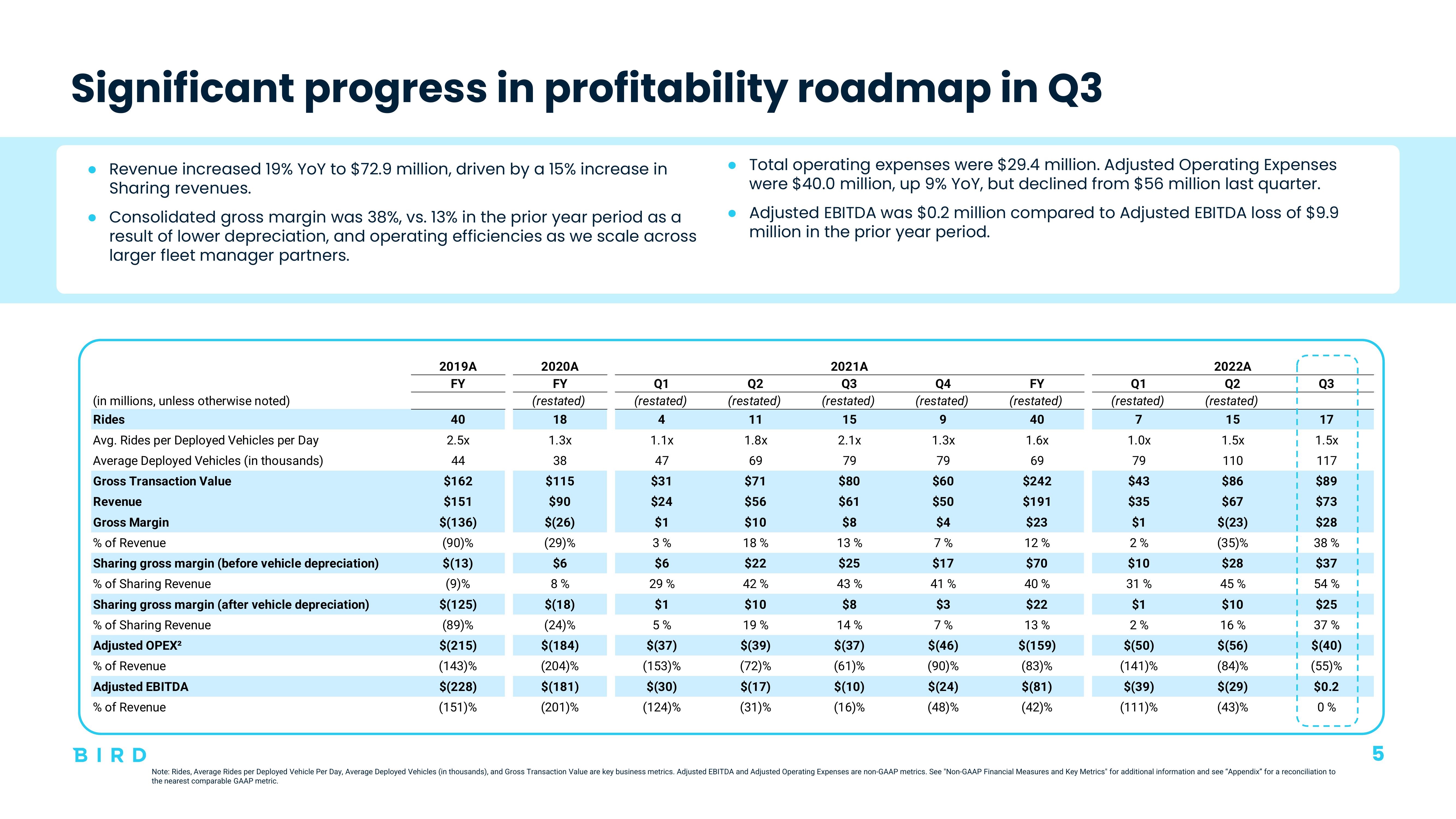

● Revenue increased 19% YoY to $72.9 million, driven by a 15% increase in

Sharing revenues.

• Consolidated gross margin was 38%, vs. 13% in the prior year period as a

result of lower depreciation, and operating efficiencies as we scale across

larger fleet manager partners.

(in millions, unless otherwise noted)

Rides

Avg. Rides per Deployed Vehicles per Day

Average Deployed Vehicles (in thousands)

Gross Transaction Value

Revenue

Gross Margin

% of Revenue

Sharing gross margin (before vehicle depreciation)

% of Sharing Revenue

Sharing gross margin (after vehicle depreciation)

% of Sharing Revenue

Adjusted OPEX²

% of Revenue

Adjusted EBITDA

% of Revenue

BIRD

2019A

FY

40

2.5x

44

$162

$151

$(136)

(90)%

$(13)

(9)%

$(125)

(89)%

$(215)

(143)%

$(228)

(151)%

2020A

FY

(restated)

18

1.3x

38

$115

$90

$(26)

(29)%

$6

8%

$(18)

(24)%

$(184)

(204)%

$(181)

(201)%

Q1

(restated)

4

1.1x

47

$31

$24

$1

3%

$6

29 %

$1

5%

$(37)

(153)%

$(30)

(124)%

●

●

Total operating expenses were $29.4 million. Adjusted Operating Expenses

were $40.0 million, up 9% YOY, but declined from $56 million last quarter.

Adjusted EBITDA was $0.2 million compared to Adjusted EBITDA loss of $9.9

million in the prior year period.

Q2

(restated)

11

1.8x

69

$71

$56

$10

18%

$22

42 %

$10

19%

$(39)

(72)%

$(17)

(31)%

2021A

Q3

(restated)

15

2.1x

79

$80

$61

$8

13 %

$25

43%

$8

14%

$(37)

(61)%

$(10)

(16)%

Q4

(restated)

9

1.3x

79

$60

$50

$4

7%

$17

41%

$3

7%

$(46)

(90)%

$(24)

(48)%

FY

(restated)

40

1.6x

69

$242

$191

$23

12%

$70

40 %

$22

13%

$(159)

(83)%

$(81)

(42)%

Q1

(restated)

7

1.0x

79

$43

$35

$1

2%

$10

31%

$1

2%

$(50)

(141)%

$(39)

(111)%

2022A

Q2

(restated)

15

1.5x

110

$86

$67

$(23)

(35)%

$28

45%

$10

16%

$(56)

(84)%

$(29)

(43)%

Q3

17

1.5x

117

$89

$73

$28

38 %

$37

54%

I

$25

I 37%

$(40)

(55)%

$0.2

0%

I

Note: Rides, Average Rides per Deployed Vehicle Per Day, Average Deployed Vehicles (in thousands), and Gross Transaction Value are key business metrics. Adjusted EBITDA and Adjusted Operating Expenses are non-GAAP metrics. See "Non-GAAP Financial Measures and Key Metrics for additional information and see "Appendix" for a reconciliation to

the nearest comparable GAAP metric.

L

5View entire presentation