Avantor Results Presentation Deck

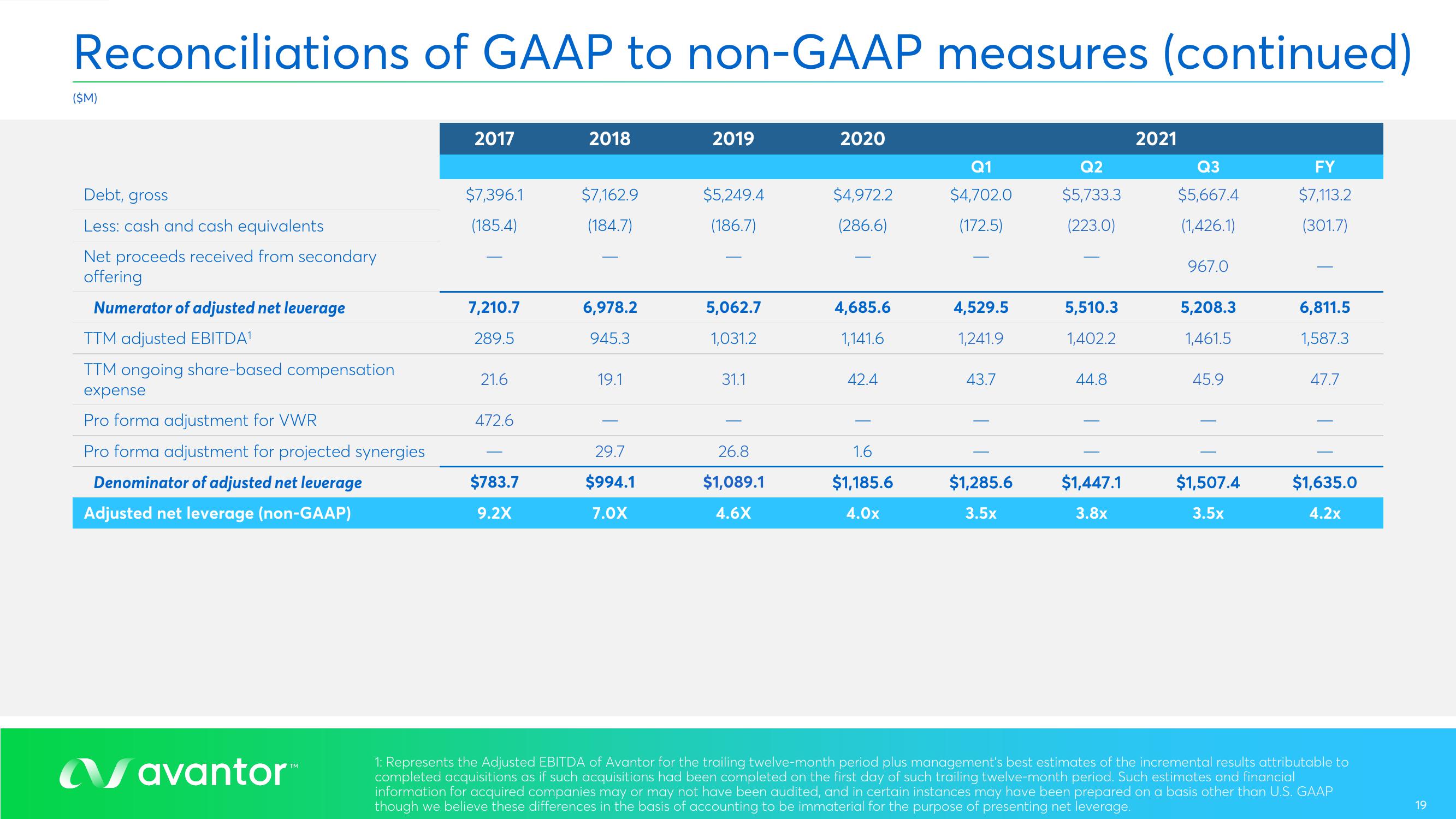

Reconciliations of GAAP to non-GAAP measures (continued)

($M)

Debt, gross

Less: cash and cash equivalents

Net proceeds received from secondary

offering

Numerator of adjusted net leverage

TTM adjusted EBITDA¹

TTM ongoing share-based compensation

expense

Pro forma adjustment for VWR

Pro forma adjustment for projected synergies

Denominator of adjusted net leverage

Adjusted net leverage (non-GAAP)

avantor™

2017

$7,396.1

(185.4)

7,210.7

289.5

21.6

472.6

$783.7

9.2X

2018

$7,162.9

(184.7)

6,978.2

945.3

19.1

29.7

$994.1

7.0X

2019

$5,249.4

(186.7)

5,062.7

1,031.2

31.1

26.8

$1,089.1

4.6X

2020

$4,972.2

(286.6)

4,685.6

1,141.6

42.4

1.6

$1,185.6

4.0x

Q1

$4,702.0

(172.5)

4,529.5

1,241.9

43.7

$1,285.6

3.5x

Q2

$5,733.3

(223.0)

5,510.3

1,402.2

44.8

$1,447.1

3.8x

2021

Q3

$5,667.4

(1,426.1)

967.0

5,208.3

1,461.5

45.9

$1,507.4

3.5x

FY

$7,113.2

(301.7)

6,811.5

1,587.3

47.7

$1,635.0

4.2x

1: Represents the Adjusted EBITDA of Avantor for the trailing twelve-month period plus management's best estimates of the incremental results attributable to

completed acquisitions as if such acquisitions had been completed on the first day of such trailing twelve-month period. Such estimates and financial

information for acquired companies may or may not have been audited, and in certain instances may have been prepared on a basis other than U.S. GAAP

though we believe these differences in the basis of accounting to be immaterial for the purpose of presenting net leverage.

19View entire presentation