Aston Martin Results Presentation Deck

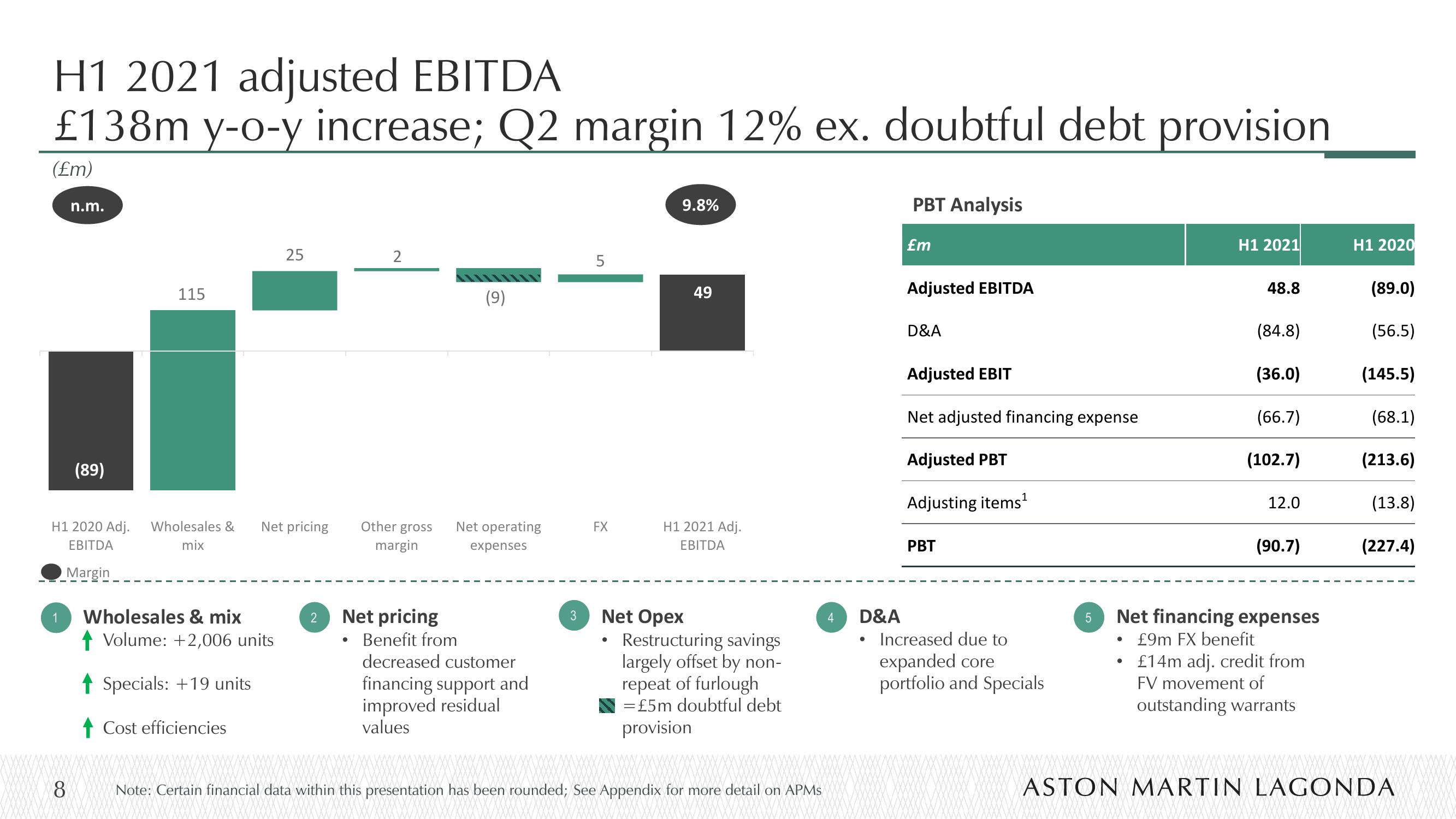

H1 2021 adjusted EBITDA

£138m y-o-y increase; Q2 margin 12% ex. doubtful debt provision

(£m)

1

n.m.

H1 2020 Adj.

EBITDA

Margin

8

(89)

115

Wholesales &

mix

Wholesales & mix

Volume: +2,006 units

Specials: +19 units

Cost efficiencies

25

Net pricing

2

2

Other gross

margin

Net pricing

(9)

Net operating

expenses

Benefit from

decreased customer

financing support and

improved residual

values

3

LO

5

FX

9.8%

49

H1 2021 Adj.

EBITDA

Net Opex

Restructuring savings

largely offset by non-

repeat of furlough

= £5m doubtful debt

provision

XXXXXXXX

Note: Certain financial data within this presentation has been rounded; See Appendix for more detail on APMs

4

D&A

●

PBT Analysis

£m

Adjusted EBITDA

D&A

Adjusted EBIT

Net adjusted financing expense

Adjusted PBT

Adjusting items¹

PBT

Increased due to

expanded core

portfolio and Specials

5

●

H1 2021

●

48.8

(84.8)

(36.0)

(66.7)

(102.7)

12.0

Net financing expenses

£9m FX benefit

(90.7)

£14m adj. credit from

FV movement of

outstanding warrants

H1 2020

(89.0)

(56.5)

(145.5)

(68.1)

(213.6)

(13.8)

(227.4)

www.xx

ASTON MARTIN LAGONDAView entire presentation