Alcon Q1 2023 Earnings Presentation

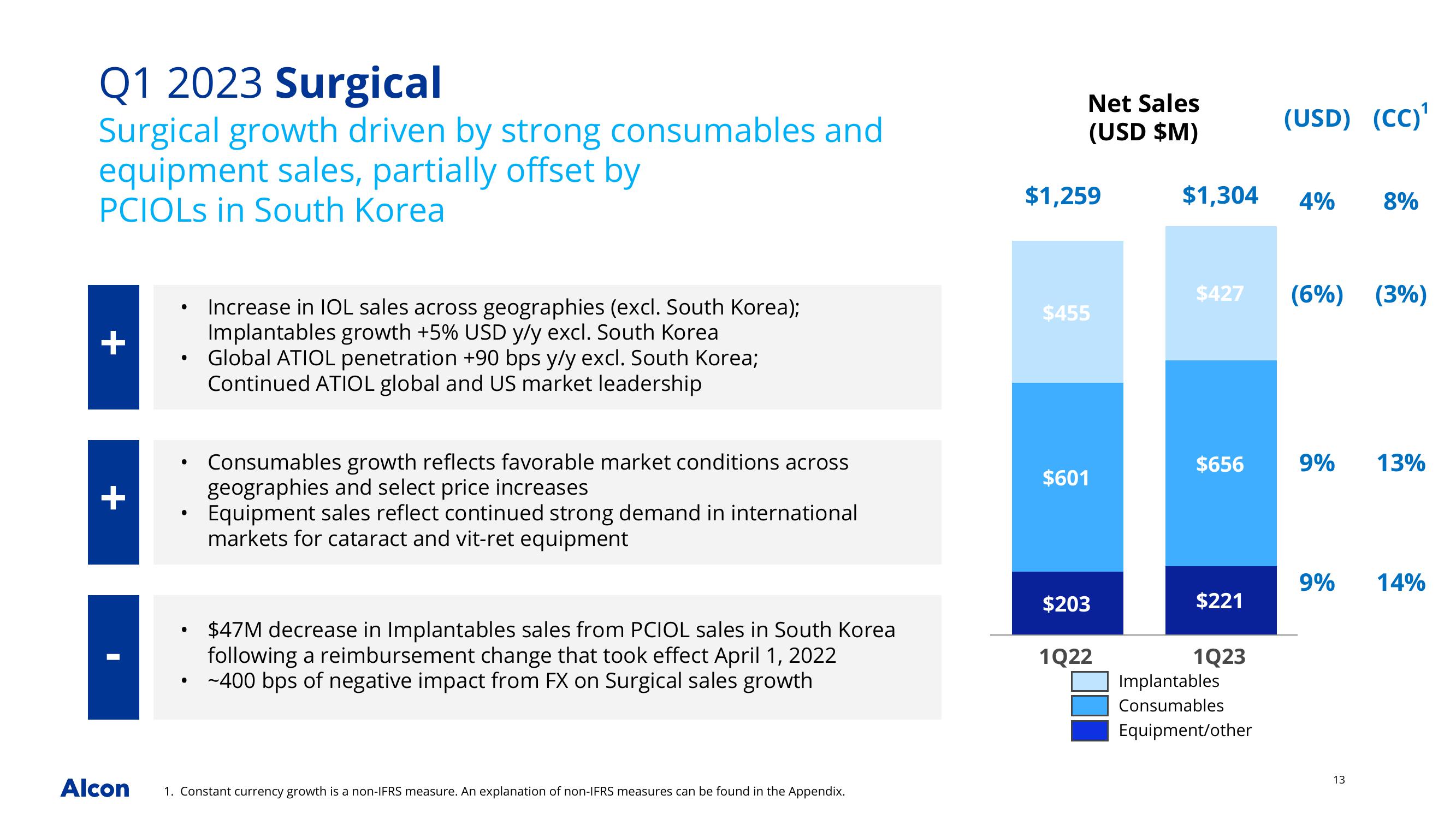

Q1 2023 Surgical

Surgical growth driven by strong consumables and

equipment sales, partially offset by

PCIOLS in South Korea

+

+

Alcon

• Increase in IOL sales across geographies (excl. South Korea);

Implantables growth +5% USD y/y excl. South Korea

• Global ATIOL penetration +90 bps y/y excl. South Korea;

Continued ATIOL global and US market leadership

• Consumables growth reflects favorable market conditions across

geographies and select price increases

Equipment sales reflect continued strong demand in international

markets for cataract and vit-ret equipment

●

$47M decrease in Implantables sales from PCIOL sales in South Korea

following a reimbursement change that took effect April 1, 2022

-400 bps of negative impact from FX on Surgical sales growth

1. Constant currency growth is a non-IFRS measure. An explanation of non-IFRS measures can be found in the Appendix.

Net Sales

(USD $M)

$1,259

$455

$601

$203

1Q22

$1,304

$656

$427 (6%) (3%)

$221

1Q23

(USD) (CC)¹

Implantables

Consumables

Equipment/other

4% 8%

9% 13%

9%

13

14%View entire presentation