AMC Other Presentation Deck

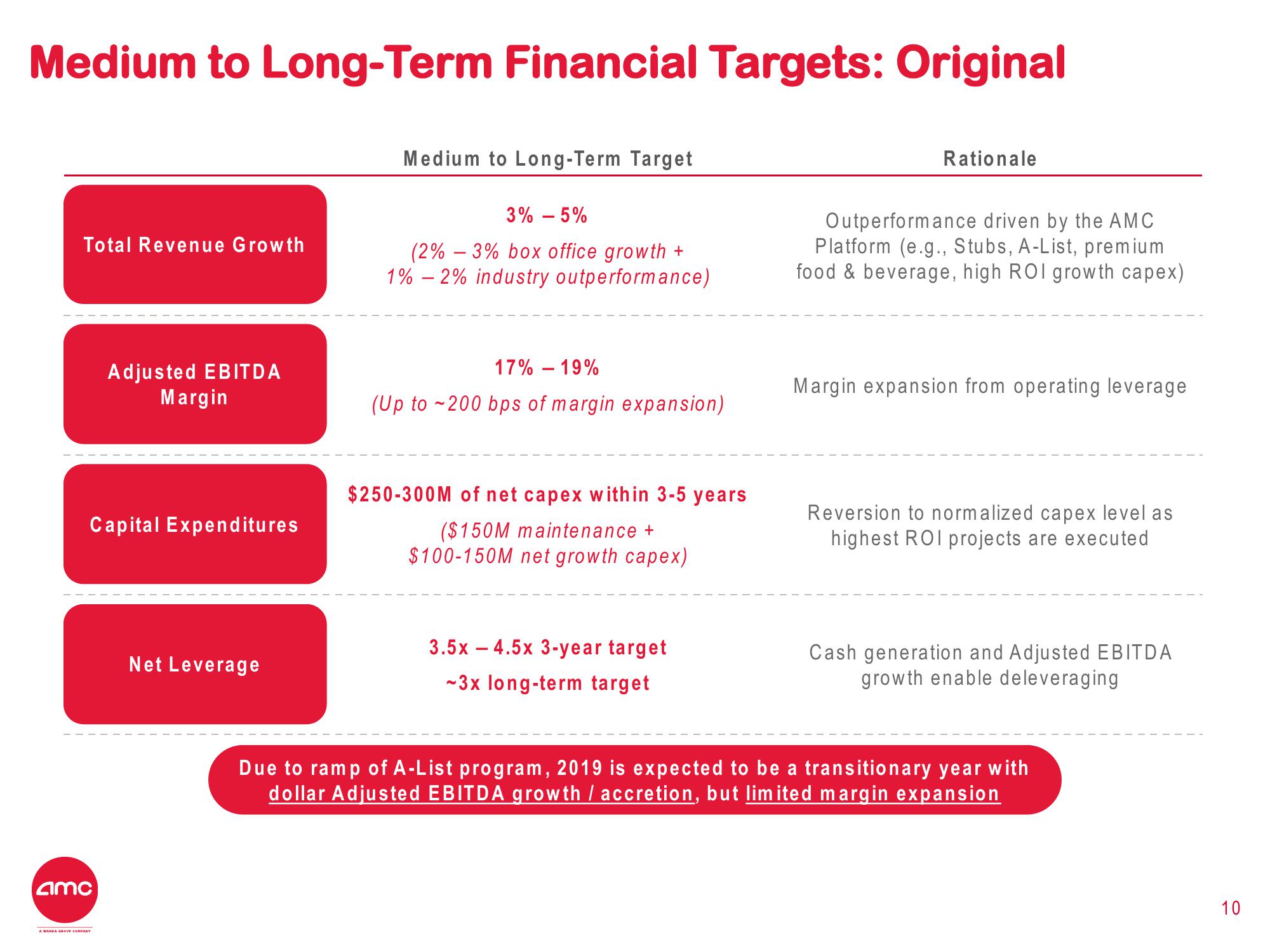

Medium to Long-Term Financial Targets: Original

Total Revenue Growth

Capital Expenditures

amc

Adjusted EBITDA

Margin

A WANDA GROUP COMPANY

Net Leverage

Medium to Long-Term Target

3% - 5%

(2% -3% box office growth +

1% -2% industry outperformance)

17% -19%

(Up to ~200 bps of margin expansion)

$250-300M of net capex within 3-5 years

($150M maintenance +

$100-150M net growth capex)

3.5x4.5x 3-year target

~3x long-term target

Rationale

Outperformance driven by the AMC

Platform (e.g., Stubs, A-List, premium

food & beverage, high ROI growth capex)

Margin expansion from operating leverage

Reversion to normalized capex level as

highest ROI projects are executed

Cash generation and Adjusted EBITDA

growth enable deleveraging

Due to ramp of A-List program, 2019 is expected to be a transitionary year with

dollar Adjusted EBITDA growth / accretion, but limited margin expansion

10View entire presentation